Adobe (NASDAQ:ADBE) has long been viewed as one of the crown jewels of enterprise software. The 43-year-old software powerhouse helped define the creative economy with legacy products like Photoshop, Illustrator and Acrobat – and successfully reinvented itself as a subscription-based SaaS leader with its Creative Cloud and Document Cloud businesses.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Yet, the stock tells a more complicated story, with shares down 24% over the past 12 months and currently trading at a 52-week low. The pressure has come from several fronts, including decelerating Digital Media growth, uncertainty around how quickly AI features can reaccelerate revenue, and a broader cooling in investor appetite for large-cap software names as interest rates stayed higher for longer.

That backdrop helps explain why ADBE tumbled about 6% today, after analyst Brian Schwartz of Oppenheimer downgraded the stock from Outperform (i.e., Buy) to Perform (i.e., Neutral). (To watch Schwartz’s track record, click here)

Schwartz acknowledged that Adobe remains a strong company, calling it “well entrenched in its customers’ digital creative landscape” with “best-of-breed” products and a growing AI-first business. However, the analyst made it clear that expectations had gotten ahead of reality. The AI-driven rebound in Digital Media growth that he had anticipated “did not play out,” with growth decelerating further over the past year.

One of the key concerns is a lack of near-term catalysts. According to Schwartz, Adobe is likely to see a slower recovery in investor sentiment than other large software peers, partly because pricing power appears to be weakening during the AI transition. The analyst also flagged softer confidence in management based on investor conversations, noting reduced messaging and visibility around long-term targets.

Competition is another growing headache. Schwartz argued that the AI transition has actually weakened Adobe’s moat, as generative AI tools increase the speed of content creation while compressing pricing and intensifying competition. New rivals range from large language model providers such as OpenAI and Anthropic to major platforms like Meta and Google, as well as design-focused players like Canva and Figma. In his view, this dynamic risks pushing Adobe toward sub-10% revenue growth in 2026, alongside down-year operating margins.

Finally, sentiment itself has become a headwind. Adobe’s market cap has shrunk sharply over the past year, and Schwartz warned it will be difficult to rebuild investor confidence unless the company delivers faster Digital Media growth, expanding margins, meaningfully higher capital returns, or a clear improvement in sentiment around the name.

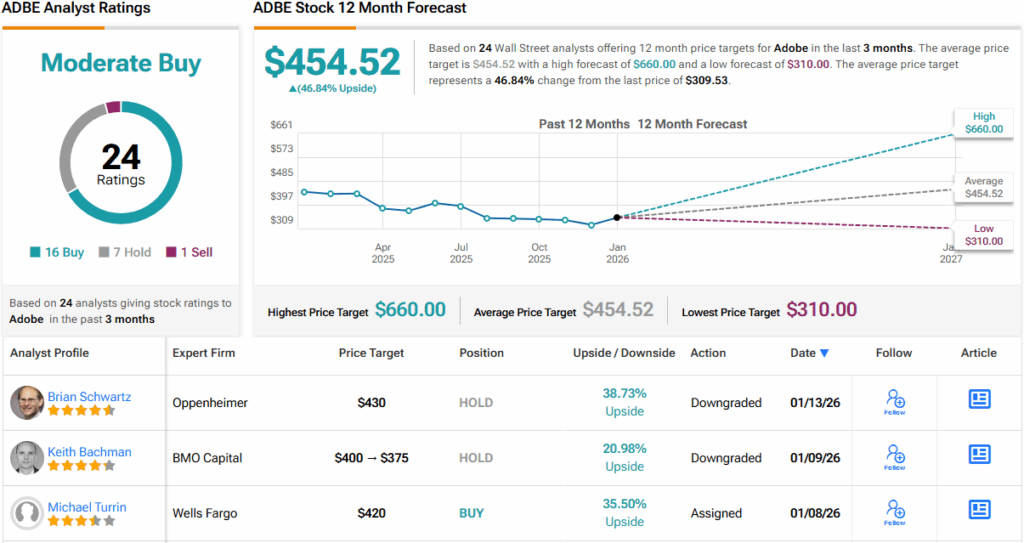

So, that’s Oppenheimer’s view. The broader Street, however, is striking a more constructive tone on Adobe. With 16 Buys, 7 Holds, and just 1 Sell, ADBE earns a Moderate Buy consensus rating. Moreover, the average price target of $454.52 points to ~47% upside over the next 12 months. (See ADBE stock analysis)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.