West Pharmaceutical Services (WST) stock plummeted 38% on Thursday, making it the biggest decliner in the S&P 500. The sharp drop followed the company’s 2025 full-year profit and revenue forecast, which fell short of Wall Street’s estimates. West Pharma attributed the shortfall to the strong dollar and noted that its clients are reducing inventory levels.

West Pharmaceutical produces packaging solutions and delivery systems for injectable medications and healthcare products.

West Pharma Issues Disappointing Outlook

The company projects its 2025 revenue to range between $2.88 billion and $2.91 billion, falling short of analysts’ expectations of $3.04 billion, based on data from LSEG. Additionally, it expects adjusted earnings per share (EPS) between $6 and $6.20, compared with estimates of $7.44.

The company noted that its revenues and order volumes have been affected by biotech clients reducing inventory stockpiles built up during pandemic-related supply chain disruptions. The market also reacted negatively to the company’s margins, with gross margins falling to 36.5% in Q4, down from 38% a year ago.

Regardless of the challenges, the company exceeded sales expectations in the fourth quarter, driven by increased demand for cartridges and syringes. Overall, Q4 net sales increased 2.3% year-over-year to $748.8 million, surpassing the estimated $740.5 million.

Bank of America Remains Bullish on WST Stock

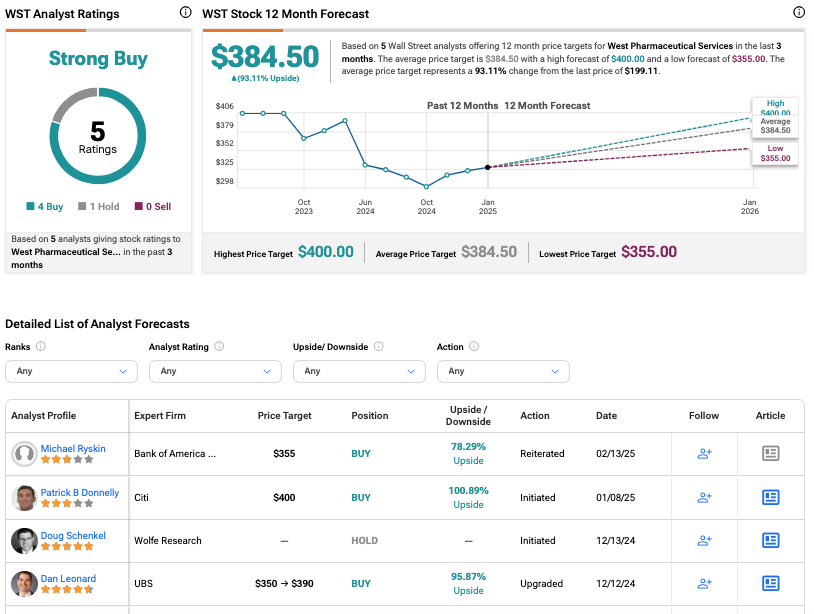

Following the results, analyst Michael Ryskin at Bank of America has maintained his Buy rating on WST stock, forecasting a huge upside of 78%. Notably, the company’s Q4 sales exceeded Bank of America’s estimates.

Ryskin believes that, despite some challenges ahead, West Pharma’s strong market position, growth plans, and focus on high-value products will help it overcome short-term obstacles and sustain its growth, making it a solid investment.

Is WST a Good Stock to Buy?

According to TipRanks, WST stock has received a Strong Buy consensus rating, with four Buys and one Hold assigned in the last three months. The average price target for West Pharma stock is $384.50, suggesting a potential upside of 93.1% from the current level.

Year-to-date, WST stock has declined by over 50%.