Apple (AAPL) came out of the Q3 earnings season relatively unscathed, beating both revenue and earnings expectations—even if EPS only edged past consensus—and, more importantly, providing constructive guidance for the December quarter, which is historically the company’s strongest period. In fact, the stock has traded flat since last week’s earnings news.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

The indication that Fiscal Q1 2026 revenue could return to double-digit growth (10%–12% YoY) was well received, especially after a softer performance in the iPhone segment and Greater China during Q4, which had raised concerns about the durability of growth in two of the most critical pillars of the long-term bull case.

That said, Apple’s AI narrative remains unconvincing, and I still view this as the Achilles heel of the investment thesis—particularly considering the company continues to trade at multiples that imply a growth profile more in line with AI-driven peers. However, there is also a case to be made that the market is increasingly comfortable viewing Apple through a value-defensive compounder lens, supported by its extraordinary ROIC and capital efficiency. Meanwhile, Big Tech peers expanding aggressively into AI infrastructure face the recurring need to demonstrate high incremental returns on those large investments every single quarter—a pressure that Apple, for now, largely avoids.

In the long run, Apple’s slow-but-steady value compounder profile remains compelling. But in the short to medium term, the stock’s rich valuation likely limits upside, making it more prone to move in line with the broader market rather than significantly outperform it. For that reason, I believe a Hold stance on AAPL appears most appropriate at this point.

How the Market Misread Apple

Investors have had plenty of reasons to be skeptical of Apple over the past few years. Among them: (1) slower growth compared to the rest of the Magnificent Seven, (2) the company’s struggle to craft a convincing AI narrative, and (3) an overreliance on share buybacks instead of reinvesting in infrastructure and long-term growth opportunities.

However, I believe one of the reasons Apple’s stock has rallied more than 50% since April’s Liberation Day is that the market has increasingly recognized that there are, after all, more reasons to like Apple than to dislike it.

Starting with growth, the recent Q4 results helped reinforce the notion that the company’s Services segment continues to expand profitably, with segment margins rising from 74% in Q4 2024 to 75.3% in Q4 2025.

Meanwhile, early data suggests the iPhone 17 cycle is shaping up to be more robust than initially feared—particularly heading into the holiday quarter—with iPhone revenue up 10% QoQ and 6.1% YoY, albeit slightly below consensus. Management’s guidance implies that December quarter iPhone revenue will likely expand in double digits YoY, potentially marking the strongest iPhone quarter in Apple’s history.

Regarding the narrative that Apple “failed” to position itself in AI, I think the CapEx comparison actually tells a more nuanced story. Apple spent ~$12.7 billion in CapEx over the past twelve months, compared to ~$120 billion at Amazon (AMZN) and ~$78 billion at Microsoft (MSFT).

In other words, Apple is not participating in the AI infrastructure arms race, which, in theory, only creates value if the returns on that capital exceed its cost. That’s why ROIC (NOPAT divided by invested capital) is the real dividing line between value creation and simple balance sheet expansion.

Apple’s High ROIC Tells a Story of Maturity, Not Momentum

And on that front, Apple stands alone: the company delivers an extraordinary ~65% ROIC, while Microsoft and Amazon operate at levels closer to ~24% and ~16%, respectively—levels temporarily pressured by massive AI-driven investment cycles.

However, and this is key, Apple’s high ROIC reflects the past, the maturity of the iPhone-centric ecosystem, rather than a new growth curve. Microsoft and Amazon are effectively sacrificing ROIC in the short term to expand TAM (total addressable market) in AI and cloud computing, while Apple maintains profitability without yet demonstrating a clear avenue to participate in that same long-duration upside.

So the emerging interpretation is not that Apple “failed” the AI story, but rather that the market is increasingly viewing Apple as a defensive compounder, sustained by extraordinary capital efficiency. Meanwhile, the AI leaders are pursuing a fundamentally different strategy: monetizing AI today, while investing heavily to scale and attempt to amplify that monetization over time.

Limited Upside at Current Prices

Another point that challenges Apple’s bullish thesis is the discrepancy between how the company is perceived and how it is priced. Apple is increasingly viewed as a value-oriented, mature compounder, yet it continues to trade at a growth multiple. Today, Apple trades around 36x earnings, nearly identical to Microsoft—but with a PEG ratio of ~3.2, reflecting a much slower structural growth outlook, with long-term EPS expected to compound at only ~10% over the next three to five years.

