ChatGPT-maker OpenAI has taken the world by storm since the launch of its generative AI (artificial intelligence) chatbot. Investors keen to gain exposure to OpenAI in 2025 will be disappointed to learn that there is no direct way of investing in the startup because it is a privately held company. However, investors can buy shares of companies that are directly or indirectly involved with OpenAI.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

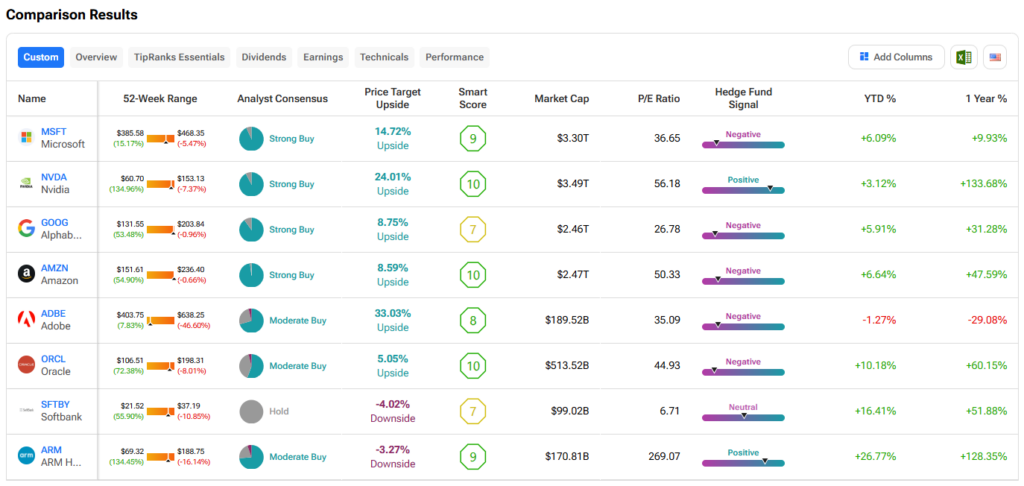

Well, how would you know which companies are related to OpenAI? Don’t worry, TipRanks has your back! We created a Stock Comparison page for OpenAI stocks to make things easy for you. You can easily navigate this page through the Tools section. Here, you will see eight publicly listed companies that have some relation to OpenAI, either through strategic investments or competition.

Let’s see how investing in one or all of these eight companies can help you gain exposure to OpenAI.

Microsoft – OpenAI’s Largest Investor to Date

One of the largest investors and beneficiaries of the OpenAI wave is tech giant Microsoft (MSFT). Since its inception and even before the launch of ChatGPT in November 2022, Microsoft has shown faith in founder Sam Altman and his vision. To date, Microsoft has invested close to $14 billion in OpenAI and it’s also the exclusive cloud infrastructure provider for the company.

Additionally, Microsoft integrates OpenAI products into its Azure cloud platform, Bing search engine, and Microsoft 365 CoPilot suite. Further, it markets OpenAI’s new technologies. Reports suggest that Microsoft is set to own a 49% stake in OpenAI after it recovers 75% of the $10 billion invested in the third funding round. All these reasons and more are enough to consider investing in Microsoft as an alternative source of investing in OpenAI.

Nvidia – Another OpenAI Investor and AI Darling

Semiconductor giant Nvidia (NVDA) is also an investor in OpenAI, though not as significant as Microsoft. It recently invested a few million dollars in the ChatGPT firm. Plus, there is no doubt that Nvidia is and will always be an AI darling, thanks to the advanced GPUs (graphics processing units) and chips that it manufactures. Nvidia is also indirectly linked to OpenAI because the latter uses its GPUs for training AI models.

Anyway, Nvidia, in itself, is a very lucrative investment opportunity, considering the billions of dollars in revenue it generates each year and the potential in the trillion-dollar TAM (total addressable market) for AI.

Alphabet – Gemini Arising as a Strong Competitor

Another tech giant, Alphabet’s (GOOGL) Google, has created its own powerful AI chatbot called Gemini, which stands as a strong competitor to OpenAI. So, if you cannot invest in the ChatGPT maker, you may as well invest in its rival, Google. Further, Alphabet’s subsidiary DeepMind also continues to explore and develop newer AI technologies.

