Tesla’s (TSLA) latest quarterly results may have disappointed Wall Street, but CEO Elon Musk is shifting the spotlight to artificial intelligence (AI). After missing Q3 earnings estimates, Musk emphasized his vision of Tesla as an AI and robotics leader, not just a car company. Following the results, TSLA stock fell over 3% in pre-market trading on Thursday as Musk’s AI promises failed to lift investor sentiment.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, Tesla reported Q3 adjusted earnings of $0.50 per share, missing estimates of $0.55. Meanwhile, revenue rose 12% to $28.1 billion, driven by higher vehicle deliveries and strong energy storage growth.

Musk’s Big Bet on Tesla’s AI Future

During Tesla’s Q3 earnings call, Musk said the company is at a “critical inflection point” as it focuses more on real-world AI projects like self-driving cars and humanoid robots. Musk reiterated that Tesla’s future growth depends on these next-generation technologies, which he believes could make it the most valuable company in the world.

He called Tesla’s Full Self-Driving (FSD) software a coming “shock wave” for the auto industry, noting that only about 12% of Tesla owners currently use it—leaving plenty of room to grow. Musk added that once drivers can text or relax while the car handles everything, “anyone who can buy the car will buy the car.” Musk also predicted that Tesla’s robotaxis in parts of Austin could operate without safety drivers by the end of this year, with expansion planned to up to 10 more U.S. cities.

Beyond cars, Musk told investors that Tesla is “on the cusp of something really tremendous” with Optimus, the company’s humanoid robot. He said a new version of Optimus could be unveiled in the first quarter. Musk has suggested that Optimus could become Tesla’s “biggest product ever,” potentially accounting for over 80% of the company’s value.

What Musk’s AI Push Means for TSLA Investors

For investors, this means Tesla’s future growth could increasingly come from AI-driven products and services, which have the potential to generate significant revenue beyond vehicle sales.

However, these bets also carry execution and regulatory risks, as the success of AI initiatives depends on technology adoption, safety approvals, and market acceptance. In short, Musk’s AI push could unlock massive upside for TSLA stock if successful, but it also adds a layer of volatility and uncertainty for investors.

Is Tesla Stock a Buy?

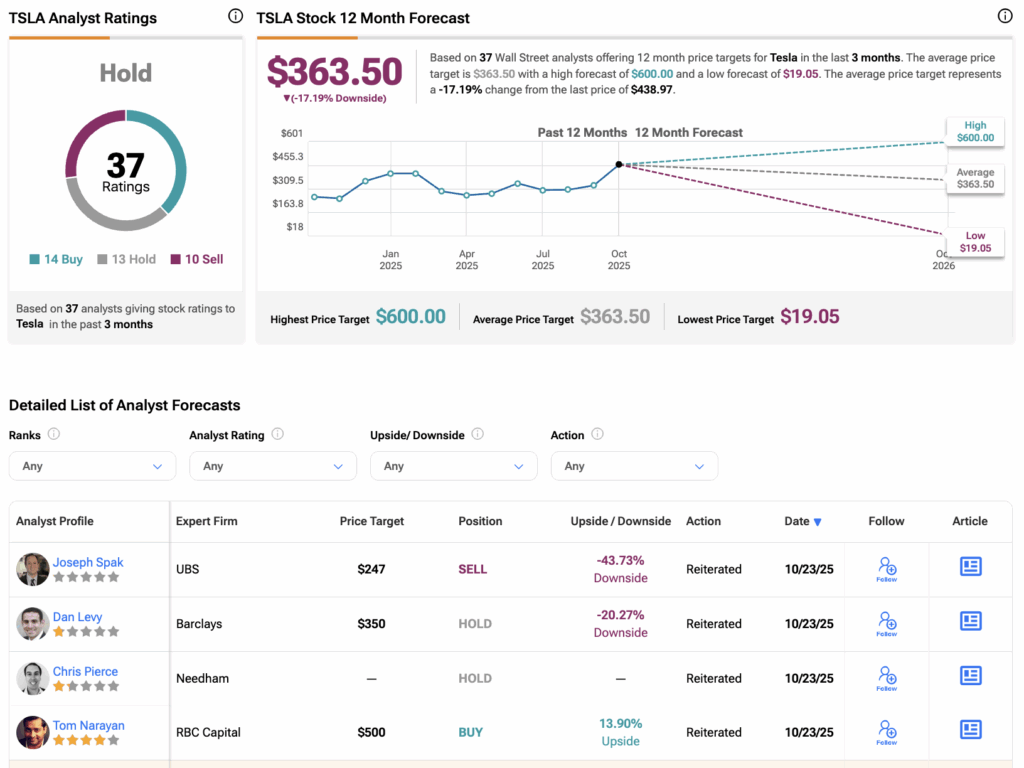

On Wall Street, analysts have maintained a neutral stance on Tesla stock. According to TipRanks, TSLA stock has received a Hold consensus rating, with 14 Buys, 13 Holds, and 10 Sells assigned in the last three months. The average Tesla stock price target is $363.50, suggesting a potential downside of 17.19% from the current level.