Kraft Heinz (KHC) is an American multinational food and beverage company. It manufactures and sells refreshment drinks, dairy, and meat products.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For Q4 2021, Kraft reported a 3.3% drop in revenue to $6.7 billion but still surpassed the consensus estimate of $6.6 billion. It posted adjusted EPS of $0.79, which declined from $0.80 in the same quarter the previous year but also beat the consensus estimate of $0.63.

The company plans to distribute a quarterly dividend of $0.40 per share on March 25 and has set March 10 as the ex-dividend date. Kraft is among the highest yielding stocks in its sector, currently offering a dividend yield of 4.16% compared to the sector average of 1.5%.

With this in mind, we used TipRanks to take a look at the risk factors for Kraft Heinz.

Risk Factors

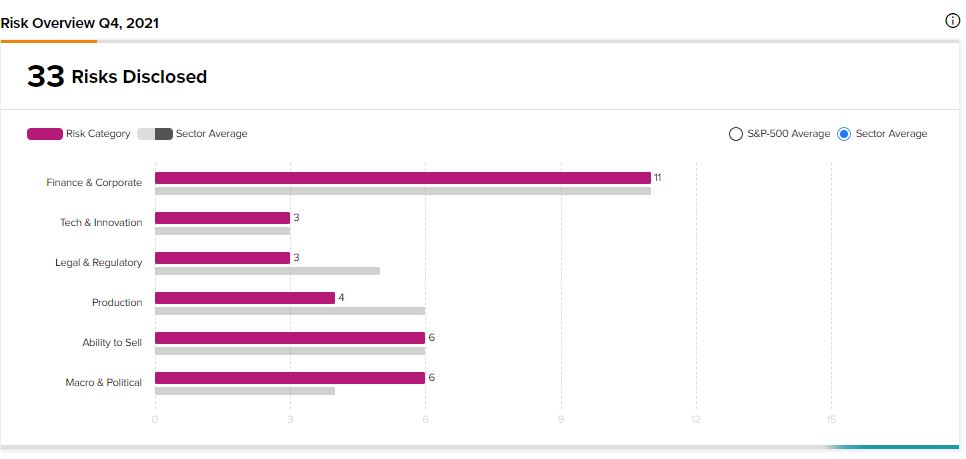

According to the new TipRanks Risk Factors tool, Kraft Heinz’s main risk category is Finance and Corporate, with 11 out of the total 33 risks identified for the stock. Ability to Sell and Macro and Political are the next two major risk categories with 6 risks each. The company has recently added one new risk factor and updated several previously highlighted risk factors.

The newly added risk factor falls under the Legal and Regulatory category and relates to climate change. Kraft Heinz explains that climate change could adversely affect its ability to obtain the necessary commodities at the right costs and quantities. It mentions that changing weather patterns may result in reduced agricultural productivity in some regions.

The company also cautions that concerns over climate change could decrease the demand for its products. Kraft Heinz further warns that regulatory requirements related to climate change could increase the cost of running its manufacturing facilities. Moreover, the company cautions that failure to meet its own sustainability goals could expose it to lawsuits and reputational damage.

In an updated Macro and Political risk factor, Kraft Heinz informs investors that the evolving COVID-19 pandemic situation may result in a much greater adverse impact on its operations than previously expected. For example, it mentions that if any of its key employees become sick with the virus and are unable to work, the resource and management team’s attention could be diverted.

Kraft Heinz stock has gained about 12% year-to-date.

Analysts’ Take

Bank of America Securities analyst Bryan Spillane recently reiterated a Buy rating on Kraft Heinz stock and raised the price target to $48 from $46. Spillane’s new price target suggests 18.81% upside potential.

Consensus among analysts is a Hold based on 2 Buys, 8 Holds, and 1 Sell. The average Kraft Heinz price target of $40.54 implies that shares are fully-valued at current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Macy’s Exceeds Q4 Expectations, Hikes Share Buyback and Dividend

Teladoc Sinks More Than 3% Despite Upbeat Q4 Results

RBC Q1 Earnings Preview: What to Expect