Advanced Micro Devices (AMD) will hold its next Financial Analyst Day on Tuesday, Nov. 11, 2025. This event will provide investors with details on the company’s future, such as its financial plans, strategy and growth opportunities, and technology and product roadmaps.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Those roadmaps are going to be of huge interest to investors, as they will provide them with insight into the company’s upcoming products. AMD’s artificial intelligence (AI) chips are a hot topic as the company tries to catch up with Nvidia’s (NVDA) lead in the market. Depending on what it shows off during its 2025 Financial Analyst Day, this could be a positive or negative catalyst for AMD stock.

On top of that, AMD will likely reveal details about its consumer-level products, such as new graphics processing units (GPUs) and processors. It has recently challenged Nvidia with budget-minded GPUs, while also whittling away at Intel’s (INTC) market share in the CPU sector. New products that impress consumers could see it grow its share in the GPU and CPU markets.

AMD Stock Movement Today

AMD stock was down 1.06% on Monday but remained up 45.39% year-to-date. The shares have also rallied 14.32% over the past 12 months. Shares of AMD were recently weighed down by tariff updates. These includes plans to introduce heavy tariffs on processors by the end of the month. If these tariffs do go into effect, they could have negative consequences for AMD stock. Any tariffs will also likely be addressed in the company’s Financial Analyst Day.

Is AMD Stock a Buy, Sell, or Hold?

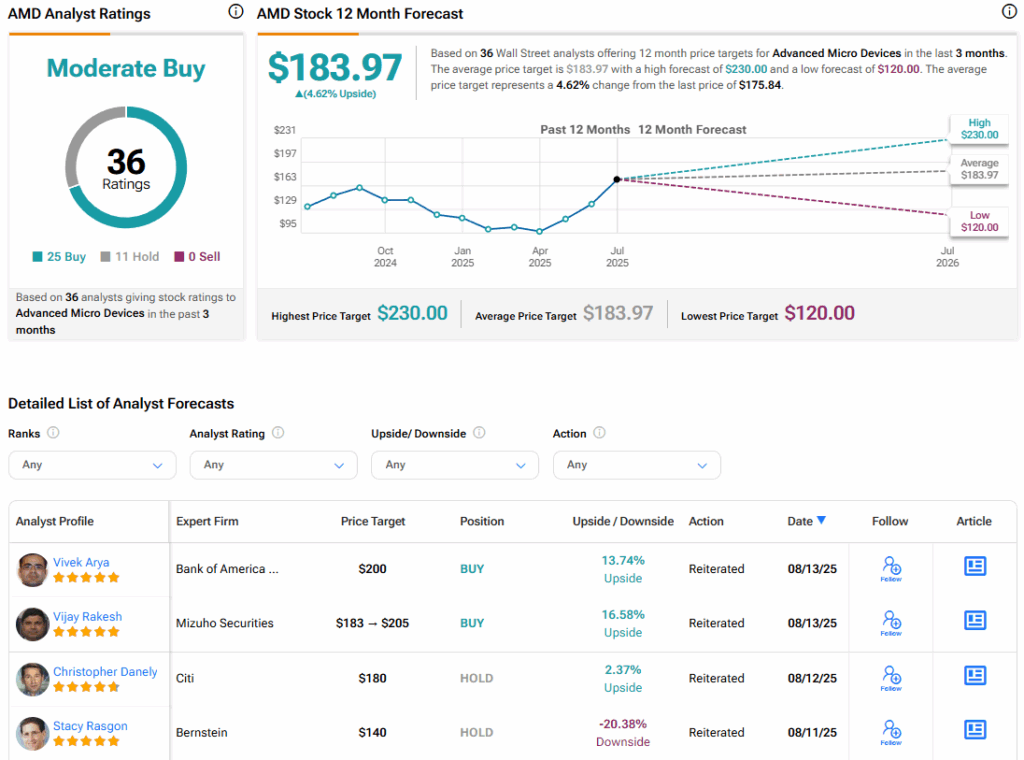

Turning to Wall Street, the analysts’ consensus rating for AMD is Moderate Buy, based on 25 Buy and 11 Hold ratings over the past three months. With that comes an average AMD stock price target of $183.97, representing a potential 4.62% upside for the shares.