Google’s Android operating system has also integrated Gemini into its apps and Google Search engine. Moreover, Google has integrated AI tech into its Google Cloud platform.

Amazon – A Formidable Cloud Computing Provider

Behemoth e-commerce retailer Amazon.com’s (AMZN) AWS (Amazon Web Service) segment is one of the largest cloud computing providers for AI and machine learning services. The AWS servers are set to perform a significant chunk of cloud computing operations in the future, positioning it as a noteworthy investment in the AI race.

Interestingly, Amazon has also invested in AI startups that rival OpenAI. One such notable move is its $4 billion investment in Anthropic. In return, Anthropic also named Amazon as its primary cloud provider and training partner, utilizing Amazon’s Trainium AI chips to train its models.

Adobe – Late to the Party but Here to Stay

Software giant Adobe (ADBE) is slowly catching up to the AI revolution. Adobe has launched AI video tools that are capable of generating videos from text prompts in competition with OpenAI’s Sora video editor.

Furthermore, Adobe’s Firefly is a suite of generative machine learning features used for text-to-image generation. Firefly is offered as part of Adobe’s Creative Cloud offering. It also boasts additional features such as adding or deleting objects, embellishing text with effects, and exploring color schemes. Investors can also buy Adobe stock and benefit from any potential upside since its stock price has yet to fully reflect the full impact of the AI integration.

Oracle – Strengthening AI Ambition with Stargate

Software giant Oracle is strengthening its AI ambitions with the Stargate project. Co-founded by billionaire Larry Ellison, Oracle is poised to invest $100 billion in Trump’s humongous AI project, alongside Microsoft (MSFT)-backed OpenAI and Masayoshi Son-led Softbank (SFTBY). Stargate is expected to balloon to a $500 billion project, with other companies joining in. The data center infrastructure project will enable Oracle to boost its performance and become a recognized name in the AI domain.

Moreover, the uncertainty looming around the ban on TikTok in the U.S. has also subsided since President Trump extended the deadline. Trump is open to the idea of a joint venture with TikTok’s U.S. operations. Notably, Oracle is TikTok’s primary cloud infrastructure provider in the U.S.

Softbank – Increasing Proximity with OpenAI

Masayoshi Son-led Softbank is investing in the Stargate project and increasing its proximity with OpenAI. Importantly, Softbank invested $1.5 billion in OpenAI during its latest fund-raising round, which valued the AI startup at $157 billion. Softbank has earlier invested $500 million in OpenAI. The close ties between SoftBank and OpenAI imply that investors can gain exposure to the AI firm by investing in the Japanese investment conglomerate, which also has other meaningful businesses.

The duo even made the first round of investment in Stargate, each contributing $19 billion to the project and gaining 40% ownership. Softbank is responsible for managing the financial resources and efficient execution of the project.

ARM Holdings – A Renowned Player in AI Chip Designing and Compute

ARM Holdings (ARM) is already a renowned player in the AI space and is backed by Japan’s Softbank. The company designs the architecture for chips and licenses efficient IP (intellectual property) solutions for the tech and semiconductor sectors. Some of the large players, such as Nvidia, Qualcomm (QCOM), Apple (AAPL), and Samsung, use Arm’s advanced chips and compute subsystems for their products.

ARM is also one of the strategic investors in the Stargate project, making it an important AI play. The project spans four years, but it is obvious that companies will continue to reap the returns from this investment for several years.

Ending Note

Investing in OpenAI stock is a far-fetched dream for now, since it is a closely held company. Nevertheless, investors have ample opportunities to invest in listed companies that are making a mark in the AI domain. As can be seen from the Stock Comparison chart above, most of these companies have won a Strong Buy consensus rating from Wall Street analysts and could offer attractive share price upside potential in the next twelve months.

Meanwhile, OpenAI has a mix of non-profit and for-profit structures. It started operations as a non-profit entity, but in 2019, it created a for-profit unit to attract more financing to fund its high AI development costs. This could even mean that founder Altman could slowly open up to the idea of taking the company public. For now, investors can only invest in companies that are directly or indirectly related to OpenAI.