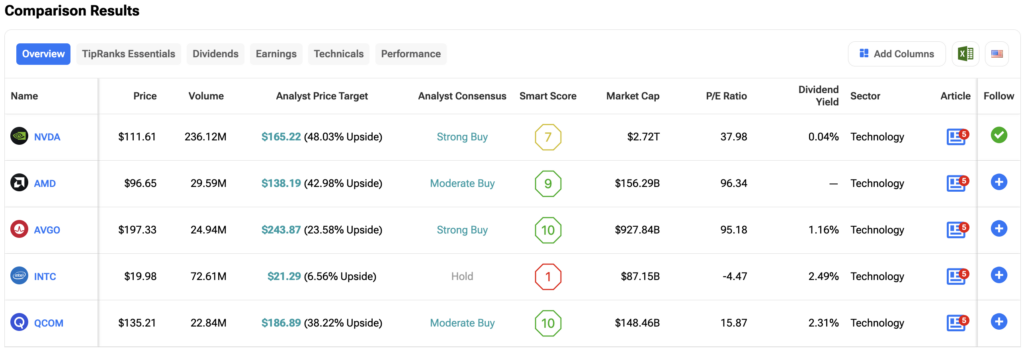

Nvidia (NVDA) still holds the crown in the chip world, and TipRanks Stocks Comparison tool makes that clear. Analysts rate it a Strong Buy with a projected 48% upside—one of the highest among peers. Despite its Smart Score sitting at 7 (a bit lower than rivals), the $2.72 trillion giant is widely seen as the leader in AI infrastructure, with its H100 chips powering nearly every major cloud platform. Investors are betting big that Nvidia’s dominance in training large AI models will continue to translate into aggressive earnings growth. Its P/E ratio of 37.98 may seem rich, but in this environment, investors are paying for leadership, not just profits.

Advanced Micro Devices (AMD) Is the Most Volatile

Advanced Micro Devices (AMD) is the most volatile of the group. With a Moderate Buy rating and a 43% price target upside, analysts are cautiously optimistic. AMD’s Smart Score of 9 shows strong underlying fundamentals, but its eye-watering P/E ratio of 96.34 reflects just how much future growth is already priced in. The company is building momentum in both CPUs and GPUs, especially in the gaming and cloud sectors, but it hasn’t yet matched Nvidia’s scale in AI workloads. For now, AMD looks like a promising runner-up—but not the one leading the pack.

Broadcom (AVGO) Pulls In Strong Numbers

Broadcom (AVGO) takes a different route. It’s not chasing pure AI hype, but it’s still pulling strong numbers. The chip-and-software conglomerate boasts a Smart Score of 10 and a Strong Buy consensus, with a 23.6% upside to its $243.87 target. That may sound tame next to Nvidia or AMD, but Broadcom brings stability and cash flow—plus a dividend yield over 1% for income-focused investors. Its strength in networking and infrastructure chips gives it a different edge in this cycle, one that’s built more on enterprise scale than GPU dominance.

Intel (INTC) Has the Weakest Analyst Sentiment

Intel (INTC), by contrast, looks outclassed. It has the weakest analyst sentiment of the group, rated Hold with just a 6.6% upside. A negative P/E and a bottom-tier Smart Score of 1 make it the clear laggard. While Intel is investing heavily in manufacturing and AI to stage a comeback, the data doesn’t lie—Wall Street isn’t buying the turnaround yet.

Qualcomm (QCOM) Is Underappreciated

Qualcomm (QCOM) is perhaps the most underappreciated of the bunch. With a Smart Score of 10, a Moderate Buy consensus, and a solid 38% upside, it offers a compelling value play. Qualcomm trades at just 15.87x earnings—by far the lowest valuation here—while maintaining strong positioning in 5G, automotive chips, and IoT. It also pays a healthy dividend above 2%, which adds to the case for more conservative investors looking for growth plus yield.

Overall, Nvidia is still the poster child of AI, but Broadcom and Qualcomm are making a serious case for being better risk-adjusted plays. AMD has upside but is priced to perfection. Intel is still rebuilding its story.