E-commerce giant Alibaba (BABA) (HK:9988) has emerged as a top AI play in China, with its U.S.-listed shares up more than 127% this year. The rally has added roughly $250 billion in market value due to growing investor confidence in Beijing’s AI push, according to a Bloomberg report. Despite the strong run, Alibaba still trades well below its 2020 peak, leaving fund managers to believe that further upside is possible.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For instance, Jian Shi Cortesi, a fund manager at GAM Investment Management, sees “significant upside” in Alibaba stock. The optimism comes from both the company’s improving outlook and the rush by investors who don’t want to miss further gains after the stock’s recent rally.

It’s important to highlight that domestic investors have increased their exposure to Alibaba, raising their stake to 11% of outstanding shares by September 30, up from 8.6% a month earlier, according to Hong Kong Stock Exchange data. Overseas funds remain cautious, but ace hedge fund manager, Cathie Wood, reopened a position in Alibaba ADRs last month for the first time in four years.

Valuation Leaves Room for Gains

Alibaba trades at about 22 times estimated forward earnings in Hong Kong, double its three-year average but still below its 2020 high of 29 times. Importantly, its valuation is also cheaper than U.S. tech peers like Amazon (AMZN) and Microsoft (MSFT). “I don’t think anyone will be calling Alibaba’s valuation egregious anytime soon,” said Richard Clode of Janus Henderson, adding that this helps global investors re-enter the name.

Still, risks remain. Short bets spiked last month as investors flagged weak Chinese consumption, regulatory uncertainty, and ongoing price wars in e-commerce.

AI Spending Fuels the Rally

Alibaba CEO Eddie Wu recently announced plans to expand the company’s $53 billion AI budget over the next three years, highlighting the need to keep pace with U.S. rivals that plan to spend more than $340 billion this year. Building on this push, Alibaba Cloud reported strong second-quarter revenues, rising 26% and making it the fastest-growing unit in the group.

Fund managers note that Alibaba is one of the few Chinese companies with large language models, cloud scale, and access to advanced AI chips. “Unlike the U.S., where there are many players, Alibaba stands out in China,” said Xiadong Bao, a fund manager of Edmond de Rothschild.

Is BABA a Good Stock to Buy Now?

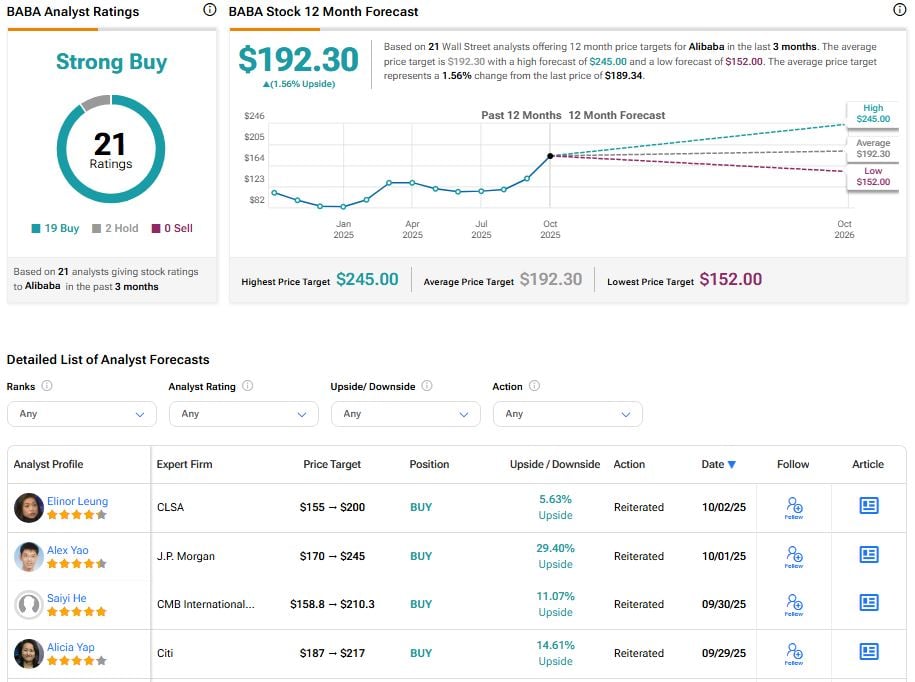

For now, Wall Street remains highly bullish on Alibaba stock. With 19 Buys and two Holds, Wall Street has a Strong Buy consensus rating on Alibaba stock. The average BABA stock price target of $192.30 indicates 1.56% upside potential.