Sony (SONY) and Microsoft (MSFT) could be in real trouble thanks to the RAMpocalypse. The price of RAM has skyrocketed over the past few weeks, largely due to the increased demand for the component in artificial intelligence (AI) data centers. This has put stress on console makers, as RAM is an integral part of gaming machines.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The latest reports claim that the RAMpocalypse could even result in delays of next-generation gaming devices. Insider Gaming suggested that Sony’s PlayStation 6 and Microsoft’s next-generation Xbox might not be released as soon as expected due to these issues.

This aligns with five-star Jefferies analyst Atul Goyal’s comments on X, formerly Twitter. He said that he doesn’t “think PS6 is coming in 2027 or 2028” when responding to a post about increasing RAM prices. Others have suggested this could delay the console’s launch to 2030, with the next Xbox likely to target a similar release period.

Sony & Microsoft Stock Movements Today

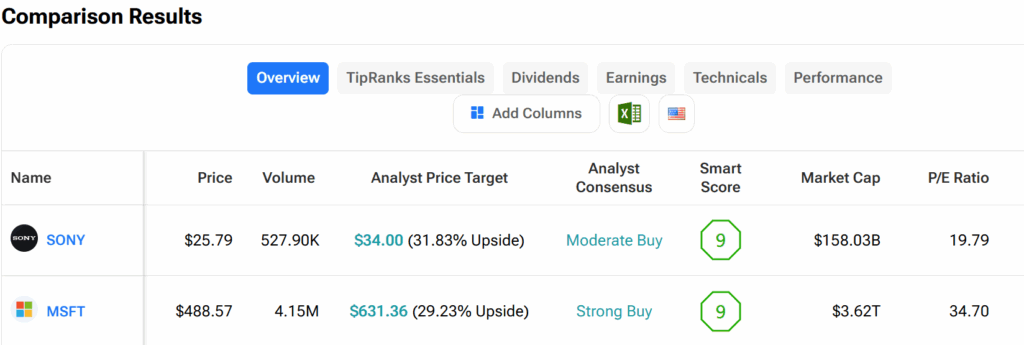

Sony stock was up slightly on Tuesday, building on a 25.3% rally year-to-date. The stock also saw low trading volume at about 512,000 shares, compared to a three-month daily average of roughly 4 million units.

Microsoft stock also saw a slight increase on Tuesday, extending a 16.79% year-to-date rally. The stock’s trading volume is below average today at around 4.13 million shares, compared to a three-month daily average of approximately 23 million units.

Sony vs. Microsoft: Which Stock Do Analysts Prefer?

Turning to TipRanks’ stock comparison tool, traders can see which of these two stocks analysts favor. Microsoft has the better analysts’ consensus rating at Strong Buy, compared to a Moderate Buy for Sony. However, SONY stock’s upside potential is slightly higher at 31.83%, compared to a 29.23% upside potential for MSFT shares.