Shares of the fast food chain McDonald’s (NYSE:MCD) are down over 15% year-to-date and have underperformed the broader equity markets. Further, Loop Capital Markets analyst Alton Stump’s latest checks in the U.S. indicated that MCD’s same-store sales growth was below expectations for Q2. Given the pressure on same-store sales growth, it’s time to see who owns MCD stock.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Now, according to TipRanks’ ownership page, public companies and individual investors own 60.76% of McDonald’s. They are followed by other institutional investors, mutual funds, and insiders at 19.58, 19.45%, and 0.20%, respectively.

Digging Deeper into MCD’s Ownership Structure

Looking closely at institutions (Mutual Funds and Other Institutional Investors), Vanguard owns an 8.59% stake in MCD stock. Next up is Vanguard Index Funds, which holds a 6.74% stake in the company.

Among the institutions, the Hedge Fund Confidence Signal is Very Negative on McDonald’s stock based on the activity of 43 hedge funds. Hedge funds decreased their MCD holdings by 421.9K shares in the last quarter.

Meanwhile, individual investors have neither Positive nor Negative views of the company. In the last 30 days, the number of portfolios (tracked by TipRanks) holding MCD stock increased by 0.8%. Overall, among the 744,499 portfolios monitored by TipRanks, 1.3% have invested in McDonald’s stock.

Is McDonald’s Stock a Buy or Sell?

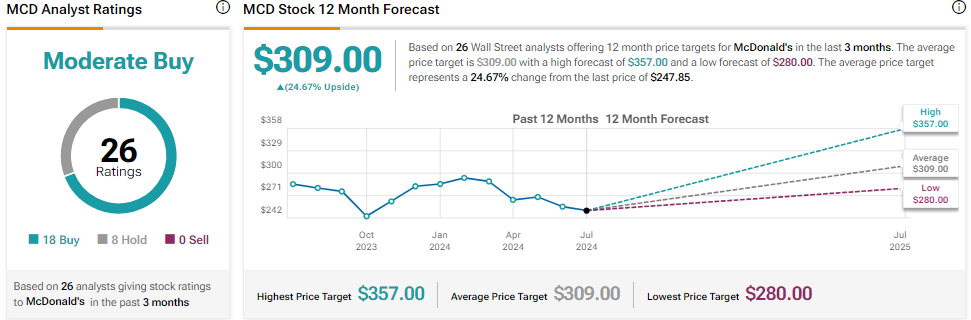

Wall Street is cautiously optimistic about McDonald’s stock. It has 18 Buys and eight Hold recommendations for a Moderate Buy consensus rating. Analysts’ average price target on MCD stock is $309, implying 24.67% upside potential from current levels.

Conclusion

TipRanks’ Ownership tool provides McDonald’s ownership structure by category, enabling investors to make well-informed investing decisions.

For a thorough assessment of McDonald’s stock, go to TipRanks’ Stock Analysis page.