Shares of Hilton Worldwide Holdings (NYSE:HLT), formerly Hilton Hotels, are up over 31% in one year, outperforming the S&P 500’s (SPX) nearly 20% gain. This growth stems from higher occupancy rates, led by a stellar rebound in travel demand. Looking ahead, strength across all major regions, especially in the international markets, and steady leisure demand will likely boost Hilton’s financials and share price. Consequently, it’s the right time to see who owns Hilton Worldwide Holdings.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

As the earnings season is in full swing, it’s important to highlight that the company will release its Q1 2024 financial results on Tuesday, April 24.

Now, according to TipRanks’ ownership page, mutual funds own 38.55% of HLT. They are followed by public companies and individual investors, other institutional investors, and insiders at 32.58%, 20.22%, and 8.65%, respectively.

Digging Deeper into Hilton’s Ownership Structure

Looking closely at institutions (Mutual Funds and Other Institutional Investors), Vanguard owns an 8.85% stake in HLT stock. Next up is Vanguard Index Funds, which holds an 8.22% stake in the company.

Among the institutions, the Hedge Fund Confidence Signal is Vey Negative on TGT stock based on the activity of 12 hedge funds. Hedge funds decreased their HLT holdings by 1.3M shares in the last quarter.

Meanwhile, individual investors have a Neutral view of the company, given that in the last 30 days, the number of portfolios (tracked by TipRanks) holding HLT stock increased by 0.9%. Overall, among the 729,232 portfolios monitored by TipRanks, less than 0.1% have invested in Hilton Worldwide stock.

Is Hilton Hotels a Good Stock to Buy?

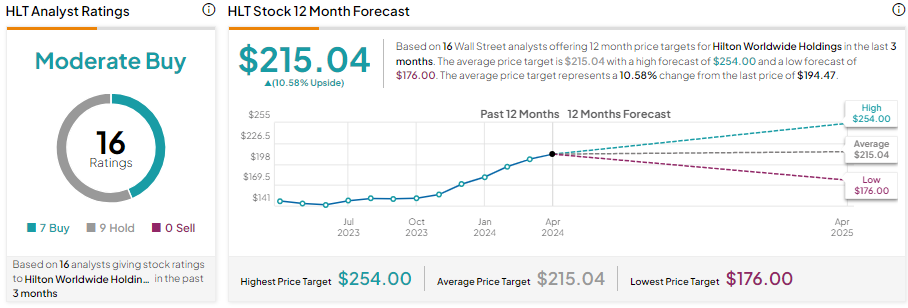

Wall Street is cautiously optimistic about Hilton stock. It has seven Buy and nine Hold recommendations for a Moderate Buy consensus rating. Analysts’ average price target on HLT stock is $215.04, implying 10.58% upside potential from current levels.

Conclusion

TipRanks’ Ownership tool provides HLT ownership structure by category, enabling investors to make well-informed investing decisions.

For a thorough assessment of HLT stock, go to TipRanks’ Stock Analysis page.