Broadcom (AVGO) is a dominant semiconductor firm whose share price has risen more than 600% over the last five years. Going forward, tailwinds from artificial intelligence (AI) should propel the stock even higher. Rising AI revenues, the integration of recently acquired VMware, and bullish sector trends are all reasons why investors should be optimistic about AVGO stock.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

AI Demand is Strong

One reason to be bullish on Broadcom’s stock is that the AI industry is still in its early innings, with new technologies coming to market that are attracting investors. The industry is projected to grow at 19.3% each year over the next decade. Even though Nvidia (NVDA) remains the industry leader, the AI pie is big enough for several semiconductor players, including Broadcom.

Broadcom has been a beneficiary of the AI boom. The company anticipates $12 billion in AI revenues for its current Fiscal 2024 year. CEO Hock Tan made this claim after the company reported strong Fiscal Q3 results. Revenue surged 47% year over year during the quarter, with AI and the integration of VMware playing big roles in the strong financial results.

Many corporations are ramping up their AI investments, and that creates opportunities for Broadcom. Big tech companies are expected to spend more than $1 trillion on AI technology in coming years, according to investment bank Goldman Sachs (GS). The spending presents a tremendous opportunity for Broadcom, which was already a microchip leader before companies poured even more capital into AI.

Earnings Growth at Broadcom

My bullish view of Broadcom is strengthened by the company’s 47% year-over-year revenue growth. Optimistic guidance also makes me excited about AVGO stock. The technology giant has said that it expects sales of $14 billion in the fourth quarter of Fiscal 2024. This projection represents 7% sequential growth from the previous third quarter.

Broadcom also pays a quarterly dividend of $0.53 a share, and underwent a 10-for-1 stock split this past summer. The tech giant has been a top dividend stock for some time, with an annualized 14.71% growth rate over the past five years. The company’s strong financials and AI tailwinds suggest that it can continue growing its distribution to shareholders by double digits.

Broadcom delivered Fiscal Q3 earnings of $8.2 billion, up 41.8% year over year. Furthermore, the company closed the quarter with a strong cash position of $9.95 billion. That’s a slight increase from $9.81 billion of cash held at the end of the previous quarter.

Broadcom Continues to Win Partnerships

Broadcom also continues to win new AI partnerships, which makes me bullish on the stock. The semiconductor firm has partnerships in place with notable companies such as Alphabet (GOOGL), OpenAI, Dell (DELL), and others.

Broadcom’s partnerships have two advantages. The first is that they generate revenue for Broadcom. Doing business with industry leaders creates stable cash flow and increases revenue growth. These customers also have deep pockets and can invest more capital into AI initiatives, if needed. The second benefit is that these partnerships strengthen Broadcom’s position and can generate even more business as success breeds success. Each partnership further establishes Broadcom as a top choice for AI microchips and processors.

Broadcom’s VMware acquisition complements the company’s other services. VMware has several privately held AI partners, including Domino Data Lab and DKube.

Is Broadcom Stock a Buy?

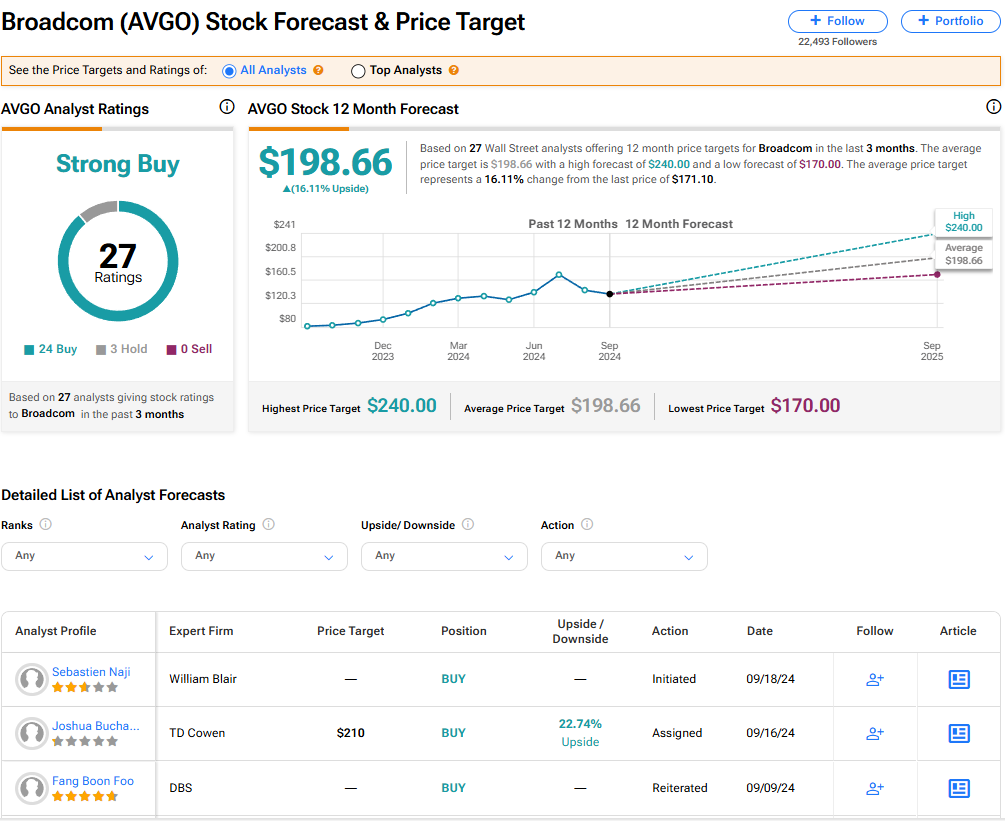

Broadcom’s stock has a consensus Strong Buy rating among 27 Wall Street analysts. This is based on 24 Buy and three Hold recommendations made in the last three months. There are no Sell ratings on AVGO stock. The average price target of $198.66 implies 16.11% upside potential from current levels.

Read more analyst ratings on AVGO stock

The Bottom Line on AVGO Stock

Broadcom has produced a 500% return over the last five years. Moving forward, AI tailwinds should continue to carry the company to new heights. Revenue is growing at a strong pace and the company offers a competitive dividend to its shareholders. Although Nvidia remains the industry leader when it comes to AI microchips and processors, the pie is big enough for other companies, such as Broadcom, to also capitalize. Investors should continue to expect AVGO stock to outperform.