It’s no surprise that Adobe’s (ADBE) stock has struggled this year, given the narrative that its growth story might slow as new entrants in generative AI compete with the leading creative software company. However, upon closer inspection, ADBE stock may offer more than its price suggests.

TipRanks Black Friday Sale

- Claim 60% off TipRanks Premium for the data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

Even though top and bottom-line growth have continued at a solid pace in recent quarters, slight slowdowns in sequential subscription growth have been enough to fuel ongoing skepticism and weigh on the stock. While this may justify analysts projecting more modest future growth, these projections arguably need to align with valuations.

The data suggests that even under conservative base-case assumptions—especially given Adobe’s track record of steady growth—the stock still offers a wide margin of safety. At around ~$362, the market already seems to be pricing in a worst-case scenario. Despite recent weakness in the share price, I’m reaffirming my Buy rating with a $400 price target, aligned with ADBE’s 200-day moving average.

How the Market Views Adobe Today

Adobe’s latest quarterly report, published at the end of August, once again beat market estimates by delivering double-digit growth in both EPS and revenue (and also raising its annual guidance), prompting analysts to revise their forward EPS estimates for the next three years—and, albeit more modestly, revenue estimates for the same period.

For example, prior to Q3, when Adobe was trading at $350 per share—down from $441 at the start of the year—analysts had projected Fiscal 2025 revenues of $23.57 billion. They now estimate $23.69 billion, a difference of roughly 0.5%, but enough to consolidate double-digit growth. For the next two fiscal years (2026 and 2027), revenue estimates were also revised slightly upward, by 0.3% and 0.1%, respectively.

On the bottom line, the revisions were slightly more meaningful: EPS for Fiscal 2025 was previously estimated at $20.57, and is now projected at $20.76—roughly a 1% upward revision. Fiscal 2026 and 2027 estimates were similarly revised about 1% higher.

In short, Adobe’s recurring revenue model provides strong predictability for both top and bottom-line performance, rarely surprising analysts by more than a percentage point. As a result, using consensus estimates with a margin of error of ~1% can be a reliable way to model valuations based on discounted cash flows for the leading creative software company.

Pricing in the Bear Case for Adobe

Since trying to predict a company’s growth more than three years out is highly speculative—even for mature, stable companies—the vast majority of analysts currently forecast Adobe’s revenue and EPS only through 2027. Those few who provide estimates for 2028 and beyond offer a more modest outlook, possibly acknowledging that this may be the period when Adobe permanently slows from double-digit or high single-digit growth in both revenue and EPS.

For example, in 2028, a consensus formed by just three analysts forecasts only 7.8% annual revenue growth and 3.2% EPS growth, which would be Adobe’s lowest historical revenue growth since 2014, when the company grew revenues by just 2.3% and saw EPS decline by 5.4% during its transition from perpetual licensing to the cloud. In 2029, the same three analysts project 8% growth for both revenue and EPS, still historically modest. I believe these projections may be overly conservative, particularly given Adobe’s consistent cash generation, which often funds significant buybacks, boosting EPS growth even if core business growth slows.

That said, if we take the analysts’ overall consensus for the next five years as a basis for how ADBE is priced today, the five-year revenue CAGR stands at 8.8%, and the EPS CAGR at 7.2%.

Adobe’s Value Hides in the Margins

Although the market has not priced in a strong near-term growth trajectory for ADBE, as it has in recent years, if such sluggish growth materializes, the stock should theoretically be priced accordingly.

I argue, however, that this is not the scenario today. Using a reverse discounted cash flow approach, and assuming the same 8.8% five-year revenue CAGR and 7.3% EPS growth, it is theoretically possible—if revenue and share count remain constant—for operating margins to grow by a factor of 1.4 over five years. While this may sound aggressive, given it would be well above historical norms, a more reasonable approach is to maintain EBIT margins around 36–40% for the next five years and let revenue growth drive most of the EPS CAGR.

