While we have been hearing relentlessly about every part of the effort to buy entertainment giant Warner Bros. Discovery (WBD), there are other parts of the business still running. And Warner just lost a lawsuit against Dish Network (SATS) over the Sling TV concept. The news did little to hurt Warner, though, as shares still notched up fractionally in the closing minutes of Wednesday’s trading.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

A while back, Warner filed suit against Dish over Dish’s plan to offer Sling TV service in extremely short terms, sometimes as little as one day. This allowed access to content at a fraction of normal prices, which is reasonable enough. If you pay for a day, you should not have to pay for the month. Warner cried foul over this move and took its case to U.S. District Judge Arun Subramanian, who ultimately found in Dish’s favor on the strength of what a “subscriber” is.

Normally, a network like Warner would buy access to some events, like the U.S. Open, in a multi-week package. It then sells access back to the cable providers or offers access through streaming. But in Dish’s case, Dish was circumventing this process by offering subscriptions in the short term, for when people actually wanted the content. But the licensing agreements generally do not spell out what counts as a “subscriber” and for how long. The court pointed out that companies like Warner simply needed to restate what qualifies as a “subscriber,” a point that will almost certainly return to haunt Dish in contract negotiations.

Big New Hire

Meanwhile, preparing for the spin-off between Warner and Discovery Global, Warner has brought in a new figure to serve as Discovery Global’s new head of communications and public affairs. Adrienne O’Hara will be tasked with that position, once the spin-off goes live sometime next year. She will report directly to incoming CEO Gunnar Wiedenfels, who currently serves as Warner’s CFO.

Wiedenfels noted, “Adrienne is a proven leader with deep experience guiding iconic branded portfolios through transformation and change. Her ability to translate strategy into clear, compelling narratives will be critical as we look to engage our investors, employees, partners and other stakeholders, building continued belief in Discovery Global’s incredible potential as a standalone company.” The hire, however, could be rendered moot should Paramount Skydance (PSKY) achieve its plan to buy the entirety of Warner.

Is WBD Stock a Good Buy?

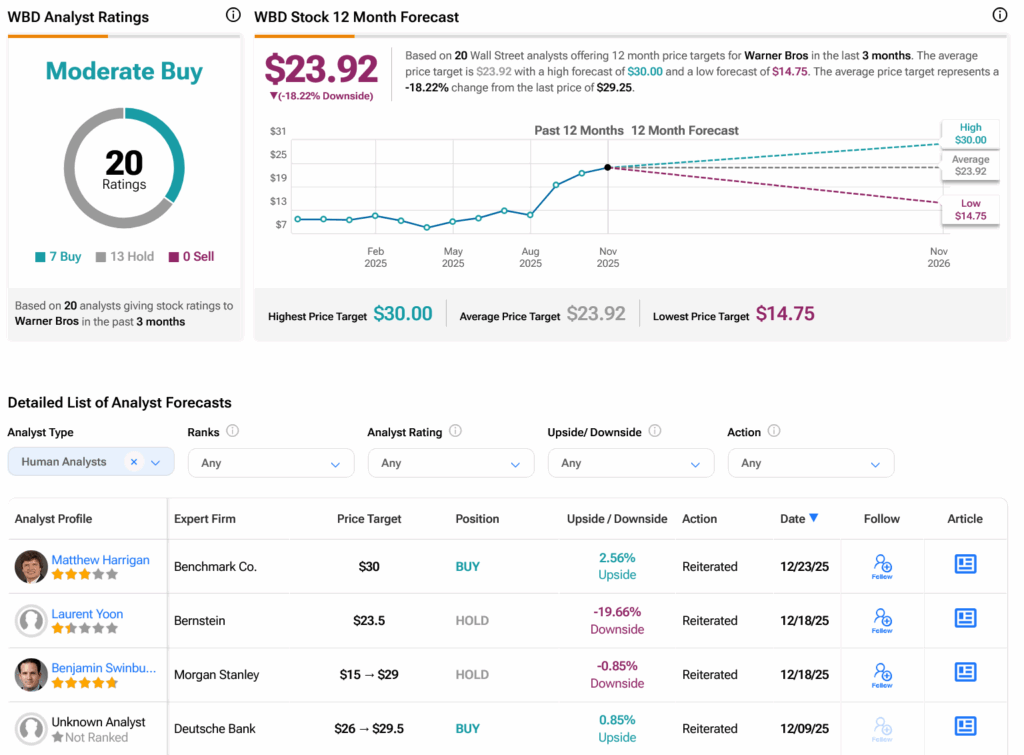

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WBD stock based on seven Buys and 13 Holds assigned in the past three months, as indicated by the graphic below. After a 174.48% rally in its share price over the past year, the average WBD price target of $23.92 per share implies 18.22% downside risk.