No one buys a car from electric vehicle giant Tesla (TSLA) because it is cost-effective. But the disparity between regular cars and Teslas took on a whole new life recently as reports revealed that it is now slightly more cost-effective to lease a Cadillac Lyriq than it is a Tesla Model Y. This might have disturbed some, but investors seemed reasonably okay with this, giving Tesla shares a fractional boost in Wednesday afternoon’s trading.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Cadillac recently released details on its January 2026 lease prices, and the Cadillac Lyriq’s prices were watched especially closely. That was when Cadillac dropped the bomb: a 24-month lease, with $4,879 due at signing, for $469 per month.

That might sound reasonable, but it actually looks good when compared to the lease price on a 2026 Model Y Standard. That one will hit you for less in the upfront price, but will actually ask more in the monthly rate. A Model Y Standard goes for $4,174 due at signing, but leases for $479 a month. So when you add it all up, a Model Y Standard is still slightly less expensive than an electric Cadillac, but not by much. You pay $705 more at signing for the Cadillac, but save $240 over the life of the lease. This does leave a net overage of $465, all things considered. However, for a Tesla to be that close to a Cadillac puts Tesla very much in the luxury car realm, cutting out a potentially huge bloc of sales.

Trapped at a Supercharger

Meanwhile, another tale of horror from the Tesla realm emerged, though a Ford (F) was involved this time. Someone purchased a Mustang Mach-E, and wrote up their experiences about it, including trying to recharge it at a Tesla Supercharger station. Everything went well, until it came time to disconnect. Apparently, the third party adapter that allowed a Ford to charge at a Supercharger station would not come undocked, leaving the car attached to the charger.

Online videos suggested the driver turn to a set of channel lock pliers to dislodge the adapter, but it turned out that a sufficiently frustrated 17-year-old girl could do the job with a little grunting and wrestling.

Is Tesla a Buy, Hold or Sell?

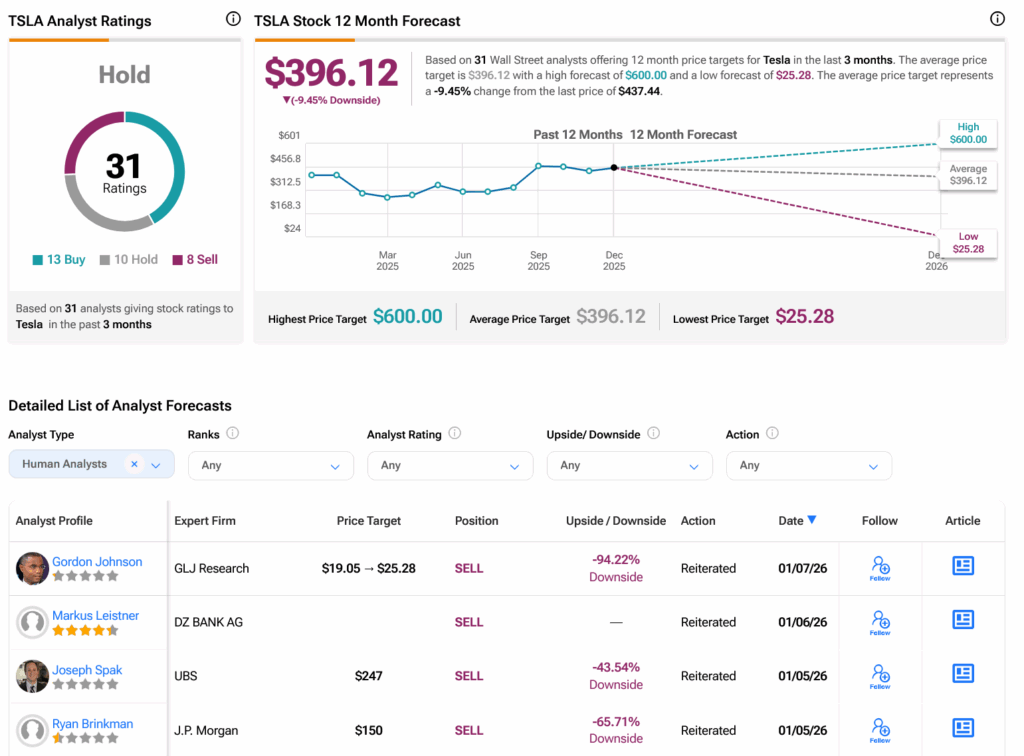

Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 13 Buys, 10 Holds, and eight Sells assigned in the past three months, as indicated by the graphic below. After a 9.63% rally in its share price over the past year, the average TSLA price target of $396.12 per share implies 9.45% downside risk.