Chinese AI stocks surged sharply today, extending a rally that began last week as investor excitement around new IPOs, chip innovations, and strong earnings forecasts lifted sentiment across the sector. Investors are now wondering whether this momentum is just a short-term boost or the start of a broader tech bull run, with China’s largest AI and chipmakers showing signs of accelerating growth and strong market demand.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

What’s Happening with Chinese Tech Stocks?

On Monday, China’s AI startups MiniMax (HK:0100) and Zhipu AI topped the sector after strong IPO performances. Zhipu, which trades as Knowledge Atlas Tech Joint Stock (HK:2513), surged over 40%, while competitor MiniMax rose over 25% in Hong Kong. At the same time, chipmaker Shanghai Iluvatar CoreX SemiCon (HK:9903) gained nearly 9% after a solid debut on the market.

Among the big Chinese names, Baidu (BIDU) rose 4% in Hong Kong, extending last week’s rally after reports said it filed to list its chip unit, Kunlunxin. Tencent (TCEHY) gained 2.1%, while Alibaba (BABA) jumped over 5% on news that Beijing may step in to ease an ongoing price war in the sector.

Elsewhere in Asia, TSMC’s (TSM) Taiwan shares rose 1.4% after the world’s largest contract chipmaker reported strong year-on-year growth in December sales. The upbeat results, along with Nvidia’s (NVDA) new chip launch and positive comments at last week’s CES trade show, helped lift sentiment across AI stocks.

Is China Tech the Next Big Winner?

Overall, the Chinese AI sector is still recovering from heavy losses in late 2025, when concerns over high valuations and overcrowded AI trades weighed on investor confidence.

Looking ahead to 2026, China’s tech sector is showing early signs of a comeback, led by a rebound in AI stocks. Government support and easing regulatory pressure are also boosting investor confidence. At the same time, Chinese tech and AI stocks are attracting attention from investors seeking alternatives to expensive U.S. shares, as they offer lower valuations with similar growth potential.

In December, UBS called Chinese tech stocks the “most attractive,” citing rapid AI monetization and Beijing’s push for technological self-reliance.

Having said that, risks remain, including policy uncertainty and uneven growth, so investors are favoring AI, chips, and leading platforms rather than the entire sector.

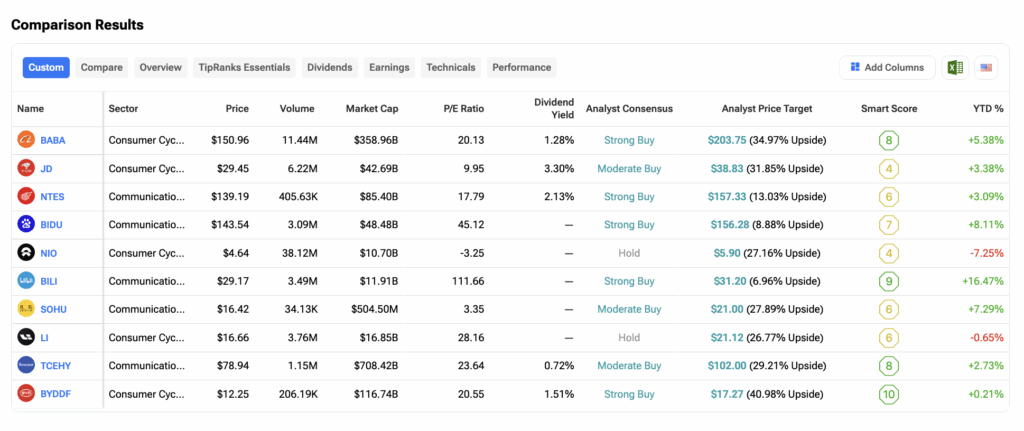

Which Is the Best Chinese Stock to Buy, According to Analysts?

Using the TipRanks’ Stocks Comparison Tool, we have lined up major Chinese companies to help investors compare them across key performance metrics. Below is a screenshot for reference.