Caterpillars are known for their slow, deliberate crawl — but as they metamorphose, they don’t just move faster — they take flight as butterflies. Caterpillar Inc. (CAT) may be entering that very phase as 2026 shapes up to be a breakout year for its growth and development. The stock is poised to break out of its multi-year trend channel, dating back to 2020.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Despite a challenging backdrop, the stock has maintained steady upward momentum, rising nearly 35% year-to-date. Investors have looked past a soft Q2 and the potential for continued volatility through the remainder of 2025, focusing instead on the recovery ahead.

Consensus now anticipates a sharp reacceleration in both revenue and earnings in 2026 — a trajectory increasingly supported by improving fundamentals. In my view, that backdrop supports a continuation of the rally, keeping my outlook firmly Bullish.

The Rally Looks Odd; Until You Peek Under the Hood

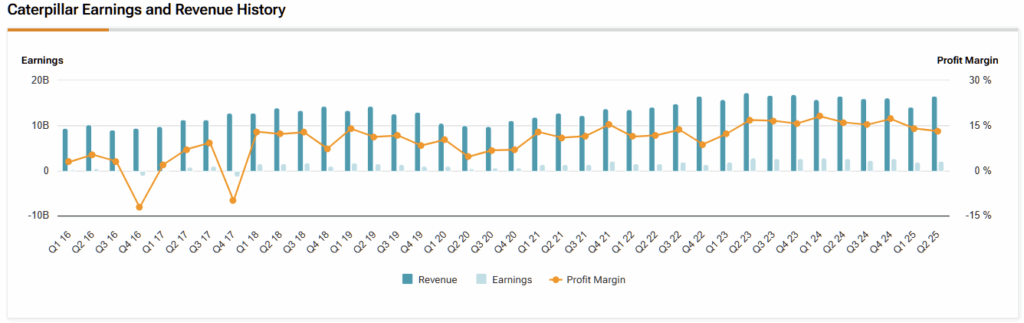

At first glance, the ongoing share price rally might seem a bit strange, as Caterpillar’s latest report wasn’t exactly great. Its Q2 sales slipped about 1% year over year to $16.6 billion as Construction Industries and Resource Industries cooled, even while Energy & Transportation held up.

Management pointed squarely to dealer inventory reductions, as last year dealers built inventory, but this year they trimmed it. This came along with softer price realization in North America and currency drags in Latin America.

Earnings fell faster than sales because margins compressed. Adjusted operating margin dropped to 17.6% from 22.4% a year ago, and adjusted EPS landed at $4.72 versus $5.99 last year. Two notable factors here were tariffs and higher manufacturing costs. In fact, in late August, Caterpillar lifted its tariff hit for 2025 to $1.5–$1.8 billion, and guided that adjusted operating margins would track toward the lower half of its target range.

Brighter Skies Expected Next Year

Unfortunately, the near-term lull isn’t over. Street models peg Q3 EPS at around $4.58, down from $5.17 last year, and Q4 at around $4.37, down from $5.14 — declines that align with management’s caution on margins and costs in the back half. In other words, H2 still looks like the digestion phase of the cycle. All eyes are on CAT’s next earnings call in less than a month.

Nevertheless, the tone seems poised to shift in 2026. Consensus shows a notable re-acceleration in both revenue and EPS next year, with multiple trackers lifting their 2026 figures through September. The reason is unusually supportive, as U.S. electricity demand is expected to hit record highs in 2025 and 2026, driven by the growth of data centers, which will be an underappreciated tailwind for Caterpillar’s Energy & Transportation unit (which includes turbines and large generators).

In August, CAT announced multi-year agreements to power hyperscale campuses with Hunt Energy and Joule. The company also highlighted a record backlog this summer — fuel in the tank for a volume rebound once inventory dynamics normalize.

Add the classic drivers, such as infrastructure and non-residential construction, which remain robust in North America, as miners become more active due to the tight supply of metals for electrification and aging fleets. It’s easy to see why the market is willing to look beyond this year’s challenges.

CAT’s Valuation Isn’t as Stretched as it Looks

Many investors argue that the stock appears expensive, but this view softens when viewed through a medium-term lens. Wall Street projects 2025 EPS of roughly $17.85, down approximately 19% year-over-year, implying a forward P/E ratio of nearly 28x. Earnings, however, are expected to rebound sharply to $21.21 in 2026 (+19%) and $25.23 in 2027 (+19%), which naturally brings the forward multiple down to around 23x and 20x, respectively. In short, CAT appears capable of growing into its valuation as profits catch up.

