SoundHound AI (SOUN) stock has taken a beating in 2025, plunging over 50% year-to-date. Once a retail favorite amid the AI boom, the voice AI specialist is now facing investor skepticism as competition intensifies. As competition in the voice AI space heats up and market sentiment cools, investors are left wondering—what’s next for SoundHound AI?

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

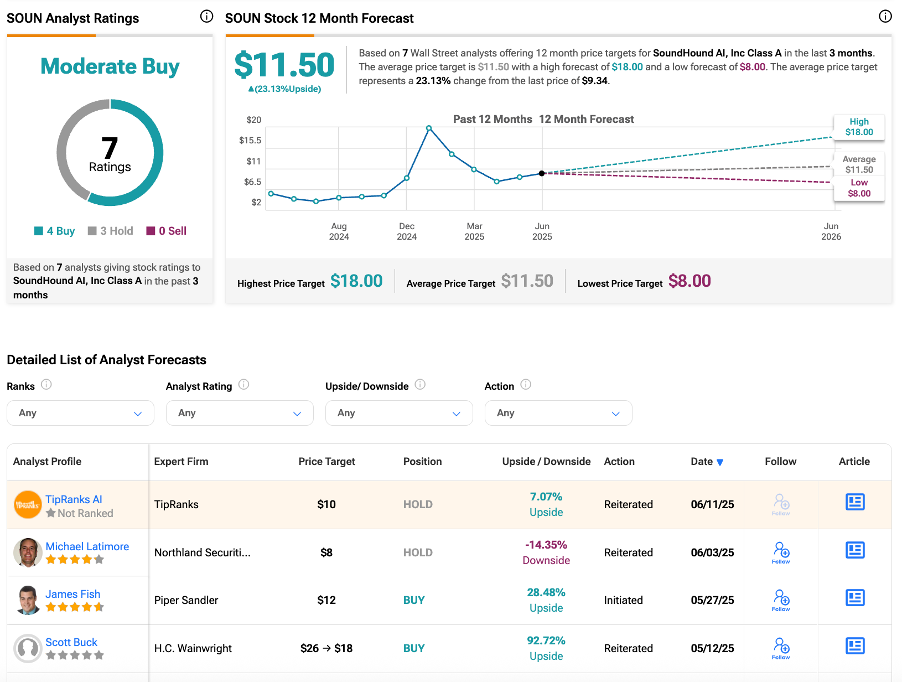

Despite near-term headwinds and macro uncertainty, the company’s long-term prospects remain promising. Looking ahead, the company is well-positioned to capitalize on the growing demand for voice-enabled technologies. From elevating in-car experiences to streamlining order-taking in fast-food chains, the company stands to benefit from a wide range of growth opportunities. Notably, Wall Street analysts maintain a Moderate Buy rating on SOUN, signaling a potential upside of over 23% for patient investors.

The Bullish Case You Can’t Ignore

Most investors might overlook a company like SoundHound due to its relatively small size, with a market capitalization of just $3.8 billion. It’s not the kind of stock that typically dominates headlines. However, some bullish observers believe that the company has the potential to scale much faster than many expect.

First and foremost is the company’s impressive revenue growth. SoundHound began 2025 on a strong note, reporting Q1 revenue of $29.1 million, marking a 151% year-over-year increase. This highlights the growing demand for voice AI technology over recent quarters. What makes this business stand out is its subscription-based revenue model, which brings in consistent and predictable income. In today’s uncertain S&P 500 environment, that kind of stability is increasingly attractive to investors looking for safer bets.

Next is its diversified client base. SoundHound’s growth doesn’t hinge on a handful of large customers. In Q1, no single client accounted for more than 10% of its revenue, highlighting broad adoption, reduced dependency risks, and solid demand across various industries.

Wall Street Stays Bullish

Among the bullish analysts, H.C. Wainwright analyst Scott Buck predicts more than 90% upside for SOUN stock. Despite a slight Q1 revenue miss, Buck praised the firm’s steady outlook, cost-cutting AI tools for SMBs, and strong cash position to pursue future growth through acquisitions.

Likewise, Piper Sandler’s top-rated analyst James Fish initiated his coverage with a Buy rating on SOUN last month. Fish sees SoundHound as an early leader in voice AI, thanks to its strong ASR and NLP architecture powering real-time conversational experiences. Additionally, Piper Sandler highlights QSRs and customer experience as key growth areas for SoundHound, especially after its Amelia acquisition, which expands its reach into contact center AI.

Is SOUN a Good Stock to Buy?

According to TipRanks, SOUN stock has received a Moderate Buy consensus rating, with four Buys and three Holds assigned in the last three months. The average SoundHound stock price target is $11.50, suggesting a potential upside of 23% from the current level.