Gallup’s latest survey shows that just 28% of Americans trust the mass media to report the news fully, fairly, and accurately—the lowest reading since the survey began in the 1970s. Funnily enough, the poll shows most mistrust is among Republican voters (only 8% of them trust mass media), which is surprising considering that Donald Trump sailed into the White House with the biggest mandate since 2004, primarily built on populist issues highlighted by mass media.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For U.S. stock investors, this matters far beyond the realm of politics. Confidence in information is central to how markets function, and a collapse in media trust can ripple through investors’ minds, specific sectors, and individual companies in the U.S. stock market.

Investors rely on timely and accurate reporting to inform their decisions about company earnings, economic data, and policy shifts. When skepticism dominates, two risks emerge: hesitation to act on legitimate news and overreliance on unverified sources. Both outcomes can lead to fractured markets and increased volatility. For retail traders, especially, mistrust of traditional outlets may prompt them to turn to social media or online forums for financial news.

While sometimes useful, these spaces can also spread rumors and speculative narratives, as seen in the 2021 GameStop (GME) saga, or, as some argue, in the current situation with certain AI stocks, which are rising on hype and mania based on outlandish expectations that are exacerbated by media reporting. Low confidence also affects sentiment.

Markets often move as much on psychology as fundamentals. If investors broadly distrust the information environment, uncertainty becomes more common. This can lead to the opposite effect: defensive positioning resulting in greater flows into bonds, cash, or gold—and a reduced risk appetite for stocks, i.e., the “risk-off” trade.

Gallup Poll Implications for U.S. Stocks

Public companies in the media sector are directly exposed to fluctuations in public confidence. For example, The New York Times (NYT) has built its brand on timely and accurate reporting. While it has successfully grown digital subscriptions and can take pride in ~12 million readers, persistent mistrust could slow subscription growth and limit pricing power.

Gallup’s poll clearly points fingers at some firms more than most, with the NYT being a prime candidate about whom the 28% are thinking of when answering Gallup’s poll. If investors believe that consumers will continue to abandon mainstream news sources, the NYT’s stock may face headwinds despite a healthy balance sheet and some sturdy results in 2025.

Meanwhile, television networks such as CBS (owned by Paramount Global (PARA)) and Comcast’s NBC (CMCSA) also feel the pressure. Advertising revenue depends on audience trust and engagement. If skepticism drives viewers elsewhere, advertisers may redirect spending to digital platforms that capture attention—even if those platforms lack journalistic rigor. However, if viewers turn away from “the news” entirely and resort to watching entertainment, those same networks have plenty of content to keep customers satiated.

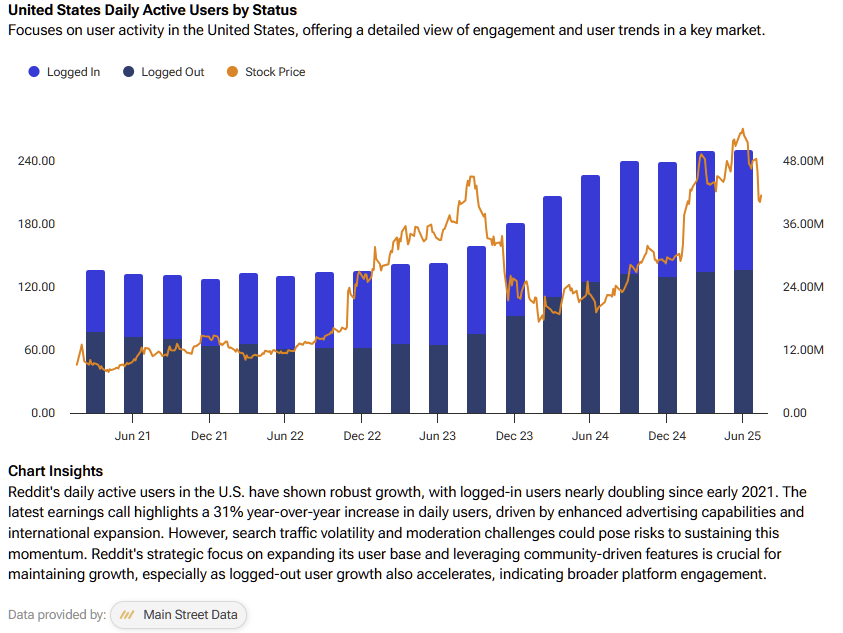

Interestingly, companies like Meta Platforms (META) and Alphabet (GOOGL) could be indirect beneficiaries, given their role in helping users find content they want — not necessarily the content they should trust. Additionally, readers shouldn’t forget that the “discussion” social media platform Reddit (RDDT) went public on the NYSE last year. Splashing down in a market with the lowest media confidence in U.S. history has been more of a blessing than a curse, as far as RDDT investors are concerned. The stock has more than tripled in 18 months.