If conditions improve more quickly — for example, if data center projects accelerate or miners approve additional brownfield expansions — 2026 estimates could rise. Signs of that are already emerging: CAT has been described as an unlikely AI beneficiary amid rising power-generation demand. At the same time, utilities continue to outline record capital spending to meet load growth. In that scenario, the valuation multiple could compress even as the share price climbs, with earnings doing the heavy lifting.

Is Caterpillar Stock a Buy or Sell?

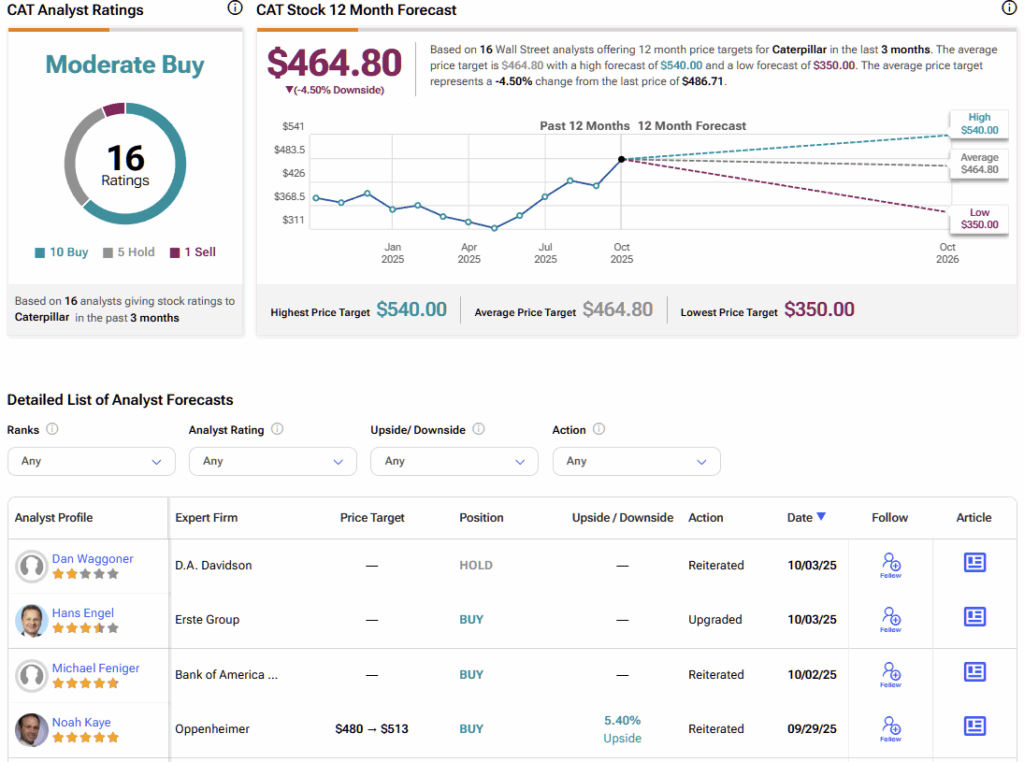

There are 16 analysts offering price targets on CAT stock via TipRanks, with a somewhat bullish consensus. Specifically, 10 analysts have rated the stock a Buy, five a Hold, and one a Sell. At $484.80, however, CAT’s average stock price target implies about 4.5% downside over the next twelve months, meaning that Wall Street believes any future upside has likely already been priced in.

CAT’s Internal Grind Sets the Stage for Market Uplift

Just like a real fleshy caterpillar, Caterpillar’s 2025 has been, and will likely remain a year of change and internal transformation, with an apparent blooming phase expected in the near future. The company is contending with dealer inventory swings, softer price realization in select segments, and a sizable tariff-related tax that’s pressuring margins on top of existing top-line headwinds.

Analysts view the current phase as an internal grind setting up an external flight for CAT stock in 2026. The outlook for next year appears favorable, with Caterpillar sitting on a record backlog, supported by secular power demand from data centers and a likely volume rebound as destocking runs its course. If those elements come together, the recent rally looks justified — and may still have room to run. I remain constructive on CAT, viewing any second-half volatility as an opportunity to add to my position.