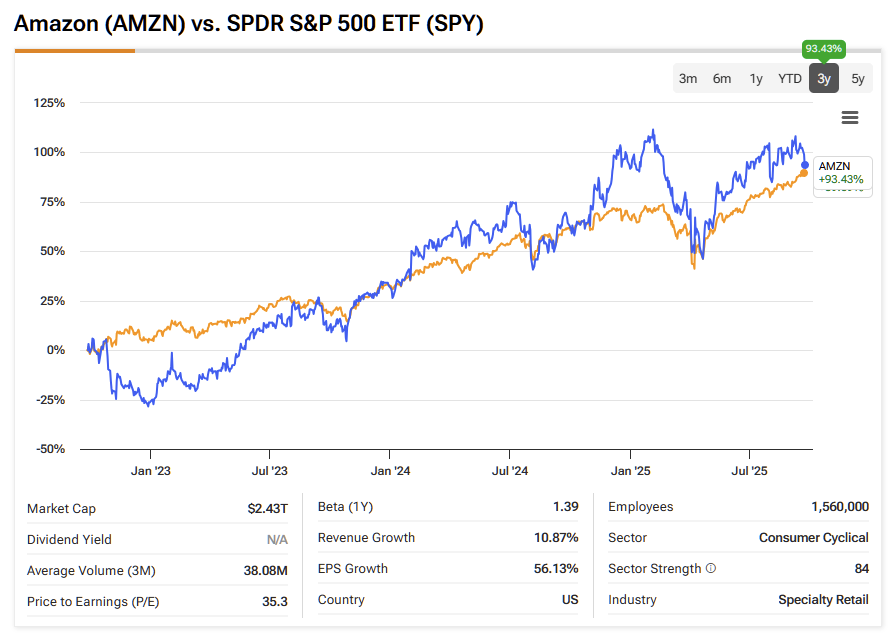

Investors often frame the Amazon (AMZN) story around AWS—and rightly so, given its scale and profitability. But what continues to surprise many is the resilience and profitability of Prime and Amazon’s broader retail ecosystem. Prime continues to add value, delivery speeds are accelerating, and the retail network has matured to the point where it consistently generates significant profits. This helps explain the stock’s remarkable ability to track the S&P 500 (SPX) and its 93% stock price jump since 2022.

TipRanks Black Friday Sale

- Claim 60% off TipRanks Premium for the data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

If AWS is the turbocharger, Prime is the steady growth engine: ever-present, often overlooked, but crucial when operating leverage kicks in. Given the confluence of positive factors, I remain stoutly Bullish on AMZN stock.

Prime’s Momentum Is Real

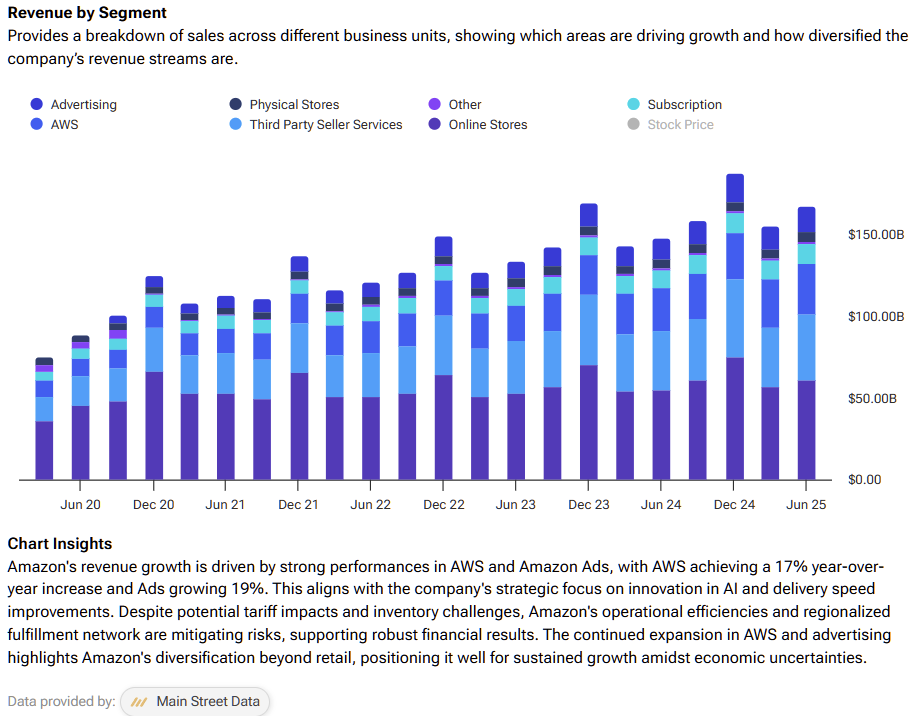

Amazon’s most recent results showed that Prime isn’t fading, but rather it’s accelerating. “Subscription services”, which include Prime membership fees and digital content, grew to $12.2 billion in Q2, up 12% year over year. Advertising services tied to that ecosystem (including Prime Video ads) increased 23% to $15.7 billion, while the company described July’s event as its biggest Prime Day in its history. That’s the membership, the media, and the shopping loop all pulling together.