As mainstream credibility declines, more Americans are turning to Facebook, YouTube, Google search, and now even ChatGPT for accurate information. While these firms face their own challenges with misinformation, they dominate digital ad markets and may continue to attract dollars that are flowing away from traditional outlets.

What Marketwatchers Should Watch

For investors, problems are often opportunities in disguise. So too with the recent Gallup poll. Although trust in the media may be declining, investors can isolate particular factors that can help forecast which stocks will be affected and to what degree. Tracking the following data should help provide clarity and insight for traders and investors.

Subscription Trends: For NYT and other major news publishers, subscriber growth and churn are key indicators of how audience trust converts into financial performance. Tracking subscription metrics offers investors a clear view of whether these outlets remain relevant and credible to their audiences. The NYT discloses up-to-date figures every quarter, while newcomers like RDDT publish daily active user (DAU) statistics, as tracked by TipRanks.

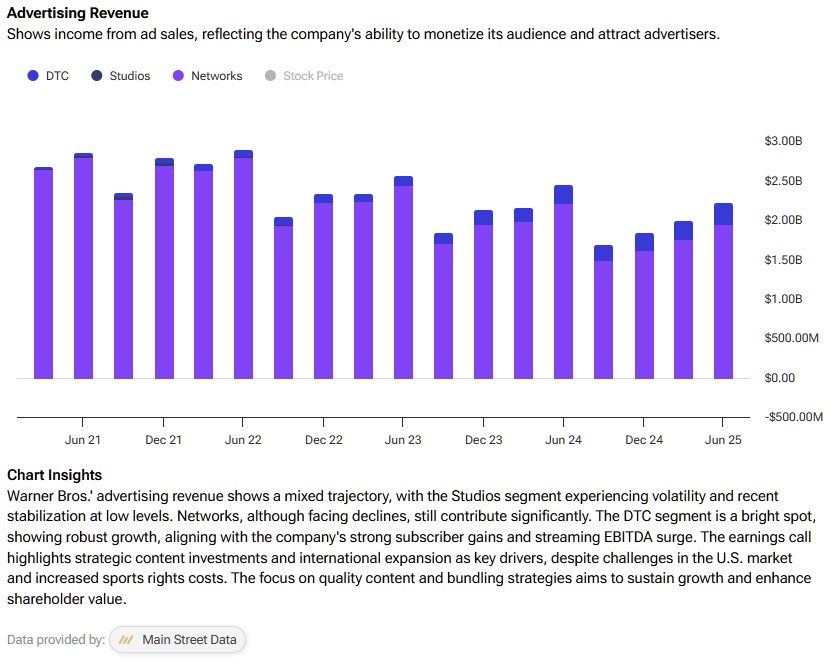

Ad Revenue Shifts: Quarterly advertising results from television and radio broadcasters can serve as a helpful gauge of broader media industry trends. The continued migration of ad spending away from traditional outlets could place additional earnings pressure on firms with substantial advertising exposure, including Warner Bros. Discovery (WBD) and Fox Corporation (FOXA).

Policy Environment: A growing concern over misinformation could prompt new regulations for digital platforms, potentially influencing valuations in relatively new tech-driven media companies that haven’t established a strong reputation. The companies most at risk here would be names like BuzzFeed (BZFD) and Rumble (RUM), given their brand positioning within the so-called “alt-media” space.

Investor Sentiment: Eroding trust in mainstream news can amplify market volatility—both in its frequency and magnitude. As uncertainty persists, investors tend to shift toward defensive assets, such as bonds, utilities, and consumer staples. In such environments, markets can become increasingly polarized, with participants holding sharply divergent views on what constitutes fair value.

Bottom Line for Investors When Navigating Media Distrust

For long-term investors, declining trust in the media presents both risks and potential opportunities. Traditional news organizations such as NYT, PARA, CMCSA, and FOXA may face ongoing structural challenges, while digital-first platforms like RDDT and BZFD could benefit from evolving consumption habits.

The trend shows little sign of reversing. When Gallup first began tracking public trust in the media in the 1970s, roughly 70% of Americans expressed confidence in news reporting. By 1997, that figure had dropped to 53%, then to 44% by 2004. The latest reading—just 28%—marks the first time in history that trust has fallen below 30%.

In a marketplace where mass media credibility has eroded, investors with accurate information at their fingertips will be in a better position to distinguish between signal and noise. And that may just be the ultimate point: in an age of distrust, the true edge belongs not to those who track the headlines, but to those who see beyond them.