As we head into 2026, the technology sector sits at a pivotal moment. The artificial intelligence (AI) revolution is clearly underway, yet investors remain divided. On the one hand, this represents a genuine Fourth Industrial Revolution, with the U.S. firmly back in the lead on foundational technology for the first time in decades. On the other hand, the sheer scale of capital investment required to support enterprise and consumer AI has made some investors cautious.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

I believe Microsoft (MSFT) sits directly at the center of this transition—and 2026 is shaping up to be its sweet spot. As enterprises move from experimentation to full-scale AI deployment, Microsoft’s combination of Azure, Copilot, and its massive installed base positions the company to be one of the biggest beneficiaries of the next phase of AI adoption. For that reason, I remain bullish on Microsoft and view it as one of the most compelling large-cap technology opportunities heading into 2026.

A Strong Year, With More to Come

Microsoft shares are up roughly 16% this year, broadly in line with the S&P 500 (SPX). While that performance may appear “average” on the surface, I believe it masks what is coming next. AI adoption across enterprises remains in its early stages. Many CIOs are only now formalizing long-term AI strategies. That shift—from pilots to production—is where Microsoft’s platform strength becomes most visible.

In my view, the market has not fully priced in the next wave of AI-driven cloud growth that is likely to materialize in 2026. Microsoft is uniquely positioned to capture this demand because it already sits inside enterprise workflows, developer environments, security stacks, and productivity software. AI, for Microsoft, is not a bolt-on product—it is becoming the connective tissue across its entire ecosystem.

Core Growth Engines of Azure and AI

A key part of the bullish thesis is Azure. I believe the Street continues to underestimate Azure’s growth trajectory as AI workloads scale. While investors remain cautious about the pace of AI monetization, enterprise demand is steadily building behind the scenes.

Microsoft’s competitive edge lies in its installed base. Azure is not competing in a vacuum; it is embedded alongside Windows, Microsoft 365, Dynamics, GitHub, and security tools that enterprises already rely on. As Copilot adoption expands and AI becomes more tightly integrated into daily workflows, Azure becomes the default infrastructure layer for many customers.

Looking ahead, I estimate that AI-driven cloud adoption could add roughly $26 billion to Microsoft’s top-line trajectory by fiscal 2026. Over the next three years, I estimate that approximately 75% of Microsoft’s enterprise installed base will use AI-enabled functionality in some form. That level of penetration fundamentally changes Microsoft’s growth profile and margin potential.

Despite increasing competition from AWS (AMZN) and Google Cloud (GOOGL), I view Microsoft as the front-runner in enterprise-scale AI. Its ability to deliver a full-stack solution—spanning infrastructure, data, applications, security, and productivity—is challenging to replicate.

Financial Performance Reflects Momentum

Microsoft is among the best-positioned enterprise software companies to monetize trillion-dollar market opportunities associated with AI and agentic workloads.

Importantly, AI adoption creates powerful pull-through effects. As enterprises deploy AI models, they naturally increase spending on data management, analytics, developer tools, security, and business applications. Microsoft operates at the center of all these layers, allowing it to function as a “picks and shovels” provider for the AI revolution.

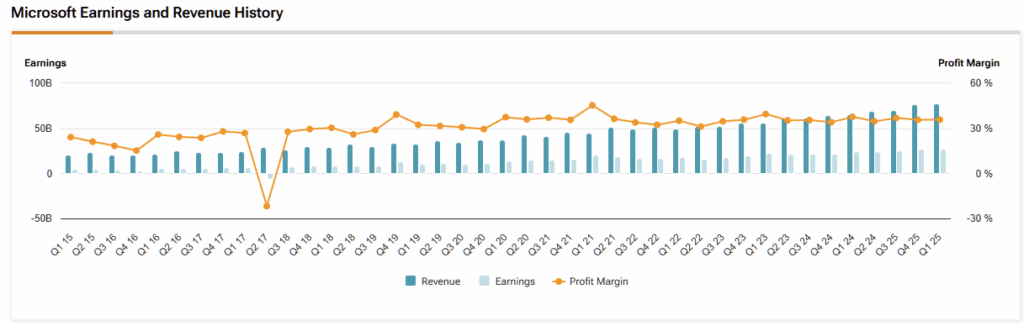

This positioning supports a long runway of double-digit revenue and operating profit growth, along with accelerating free cash flow as capacity utilization improves and scale efficiencies kick in.

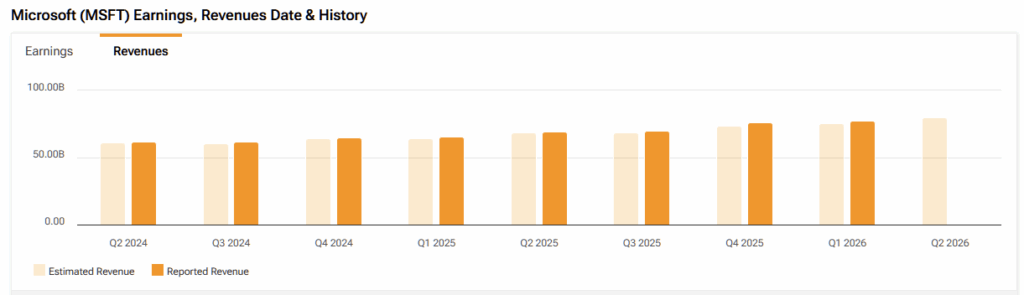

Microsoft’s financial results already reflect this momentum. In the first quarter of fiscal 2026, total revenue grew 18% year-over-year to $77.7 billion.

