So real estate stock Zillow (Z) brought out word a couple weeks ago about its projections for the 2026 housing market. And the good news for it—and for companies that depend on it like home improvement giant Home Depot (HD)—is that it should improve. But is this likely? Let’s spend our Christmas Day having a look at the projections, and what they might mean.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The Good News

Zillow has some modest, but still somewhat exciting, projections for 2026, particularly when compared to 2025’s figures. Zillow looks for an overall rise in home values, which is a surprise in and of itself given the elevated prices that we have seen for the last few months. Naturally, there will be differences going from one market to another, so consider these mostly aggregate figures.

In fact, Zillow looks for price declines in only a handful of major markets. Only 12 major markets will see price declines in 2026, a projection down from 24 markets this year. Despite this, Zillow looks for home sales to increase in 2026. Zillow expects 4.26 million homes to be sold in 2026, which will be up 4.3% against 2025’s figures.

And just to top it off, Zillow looks for rents to get worse, but only slightly. Very slightly, in fact; Zillow’s projections look for multifamily rents to increase only 0.3%. Basically, Zillow is projecting that pent-up demand will finally break, and home prices will decline at least somewhat to make sales start to rise. It is a reasonable projection, but only time will tell if it comes to pass.

And if rent prices continue to go up, that in turn should improve the likelihood that people will throw aside their rental agreements and channel that money into a property they own instead. While rising rents do make a down payment harder to save up for, rising rents also add a sense of urgency that may not have been in the picture previously.

Zillow’s chief economist, Mischa Fisher, noted, “The housing market is finally settling into a healthier state, with buyers and sellers starting to return. Buyers are benefiting from more inventory and improved affordability, while sellers are seeing price stability and more consistent demand. Each group should have a bit more breathing room in 2026.”

The Bad News

So Zillow is looking optimistic, but a key underlying condition suggests a cause for concern. J.P. Morgan (JPM) released a study about the job market for 2026, one that ran somewhat contrary to the rosier picture from Zillow. 2025, as you likely know, was a comparatively bad time for American labor.

Layoffs hit all over, as the tech sector scaled back due to cost cutting or the introduction of artificial intelligence. Widespread news of layoffs generally does not engender willingness to make big purchases, and houses are one of the biggest purchases most can make. So a gun-shy labor market is not likely to be eager to sign up for a mortgage unless something clearly changes going forward.

The picture is not all bad news here, though. The J.P. Morgan report suggests that 2026 could feature some improvement in the labor rate in the second half of the year. A combination of tax cuts and interest rate reductions would work together to improve economic conditions. And while there are some signs of AI stepping in to cut workforce numbers, J.P. Morgan makes it clear that there “…are no signs of large-scale job disruption due to AI.”

The problem there, of course, is that any hope for the housing recovery depends on J.P. Morgan’s predictions landing correctly. If the interest rate cuts do not hit, if the tax cuts do not go far enough, if the layoffs pick up speed…any one of those points could derail the whole process.

Is Zillow a Good Stock to Buy Now?

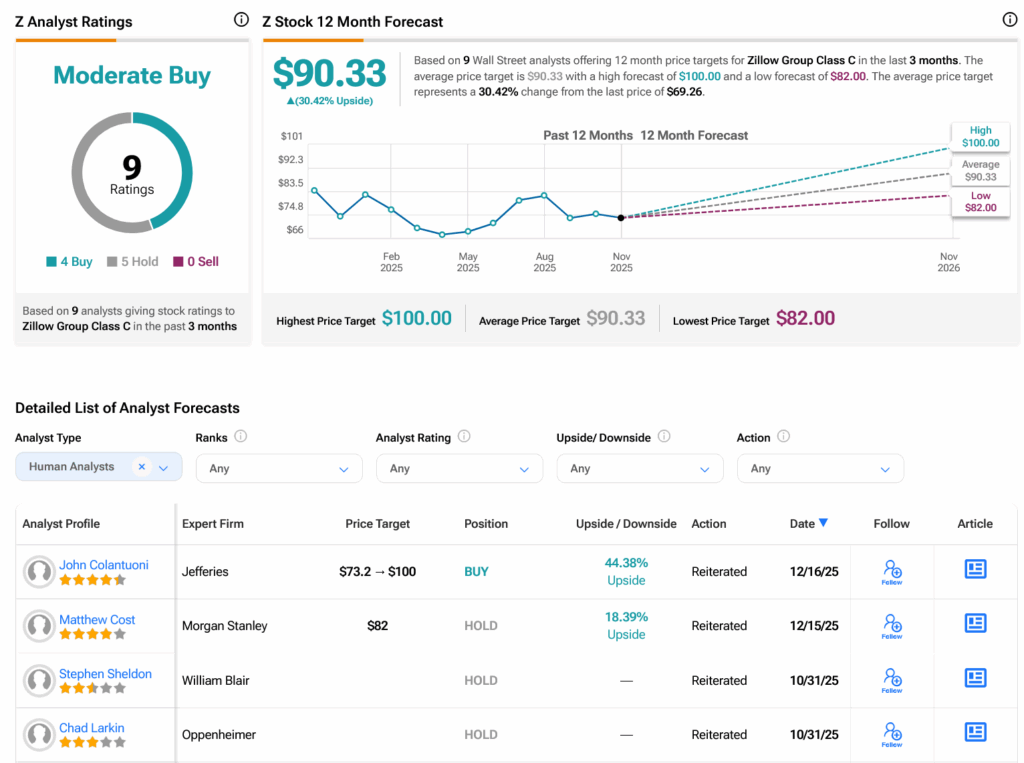

Turning to Wall Street, analysts have a Moderate Buy consensus rating on Z stock based on three Buys and two Holds assigned in the past three months, as indicated by the graphic below. After a 10.04% loss in its share price over the past year, the average Z price target of $90.33 per share implies 30.42% upside potential.