Speed remains Prime’s killer feature. Last year, Amazon delivered more than 9 billion items same-day or next-day worldwide, and the company estimates Prime members saved nearly $95 billion on fast, free delivery, or about $500 per U.S. member on average. It’s through this convenience that Amazon turns occasional shoppers into habitual ones, and considering this year’s record figures, items delivered and customer savings are expected to hit new highs, thus sustaining high retention.

In the meantime, Prime Video continues to deepen its moat. Amazon reported around 2 million viewers per race for its new NASCAR coverage (with the youngest audience among broadcasters), named a broadcast team for its upcoming NBA package, and expanded a Roku (ROKU) integration that gives advertisers access to an estimated 80 million U.S. CTV households, translating to more reach to monetize.

Where Prime Goes Next

Looking ahead, Amazon is expanding its delivery edge by introducing fast shipping to smaller markets. The company plans to offer Same-Day and Next-Day coverage for over 4,000 additional towns by year-end and is investing $4 billion to reinforce rural delivery capacity. Scale should continue to lower “cost to serve,” boost conversion, and keep competitors chasing.

On the monetization side, Prime Video’s ad business is maturing too. Ad load has increased to roughly 4–6 minutes/hour, according to industry reporting, and Amazon has just rolled out an AI creative assistant to help brands launch campaigns across its surfaces, including Prime Video. When you combine more inventory, simpler tooling, and better targeting, you achieve faster ad growth, layered on top of Prime engagement.

And the retail drumbeat continues, as another Prime Big Deal Days event lands in October, funneling even more traffic through the membership. These tentpoles keep sellers leaning into Amazon’s logistics and advertising stack, reinforcing the flywheel as we head into the holidays.

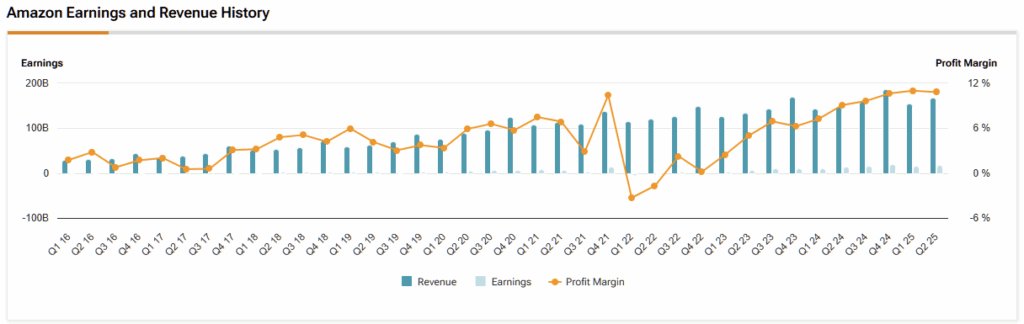

Margins Are Finally Flexing

What really moves the needle in Amazon’s investment case is that retail margins are now on the rise. North America’s operating margin reached 7.5% last quarter, up sharply from a year ago, which reflects two years of network regionalization and shorter, more cost-effective routes to customers. The company has repeatedly emphasized that lower “cost to serve” is structural, not a one-off. Pair that with International profitability, and you get a retail engine that now generates actual cash.

