Travel stocks are splitting down the middle. Some are pulling back. Others are steaming ahead. For investors looking to buy the dip or ride the next upswing, this month could be the time to act.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Airlines Cut Guidance as Uncertainty Builds

Let’s start with the airlines. Delta (DAL), American (AAL), and JetBlue (JBLU) have all scrapped their full-year forecasts. That move sparked some nerves across Wall Street, especially with summer travel around the corner. Delta CEO Ed Bastian admitted “2025 is playing out differently than we expected at the start of the year,” according to CFO Brew.

With fuel prices unpredictable and demand softening in the U.S., airline stocks are under pressure. But that also means they’re cheaper. Delta currently trades at $42, and analysts on TipRanks give it a price target of $48—a 14.3% upside. Not flashy, but maybe a solid rebound play.

Cruise Lines Charge Ahead With Record Demand

Now flip to the seas. Royal Caribbean (RCL) is having a moment. The company just raised its full-year profit forecast after what CEO Jason Liberty described to Reuters as “the best five booking weeks in the company’s history.” Shares are up, but analysts still see more to come, giving RCL a Strong Buy rating and a target of $145—about 15% above its current $126 level.

It’s the cruise sector, not the skies, that’s delivering the summer optimism right now.

Platforms like Airbnb Offer a Mixed but Promising Picture

Airbnb (ABNB) falls somewhere in the middle. The company reported solid Q1 results but warned about slower bookings in the U.S. CFO Ellie Mertz said, “We do have some U.S. consumers that are waiting and seeing before they book their summer travel.”

Still, analysts haven’t soured on the stock. It’s rated a Moderate Buy on TipRanks, with a target of $148.48 and 18.54% upside from current levels.

Analysts Back Booking and Expedia with Caution

Booking Holdings (BKNG) is another name to watch. It’s rated a Strong Buy with an 11.3% upside to $3,450. Expedia (EXPE), meanwhile, has a Hold rating, but even there, analysts see nearly 18% upside.

TipRanks Shows Which Travel Stocks Look Cheap in May

If you’re hunting for travel stocks to buy in May, TipRanks’ Stocks Comparison tool lays it all out. Airlines are cheap and controversial. Cruise stocks look steadier. And booking platforms fall somewhere in between.

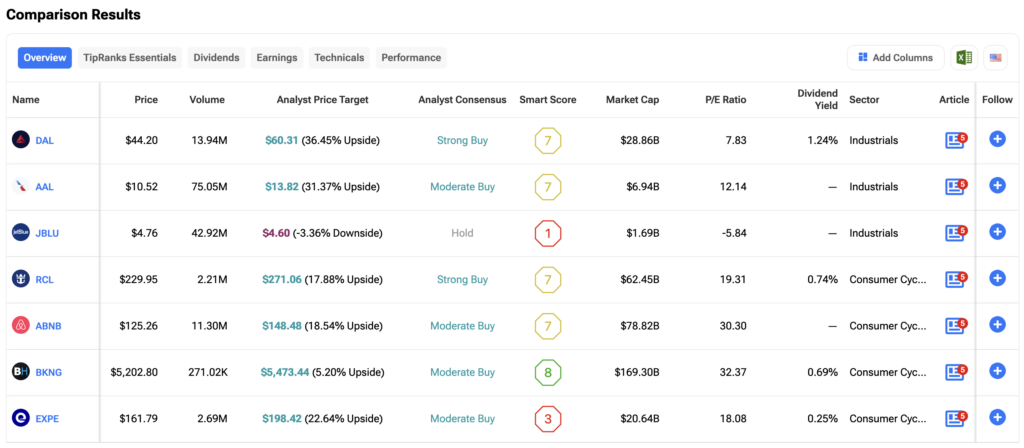

Delta Air Lines has a 36% upside, according to analyst price targets. It’s rated a Strong Buy, trading at just 7.8x earnings. American Airlines isn’t far behind with a 31% upside and a Moderate Buy consensus. But JetBlue stands out for the wrong reasons. It’s the only name flashing downside risk with a Hold rating and a TipRanks Smart Score of 1—the lowest on the board.

Royal Caribbean looks like the steadiest play in this group. It carries a Strong Buy, with a $271 target offering nearly 18% upside. The cruise line also has a decent Smart Score of 7, showing analysts and data agree for now.

On the tech side, Airbnb is sitting at a Moderate Buy with 18% upside. Expedia and Booking Holdings also carry Moderate Buy ratings, but Booking has the highest Smart Score at 8. That kind of balance between sentiment and quant is rare in this sector right now.