Under these top and bottom-line assumptions, we also assume a 20% tax rate, no change in net working capital, and minimal capital expenditures as a percentage of revenue—consistent with Adobe’s business model. I apply a discount rate of 8.5%, based on a 4% risk-free rate, Adobe’s debt-to-equity ratio of 0.04, and a cost of equity of 7.1%. Using these inputs and assuming a perpetuity growth rate of 3%, the implied equity value for Adobe today is $174 billion, compared to the current market capitalization of $154.44 billion—a spread of roughly 13.3%.

Is Adobe a Good Stock to Buy Right Now?

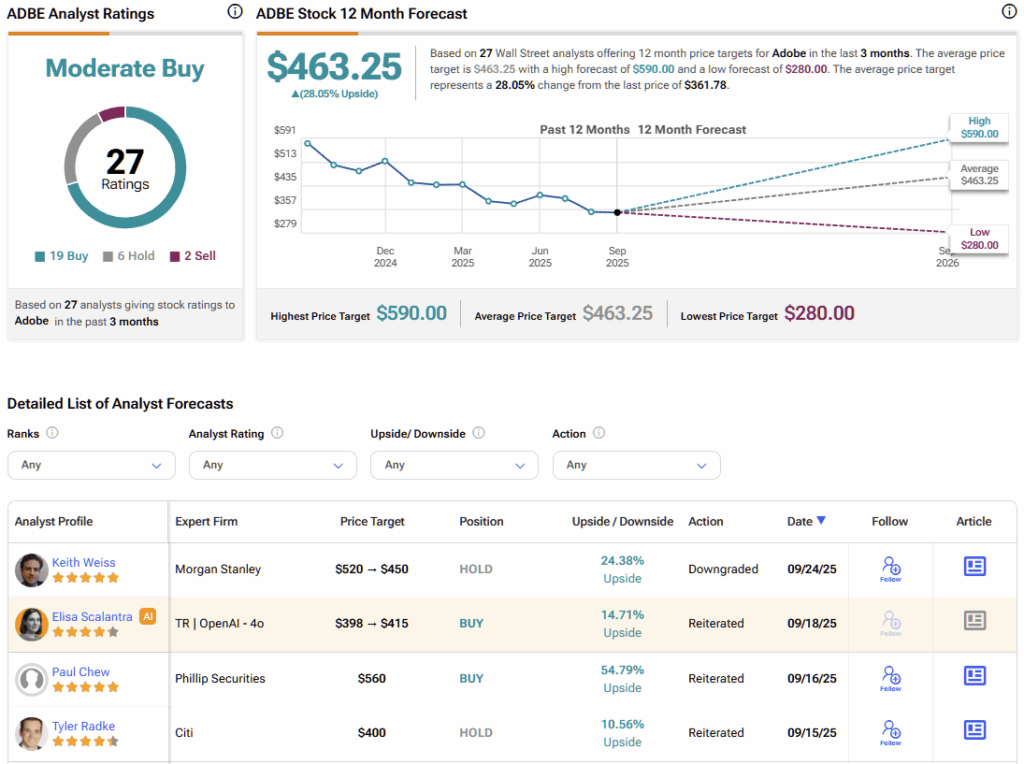

The most recent Wall Street ratings for ADBE over the past three months are largely bullish. Out of 27 analysts, 19 recommend Buy, six recommend Hold, and only two recommend Sell. The average target price is $463.25 per share, implying an upside of just over 28% from the current share price.

Compelling Risk-Reward Profile for ADBE Investors

Based on the current market consensus regarding Adobe’s thesis, it appears that a considerable margin of safety is built into the stock’s valuation, even under seemingly conservative assumptions. Of course, estimates are only as good as they are accurate, but given the predictability of Adobe’s business and its recent track record of exceeding conservative market expectations, it’s hard not to see the stock as highly attractive at current levels.

For these reasons, I reiterate ADBE as a Buy, with significant upside potential if the company continues to deliver consistent results above expectations.