BitMine Immersion Technologies (BMNR) has emerged as one of the market’s most aggressive Ethereum treasury plays. Over the past month, the company has boosted its holdings to more than 833,000 ETH, worth roughly $3.58 billion at current prices. That puts it at the top of the list for public ETH holders and makes its stock a direct proxy for Ethereum’s price performance.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

With ETH pushing past $4,300 in recent sessions, BMNR has benefited from the surge in demand for Ether exposure. Investors are rewarding the company’s rapid build-up of ETH reserves. They see it as a strong bet on Ethereum’s long-term future.

The stock’s recent climb shows just how excited traders are, and many are getting in now hoping Ethereum’s run will keep going into the fall.

Strategy Loses Ground as Capital Shifts

Strategy (MSTR), by contrast, has long been the flagship for Bitcoin treasury strategies. But as capital rotates toward Ethereum, the stock has struggled to keep pace. MSTR’s value is closely tied to Bitcoin’s price, and with BTC lagging ETH in recent performance, some investors are cashing out of BTC-linked equities in favor of ETH-focused names like BMNR.

This shift in sentiment shows us the market’s growing preference for Ethereum’s perceived growth potential over Bitcoin’s store-of-value narrative. While MSTR still commands a massive BTC treasury, it now faces a competitive disadvantage in cycles where ETH outperforms.

Two Treasury Strategies, Two Different Outcomes

The divergence between BMNR and MSTR is as much about investor psychology as it is about balance sheets. BMNR’s fortunes are directly leveraged to Ethereum’s price moves, making it a fast-moving, high-upside play in an ETH bull cycle. MSTR offers similar exposure to Bitcoin, but in a market that is currently favoring Ethereum, that positioning is proving to be a headwind.

Investors are effectively voting with their capital. Right now, they’re voting for Ethereum, and BMNR is the clearest public-market vehicle for that bet. If ETH continues to dominate flows, the performance gap between BMNR and MSTR could widen even further.

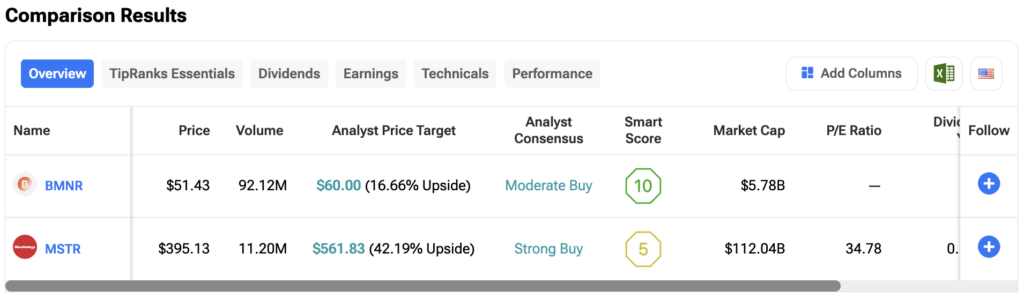

Investors can weigh the two stocks side-by-side to see which better fits them. Tools like the TipRanks Stocks Comparison feature make it easier to measure fundamentals, analyst sentiment, and growth potential before deciding where to place capital. Click on the image below to explore the tool.