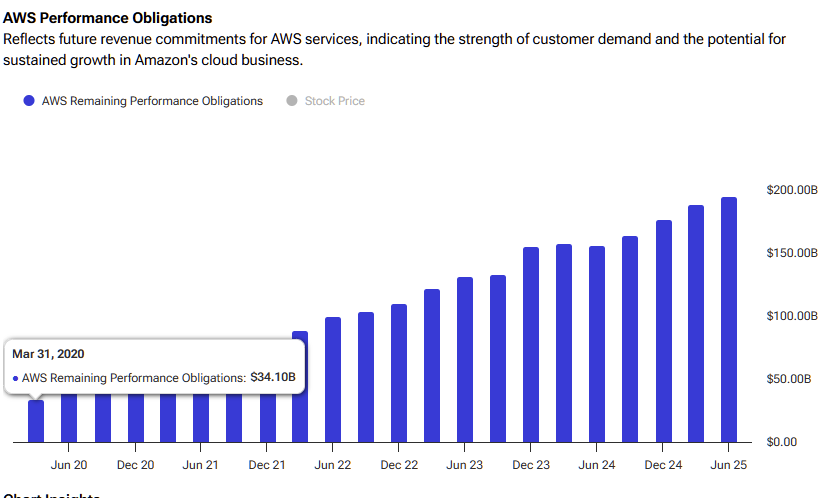

Now layer AWS on top of the retail stack that is still growing at double-digit rates with a bumper operating income, and the consolidated profit profile appears excellent. Operating income reached $19.2 billion in Q2, with AWS contributing $10.2 billion of that, providing Amazon with multiple levers to fund speed, content, and automation without compromising margins.

So the question then becomes whether today’s valuation is justified. And I think it totally does. Consensus estimates indicate that EPS is expected to rise from $6.65 (2025) to $15.57 (2030), with the forward P/E ratio compressing from the mid-30s to the mid-teens as earnings expand. If retail/Prime margins continue to inch up and AWS profits compound, Amazon has room to “grow into” that multiple rather than relying on the multiple to do the heavy lifting.

Is Amazon a Buy, Hold, or Sell?

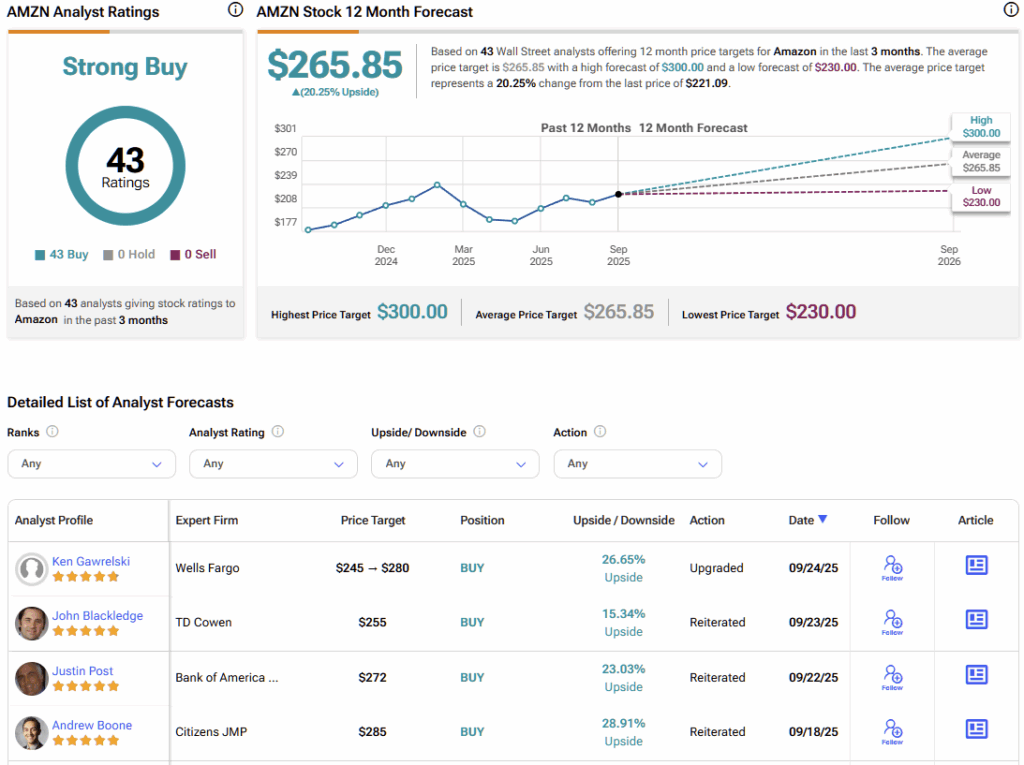

There are 43 analysts offering price targets on AMZN stock via TipRanks, with a unanimous bullish consensus. At $265.85, AMZN’s average stock price target implies more than 20% upside over the next twelve months.

The Hidden Growth Engine Behind AMZN’s Bull Case

Prime is no side business despite AWS stealing the spotlight. Instead, it’s a sticky subscription wrapped around faster-than-ever delivery, an expanding ad platform, and seasonal shopping events that keep customers coming back. The result is higher engagement, better retail margins, and more monetizable attention for video ads, while AWS continues to bankroll the future. Therefore, if you’re bullish on AMZN, being bullish on Prime’s operating leverage is the clearest, most grounded way to get there.