This article was written by Shalu Saraf and reviewed by Gilan Miller-Gertz.

Shares of Alibaba (BABA) fell more than 3% on Tuesday after Freedom Capital Markets analyst Roman Lukianchikov downgraded the stock to Hold from Buy and cut his price target to $140 from $180. The move came despite Alibaba reporting better-than-expected Q2 FY26 results, as the analyst pointed to higher spending and slower growth in the company’s core retail business.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Freedom Capital Markets Turns Cautious on Alibaba

Lukianchikov said Alibaba’s latest quarter beat expectations, but he still sees rising cost risks. In his view, the key issue is not growth, but the rising cost needed to support it.

He said cloud remains a key strength, with revenue rising about 34% from a year ago due to growing demand for AI. Still, Lukianchikov cautioned that higher spending is weighing on visibility, as it remains unclear when those investments will pay off.

At the same time, the analyst pointed to slower progress in Alibaba’s core retail business. While ad spending supported sales, growth continued to trail other e-commerce leaders. In his view, this suggests Alibaba may need to keep spending more just to stay competitive.

Taken together, Lukianchikov said these trends limit near-term upside. As a result, he prefers to remain on the sidelines for now, citing the need for clearer progress on costs and returns.

Is Alibaba Stock a Buy Now?

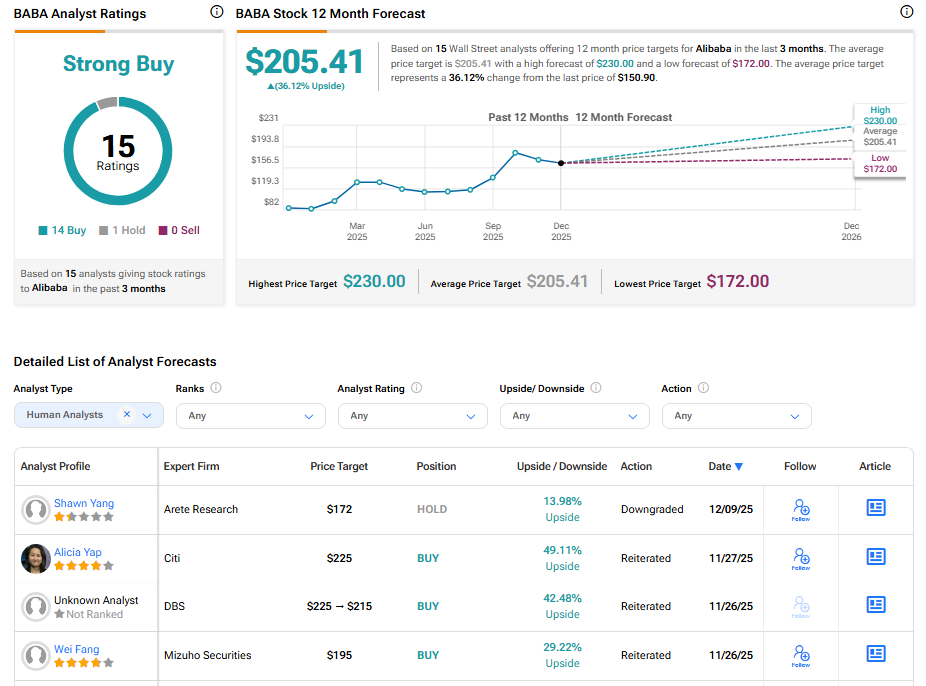

Even with these risks, Wall Street remains constructive on the stock. Alibaba stock carries a Strong Buy consensus rating, based on 14 Buy ratings and one Hold over the past three months. The average BABA price target stands at $205.41, suggesting roughly 36% upside from current levels.