Toy and entertainment company Mattel (NASDAQ:MAT) delivered a solid third-quarter performance, benefiting from the success of the Barbie movie. However, MAT stock fell about 8% in Wednesday’s after-hours trading. The company reiterated its full-year sales outlook despite a strong Q3 beat. This raised concerns about Q4 top-line growth, leading investors to dump Mattel stock.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Mattel reported net sales of $1.92 billion, up 9% year-over-year. Further, the company’s top line exceeded the analysts’ consensus estimate of $1.84 billion. The company’s adjusted EPS of $1.08 improved year-over-year and handily surpassed the Street’s estimate of $0.86. Mattel noted a significant increase in consumer demand for its products. Management said that the uptick in revenue could be attributed to the success of the Barbie movie, which made notable contributions through box office revenues, merchandising, and consumer product partnerships.

Mattel’s CEO Ynon Kreiz said, “We are very well positioned competitively and expect to gain market share in the fourth quarter and full year.” Despite strong Q3 performance and expected market share gains, the company reiterated its full-year top-line guidance. Mattel expects its Fiscal 2023 revenue to remain flat, which indicates that its Q4 revenues could come under pressure.

Addressing the financial outlook, Mattel’s CFO, Anthony DiSilvestro, expressed concerns regarding the challenging macroeconomic environment. He said that the tough operating environment and higher volatility could impact consumer demand and revenues. DiSilvestro expects the overall decline in the toy industry to offset the benefits of the Barbie movie. With this backdrop, let’s look at the Street’s forecast for Mattel stock.

What is the Projection for Mattel Stock?

While Mattel reiterated its full-year net sales outlook, it raised its full-year EPS outlook, which is positive. Further, management expects to grow the company’s market share and expand margins.

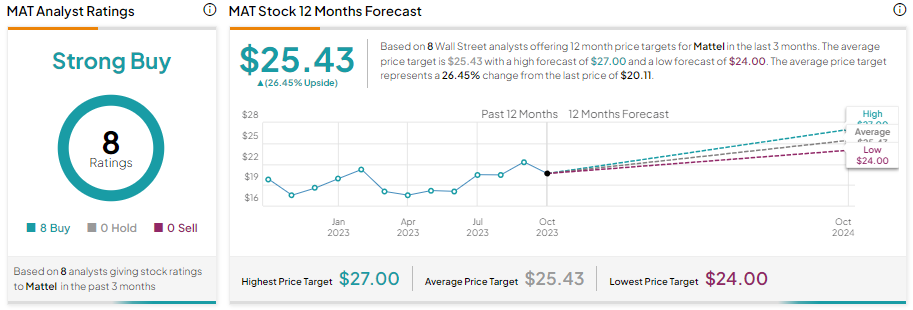

Wall Street analysts maintain a bullish outlook on MAT stock as the company is expected to gain from the expansion of its IP-driven toy and entertainment offerings. It has received eight unanimous Buy recommendations for a Strong Buy consensus rating. Further, the average MAT stock price target of $25.43 implies 26.45% upside potential from current levels.

However, investors should note that these ratings and price targets for MAT stock were issued before the Q3 earnings announcement. Thus, investors can expect a revision in price targets for Mattel stock.