Boston Scientific (BSX) is an American global medical technology provider. It makes devices used in a variety of interventional medical applications. Its products include implantable heart monitors and devices for diagnosing and treating pulmonary and gastrointestinal conditions.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For Q4 2021, the company reported a 15.4% year-over-year rise in revenue to $3.1 billion and met the consensus estimate. It posted adjusted EPS of $0.45, compared to $0.23 in the same quarter the previous year, and beat the consensus estimate of $0.44.

Boston Scientific recently completed the acquisition of Baylis Medical Company, a provider of advanced transseptal access solutions. Boston Scientific expects the acquisition to expand its structural heart product portfolios. It spent $1.75 billion upfront on the transaction.

With this in mind, we used TipRanks to take a look at the risk factors for Boston Scientific.

Risk Factors

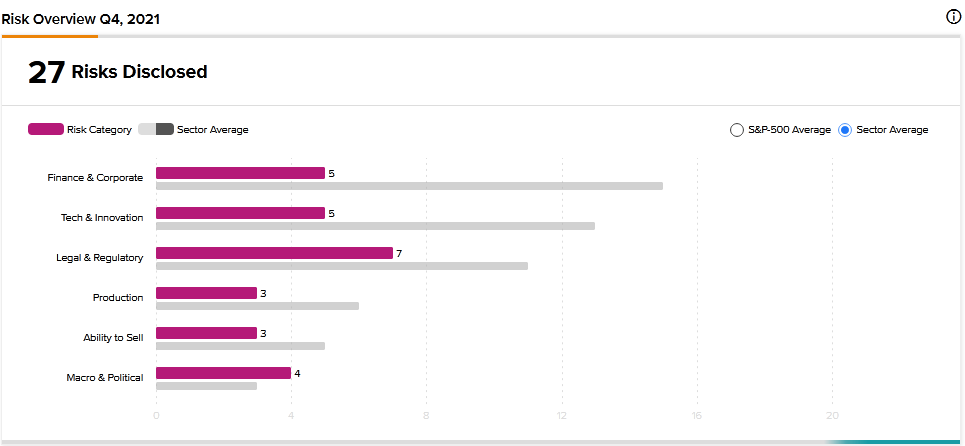

According to the new TipRanks Risk Factors tool, Boston Scientific’s top risk category is Legal and Regulatory, with 7 of the total 27 risks identified for the stock. Finance and Corporate and Tech and Innovation are the next two major risk categories with 5 risks each.

The company informs investors that climate change effects such as extreme weather conditions and natural disasters could adversely impact its business in many ways. It mentions disruptions to manufacturing and distribution networks because of damaged facilities, potential shortages of raw materials, and increases in the costs of other inputs necessary for its operations. Moreover, the company says that tightening environmental regulations could increase its operating costs and restrict some of its activities.

Boston Scientific tells investors that it ended 2021 with more than $9 billion in debt. It adds that it currently carries an investment-grade credit rating but that its cost of borrowing would increase and access to liquidity would be limited if its credit rating is downgraded. The company explains that disruption to cash flows could adversely impact its ability to manage its debt effectively, leading to credit rating downgrades.

Finally, the company cautions that healthcare policy changes may result in a material adverse impact on its business and financial condition. It explains that political and economic factors are leading to significant structural and financial changes in the global healthcare industry. Boston Scientific warns that the changes may result in lower reimbursements for its products.

Boston Scientific stock has gained about 13% over the past 12 months.

Analysts’ Take

Needham analyst Michael Matson recently maintained a Hold rating on Boston Scientific stock without assigning it a price target.

Consensus among analysts is a Strong Buy based on 9 Buys and 3 Holds. The average Boston Scientific price target of $49.73 implies 13.28% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Scotiabank Q1 Profit Rises 14%, Smashes Estimates

BMO Q1 Profit Rises 45%, Beats Estimates

First Solar Drops 16% on Revenues Miss & Muted Outlook