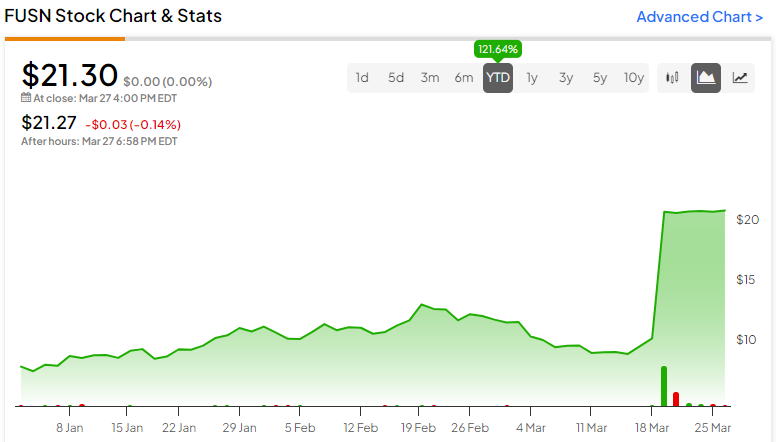

On March 19, Fusion Pharmaceuticals (NASDAQ:FUSN) announced that it entered into a definitive agreement to be acquired by AstraZeneca (NASDAQ:AZN). The price of the shares doubled overnight, reflecting the premium being paid. There is little upside for new investors to buy the stock at this point. However, current investors in FUSN may want to stick around post-acquisition to receive a kicker.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Novel Cancer Treatments

Fusion Pharmaceuticals is an active clinical-stage biopharmaceutical firm focused on developing radiopharmaceuticals that serve as precision medicines in the oncology field. The firm’s investment in targeted alpha therapy (TAT) programs is an innovative approach to solutions in cancer care. These targeted treatments are known for their ability to minimize damage to healthy cells surrounding the cancerous growth. They are gaining recognition as potential substitutes for traditional cancer treatment methods such as chemotherapy and radiotherapy.

The most significant candidate in Fusion’s diverse clinical-stage pipeline is FPI-2265. This small molecule-based TAT targets the prostate-specific membrane antigen and is currently under Phase II studies for metastatic castration-resistant prostate cancer treatment. It is notable that a Phase III registrational study is set to commence in 2025.

The market for patients requiring this form of specialized cancer treatment is anticipated to grow, with treatments predicted to reach $28 billion by 2033, reflecting a 9.5% CAGR (compound annual growth rate).

Terms of the Acquisition

AstraZeneca has agreed to purchase Fusion in cash for $21.00 per share. The upfront cash consideration results in a transaction value of roughly $2 billion, which is a 97% premium to Fusion’s closing market price as of March 18, 2024 (hence the immediate jump in share price).

Existing Fusion shareholders will also be granted an extra non-tradeable contingent value right (CV) of $3 per share, tied to a predefined regulatory milestone. The combination of the upfront cash and CV payment brings the total transaction value to approximately $2.4 billion.

The total potential value of the transaction, including the maximum possible CV payments, is around $2.4 billion, marking a 126% premium to Fusion’s closing market price on March 18, 2024. The completion of the transaction is projected for the second quarter of 2024, pending Fusion shareholder approval and necessary regulatory clearances.

Impact for Investors

When a company is acquired or bought out, the purchase price is typically higher than the current trading price of the target company’s stock, as is the case here, to gain the approval of the target shareholders.

How the transaction is conducted – via cash, stock, or a mix of both – determines the after-effects for shareholders. In a pure cash transaction, the target company’s shares disappear from related portfolios on the closing date and are replaced with cash. In a cash-and-stock deal, shareholders see cash and new shares appear in their accounts (check with your brokerage to confirm how the CV will be handled).

Investors holding shares in a taxable account are subject to the same tax rules as normal buy-sell activities. Taxes are owed on profits, with the rate depending on the holding period of the shares. Short-term capital gains tax applies if shares are held for less than a year, and long-term gains tax applies if held for more than a year.

Final Analysis on FUSN

Owning shares in a company that gets acquired can be a double-edged sword. On the one hand, you tend to get paid handsomely. On the other hand, depending on the nature of the deal, you can find yourself out of the trade and potentially missing the upside potential yet to be realized. In this case, investors get some of the upside, too. The promising nature of Fusion’s clinical-stage pipeline was enough to convince AstraZeneca to move decisively, suggesting a high probability of the company hitting the regulatory milestone and unlocking the CV for investors.