AI (artificial intelligence) stock Vertiv Holdings (VRT) has risen 31% over the past year, fueled by the demand for the company’s energy-efficient cooling and power solutions that are needed to support the ongoing AI boom. The data center infrastructure stock has advanced more than 4% year-to-date, as concerns about a slowdown in AI spending have eased. Given the growing interest in Vertiv stock, let’s look at the ownership structure of this AI play.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

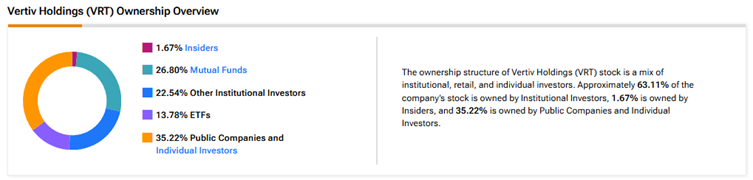

Interestingly, according to TipRanks’ ownership page, institutional investors (mutual funds, ETFs, and other institutional investors) hold the largest share of Vertiv Holdings at 63.1%. They are followed by public companies and individual investors, owning 35.2%. Meanwhile, insiders hold about 1.7% of VRT stock.

Digging Deeper into Vertiv’s Ownership Structure

Looking closely at top shareholders, Vanguard owns the highest stake in Vertiv Holdings at 9.4%. Vanguard Index Funds comes second, with an 8.92% stake.

Among the top ETF holders, the Vanguard Total Stock Market ETF (VTI) owns a 3.2% stake in VRT stock, followed by the Vanguard Mid-Cap ETF (VO), with a 2.17% stake.

Moving to mutual funds, Vanguard Index Funds holds about 8.92% of VRT. Meanwhile, Fidelity Concord Street Trust owns 1.06% of the AI infrastructure company.

Is Vertiv a Good Stock to Buy?

Turning to Wall Street, Vertiv Holdings stock scores a Strong Buy consensus rating based on 12 Buys and two Holds. The average VRT stock price target of $116.93 indicates 1.4% downside risk from current levels.