Micron (NASDAQ:MU) stock is down about 6% in today’s pre-market session. The semiconductor company delivered better-than-expected Q3 results. However, its revenue forecast matched the Street’s estimate, disappointing investors who had hoped for a stronger outlook. Nonetheless, Micron is poised to benefit from artificial intelligence (AI)-driven demand. Given this tailwind, it’s the right time to see who owns Micron stock.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

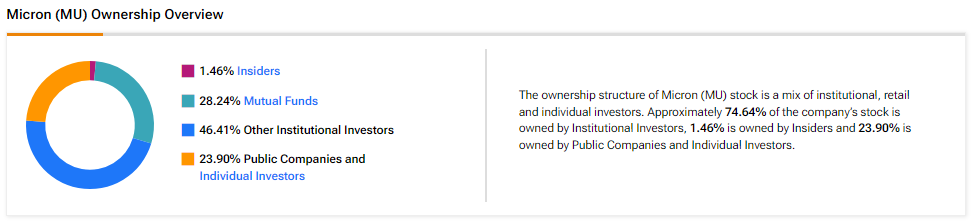

Now, according to TipRanks’ ownership page, other institutional investors own 46.41% of Micron. They are followed by mutual funds, public companies and individual investors, and insiders at 28.24%, 23.90%, and 1.46%, respectively.

Digging Deeper into Micron’s Ownership Structure

Looking closely at institutions (Mutual Funds and Other Institutional Investors), Vanguard owns a 7.74% stake in MU stock. Next up is Vanguard Index Funds, which holds a 6.59% stake in the company.

Among the institutions, the Hedge Fund Confidence Signal is Very Negative on Micron stock based on the activity of 38 hedge funds. Hedge funds decreased their MU holdings by 3.1M shares in the last quarter.

Conversely, individual investors have a Very Positive view of the company. In the last 30 days, the number of portfolios (tracked by TipRanks) holding Micron stock increased by 12.9%. Overall, among the 742,605 portfolios monitored by TipRanks, 1.8% have invested in Micron stock.

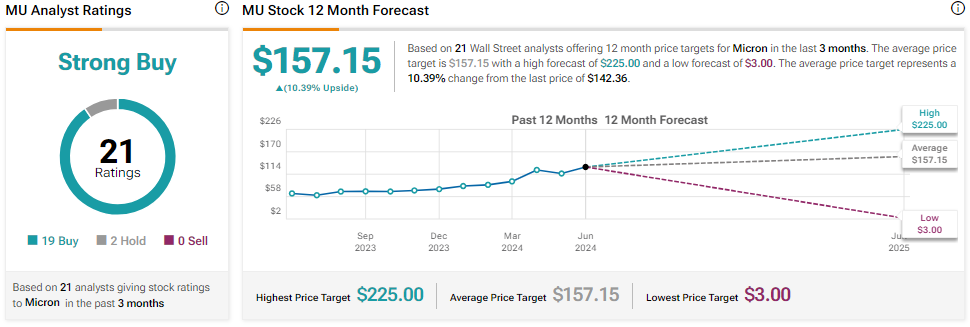

Is MU a Good Stock to Buy?

Wall Street is bullish about MU stock. With 19 Buys and two Hold recommendations, Micron stock has a Strong Buy consensus rating. Analysts’ average price target on MU stock is $157.15, implying an upside potential of 10.39% from current levels. Micron stock has gained nearly 67% year-to-date, exceeding the S&P 500’s (SPX) almost 15% gain.

Conclusion

TipRanks’ Ownership tool provides Micron ownership structure by category, enabling investors to make well-informed investing decisions.

For a thorough assessment of Micron stock, go to TipRanks’ Stock Analysis page.