SoundHound AI’s (SOUN) stock has taken a sharp hit in 2025, with shares down almost 50% in 2025 as investor sentiment around smaller AI names has cooled. With the stock under pressure, attention is turning to who is backing the company and how ownership is structured. In this article, we take a closer look at who owns SOUN and what that may signal for investors going forward.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For context, SoundHound AI focuses on voice recognition and natural language processing, providing AI-powered solutions for multiple industries.

Who Owns SoundHound Stock?

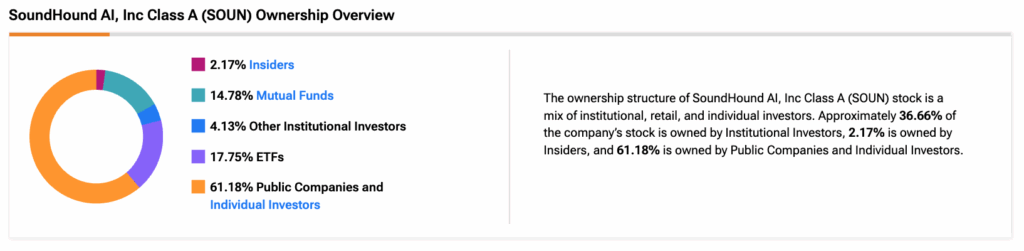

According to TipRanks’ Ownership Tool, public companies and individual investors own 61.18% of SoundHound. They are followed by ETFs, mutual funds, and other institutional investors at 17.75%, 14.78%, and 4.13%, respectively.

Looking at institutional ownership, Vanguard is the largest shareholder in SOUN, holding roughly 10% of the outstanding shares. Vanguard Index Funds are the second-largest holder, with a 7.43% stake.

On the ETF side, the Vanguard Total Stock Market ETF (VTI) owns approximately 2.89% of SOUN, while the iShares Russell 2000 ETF (IWM) holds around 2.37%.

Wall Street’s Views on SOUN Stock

Despite near-term challenges and broader macro uncertainty, SoundHound AI’s long-term outlook remains constructive. On Wall Street, analysts remain cautiously optimistic about SoundHound AI.

Top-rated H.C. Wainwright analyst Scott Buck has set a Street-high price target of $26, pointing to the company’s steady progress toward profitability. He highlighted improving margins and a clearer path to achieving positive EBITDA.

Meanwhile, Cantor Fitzgerald’s four-star analyst Thomas Blakey recently upgraded SOUN stock from Hold to Buy and raised his price target to $15 from $13. Blakey noted that expectations for the company remain relatively modest heading into 2026, leaving room for upside if SoundHound continues to deliver on its growth strategy.

Is SOUN a Good Stock to Buy?

According to TipRanks, SOUN stock has received a Moderate Buy consensus rating, with five Buys and two Holds assigned in the last three months. The average SoundHound stock price target is $17.33, suggesting a potential upside of 72.61% from the current level.