Analysts at Needham, led by five-star-rated Laura Martin, believe that social media firm Reddit (RDDT) is in a strong position as people change how they search for information online. Instead of clicking on website links, more users are now relying on AI-generated answers that summarize results directly. As this trend grows, overall referral traffic across the internet is declining. Because of that, Needham argues that the platforms quoted inside AI answers are becoming more valuable, with Reddit standing out as a major beneficiary.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

To back this up, Needham cited research from Pew, Semrush (SEMR), and Similarweb (SMWB). These studies found that Reddit appears in the majority of AI-generated responses, while searches that include AI summaries lead to fewer overall website clicks. In other words, as AI answers replace links, visibility is shifting from page visits to citations. According to the firm, Reddit now accounts for roughly 20% to 40% of all AI citations, which represents a much larger share of online discovery than it had in the past.

In addition to citations, Reddit has another potential growth driver through licensing its data to train large language models. In fact, the platform has built a massive content library with about 1 billion human-created posts and 16 billion comments collected over the past 18 years, which continues to grow with 1.2 million new posts and 7.5 million new comments every day. As a result, Needham recently named Reddit as a top pick going into 2026 and reaffirmed its Buy rating with a $300 price target.

Is RDDT Stock a Good Buy?

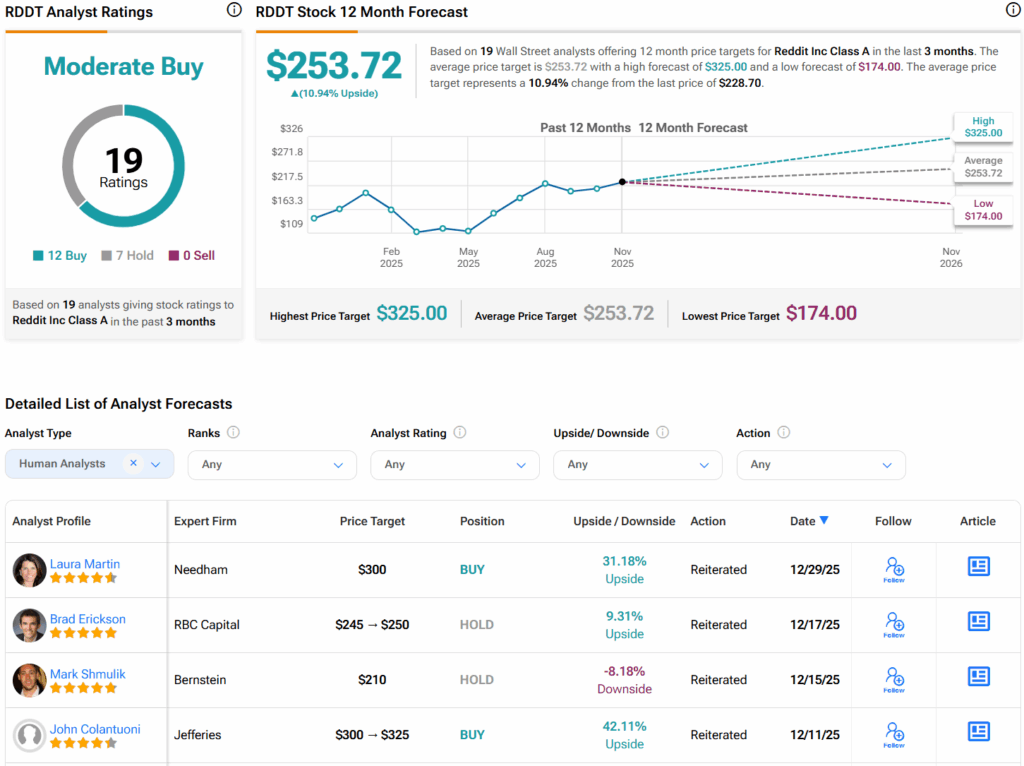

Turning to Wall Street, analysts have a Moderate Buy consensus rating on RDDT stock based on 12 Buys, seven Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average RDDT price target of $253.72 per share implies 11% upside potential.