Western Digital (WDC) has emerged as one of the top-performing stocks in the S&P 500 in 2025, riding a surge in demand for high-capacity storage solutions driven by AI and data-heavy applications. In 2025, WDC stock has surged almost 300%. With the stock up significantly this year, investors are now asking whether there’s still room to profit from WDC’s momentum in 2026.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For context, Western Digital designs, manufactures, and sells hard drives, solid-state drives (SSDs), and data center storage solutions.

AI Drives Unexpected 2025 Wins for WDC

Western Digital’s strong growth in 2025 has been largely driven by soaring demand for its highest-capacity, highest-margin drives at data centers, fueled in large part by AI adoption. This surge in demand has not only boosted revenues but also enhanced the company’s pricing power.

Likewise, data storage company Seagate Technology (STX) also gained 226% in 2025.

What Lies Ahead for WDC?

Despite its huge rally, WDC stock looks appealing for the year ahead, for many reasons. Firstly, the company recently replaced Lululemon (LULU) in the Nasdaq-100 Index (NDX). Being added to the index is a vote of confidence in Western Digital’s leaner business model after spinning off SanDisk (SNDK). The index inclusion also leads to buying by passive funds that manage billions of dollars.

Secondly, Western Digital has reinstated its dividend and launched a $2 billion stock buyback program this year, making it even more attractive as a long-term investment.

Additionally, the global data storage market is expected to grow from $250.8 billion in 2025 to $483.9 billion by 2030, according to a report by Mordor Intelligence. As a leading provider of high-capacity drives and data center solutions, WDC is well-positioned to capture a significant share of this growth.

Analysts Stay Bullish on WDC Stock

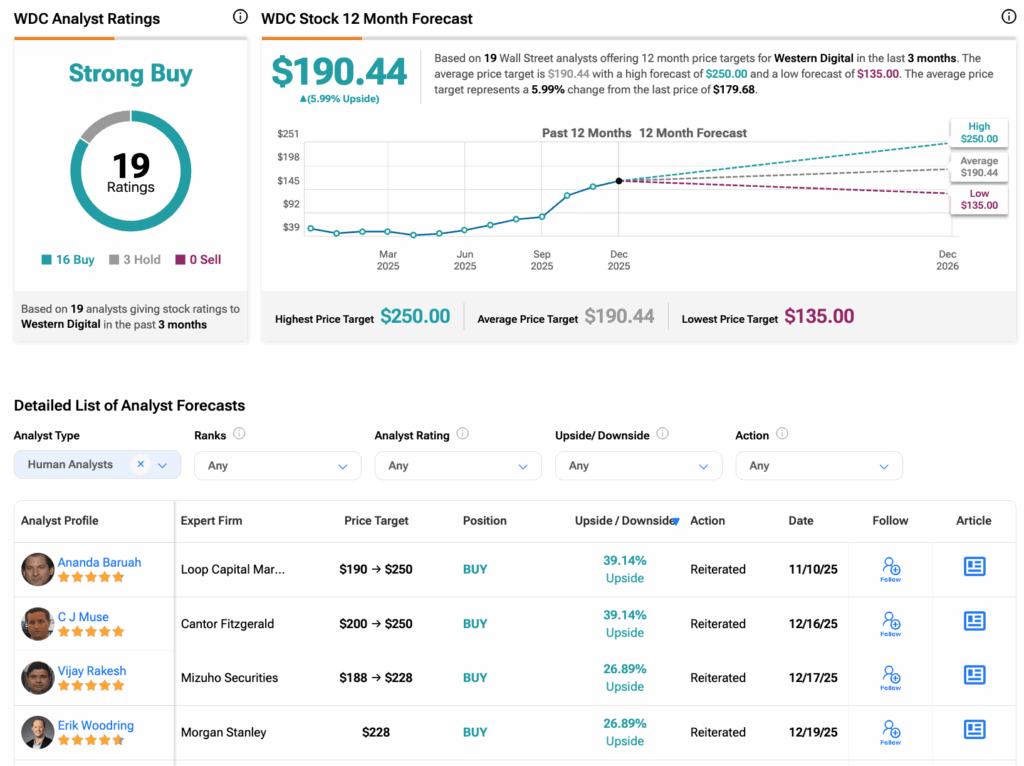

Earlier this month, five-star-rated analyst Erik Woodring at Morgan Stanley reiterated his Buy rating on WDC stock. His price target of $228 predicts another upside of 27% from current levels. Woodring remains bullish on IT hardware companies that benefit from increasing cloud capital expenditures and the steady pace of product cycles, highlighting WDC’s strong positioning in the sector.

Overall, Morgan Stanley has named WDC as a top pick for 2026, citing the ongoing surge in cloud spending.

Meanwhile, top-rated analysts at Loop Capital and Cantor Fitzgerald have the Street-high price target of $250 on WDC stock, implying almost 40% upside.

Is WDC a Good Stock to Buy?

Turning to Wall Street, analysts have a Strong Buy consensus rating on WDC stock based on 16 Buys and three Holds assigned in the past three months. Meanwhile, Western Digital’s average stock price target of $190.44 per share implies a 6% upside.