Johns Lyng Group (ASX:JLG) shares fell more than 10% to about AU$5.95 just before midday. The stock plunged after the company announced that its CEO Scott Didier has sold a large amount of his shares in the company.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Didier sold 4 million shares, representing 7.5% of his stake in the company. Even after the sale, the executive remains heavily invested in the company, with more than 49.3 million shares. The executive undertook the sale to raise funds to purchase a family home in Denver, Colorado.

Johns Lyng Group provides integrated building services in Australia and overseas. It recently acquired Reconstruction Experts (RE) to expand its business in to the U.S. market. As a result, Didier now splits his time between Melbourne and Denver, the headquarters of the RE business.

“I remain incredibly proud of what JLG does every day in Australia and now in the U.S.. The continued flood events in Australia and with events such as Hurricane Ian in Florida have demonstrated what a critical role we play,” commented Didier.

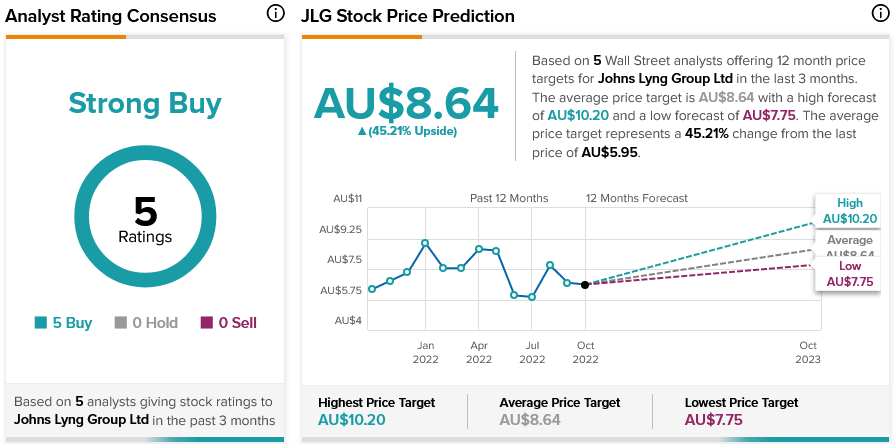

Johns Lyng share price forecast

According to TipRanks’ analyst rating consensus, Johns Lyng stock is a Strong Buy. The average Johns Lyng share price forecast of AU$8.64 implies about 45% upside potential.

Johns Lyng stock is receiving favourable mentions on financial blogs. TipRanks data shows that financial blogger opinions are 85% Bullish on Johns Lyng, compared to a sector average of 68%.

Concluding thought

Although internal share selloffs are never a great signal for external investors, Johns Lyng’s CEO still retains a significant stake in the company.