The Productivity and Business Processes segment, Microsoft’s largest, delivered $33 billion in revenue, up 17% year-over-year. For a mature segment, that level of growth is impressive and highlights the impact of AI-enhanced productivity tools.

The Intelligent Cloud segment was even stronger, growing 28% annually to $30.9 billion and accounting for roughly 40% of total revenue. Within that segment, Azure and other cloud services grew by approximately 40%, reinforcing Azure’s role as the primary driver of growth.

Another underappreciated strength is Microsoft’s remaining performance obligation (RPO). Commercial RPO increased more than 50% from last year to nearly $400 billion, providing exceptional visibility into future revenue. This backlog signals that enterprise customers are making long-term commitments to Microsoft’s cloud and AI platforms, despite ongoing macro and AI “bubble” concerns.

A Premium Valuation That’s Worth It

Microsoft trades at a premium to peers, with a P/E in the mid-30s and EV/EBITDA in the low 20s. While these multiples exceed sector medians, they are slightly below Microsoft’s historical averages.

I model long-term revenue growth of approximately 11.5%, a terminal growth rate of 3%, and a terminal free-cash-flow margin of 36%. Using a combination of valuation approaches, including DCF and multiple-based methods, I estimate fair value around $530 per share, implying close to 9% upside from current levels.

Is Microsoft a Buy, Sell, or Hold?

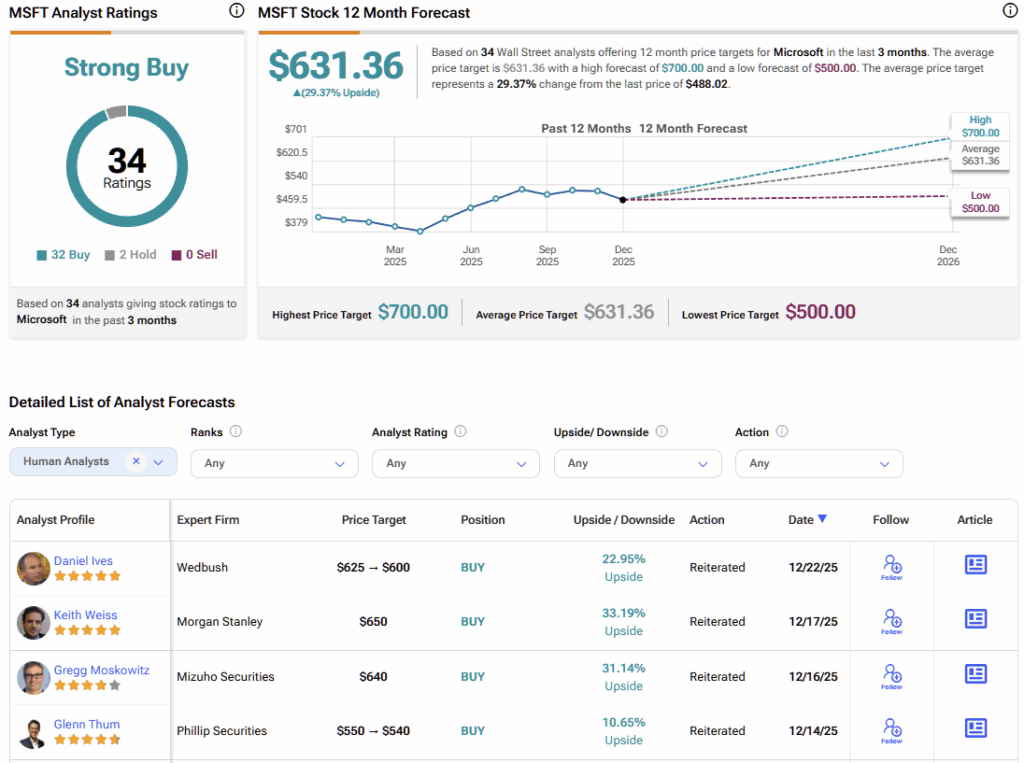

Wall Street remains constructive, with a consensus Strong Buy rating. According to analysts tracked by TipRanks, the average price target for Microsoft is $631.36, representing nearly 30% potential upside in 2026.

Microsoft Enters the Defining Phase of the AI Cycle

Microsoft is entering what I believe will be a defining phase of the AI revolution. As enterprises shift from experimentation to large-scale deployment, Microsoft’s integrated platform, massive installed base, and AI strategy position it to capture outsized value.

While valuation is not cheap, it is justified by durable growth, exceptional visibility, and unmatched positioning in enterprise AI. Looking into 2026 and beyond, I remain bullish on Microsoft as one of the core winners of the AI-driven technology cycle.