Microsoft, by contrast, trades at a similar P/E but carries a PEG of ~2.3, supported by a much clearer and more scalable AI-driven growth runway, particularly in cloud and distributed compute.

This asymmetry helps explain why, over the past three years—a period overwhelmingly dominated by AI-led re-rating in the tech sector—Apple has not been able to outperform the broader market meaningfully. In fact, it has been partially penalized for not being a direct participant in the AI boom.

At the same time, it’s equally notable that the stock has still managed to keep pace with the S&P 500 (SPX), supported by aggressive buybacks, strong pricing power, and exceptional capital efficiency. But in the short to medium term, this profile suggests that Apple behaves more like a steady, defensive long-term compounder, with limited relative upside when compared to peers that are currently aligned with secular, AI-driven growth vectors.

Is AAPL a Buy, Hold, or Sell?

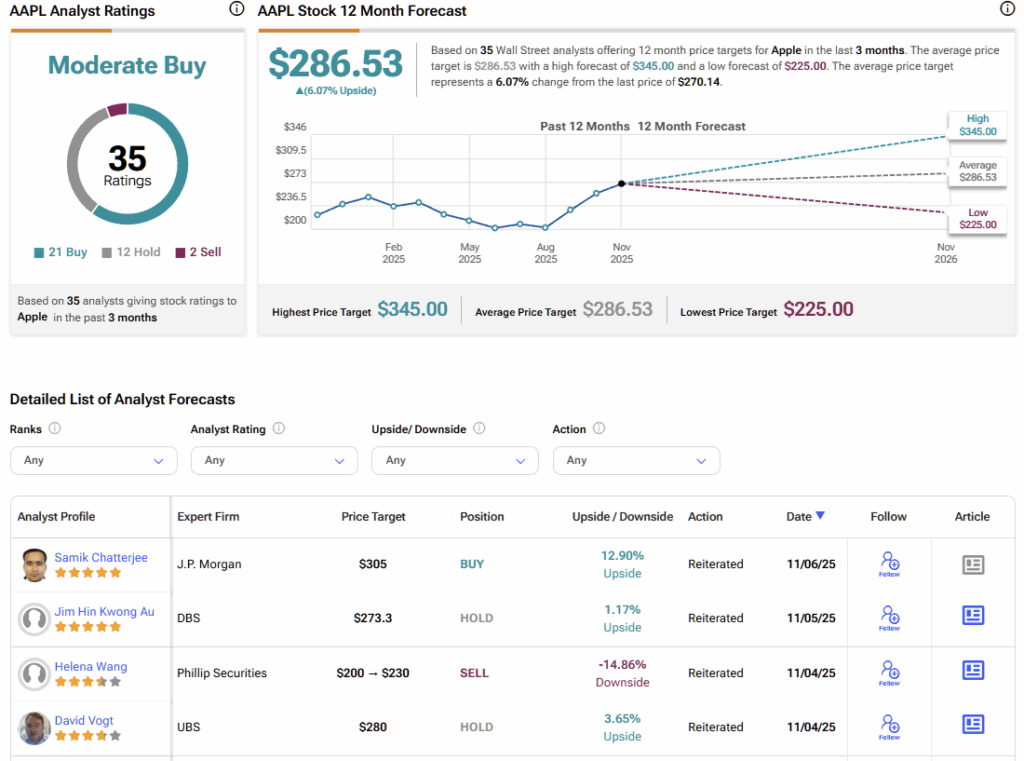

Market sentiment toward Apple remains predominantly bullish, though not without its share of skepticism. Among the 35 analysts who have issued opinions on AAPL over the past three months, 21 currently rate the stock as a Buy, 12 recommend Hold, and only 2 assign a Sell rating. The average price target sits around $286.53, implying a modest upside of just over 6% over the coming year.

Stable Compounding, But Not Much Headroom

Apple’s latest results set the stage for what could be one of its strongest holiday quarters in years. While the company did fall slightly short of iPhone expectations, the fact that the stock has been able to hold its premium multiple in an environment where peers are spending tens of billions to chase AI-driven growth emphasizes a key point: Apple’s greatest strength remains its compounding ability, supported by exceptional returns on invested capital that no other Big Tech company has been able to match consistently over multiple years.

This is why it is difficult to be bearish on Apple over the long term—the business continues to compound value steadily and defensively. However, given the rich valuation and more modest growth outlook relative to AI-leveraged peers, the near-term upside appears limited. As such, I continue to take a Neutral view on AAPL: a high-quality compounder that is likely to perform in line with the broader market, rather than significantly outperform it at current levels.