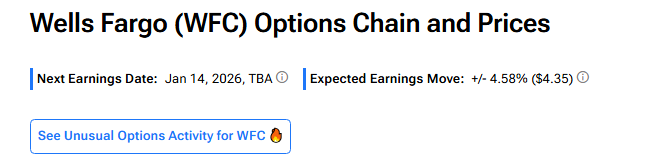

Wells Fargo (WFC) is set to release its fourth quarter 2025 earnings results tomorrow, January 14. WFC stock has gained 35% in 2025, driven mainly by stronger earnings, steady cost cuts, and rising investor confidence in the bank’s growth and capital return plans. According to TipRanks’ Options Tool, options traders expect about a 4.58% move in either direction for WFC stock in reaction to Q4 2025 results. This implied move is broadly in line with WFC stock’s average post-earnings move (in absolute terms) of 5% over the past four quarters.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

New Policy Risk That Could Weigh on WFC’s Income

U.S. President Donald Trump recently called for a one-year cap of 10% on credit card interest rates, starting January 20. Banking groups warned that such a move could limit credit access and push consumers toward higher-cost lending options, which may weigh on bank income.

What to Expect on January 14

Wall Street analysts expect the company to report earnings per share of $1.66, representing a 16% increase year-over-year. However, revenues are expected to decrease by 30% from the year-ago quarter to $21.65 billion, according to data from the TipRanks Forecast page.

Analysts’ Views Ahead of WFC’s Q4 Earnings

Ahead of Wells Fargo’s Q4 earnings, top BofA Securities analyst Ebrahim Poonawala raised his price target on the stock to $107 from $100 and maintained a Buy rating.

The five-star analyst said the stock still trades at a discount to peer JPMorgan (JPM), despite Wells Fargo’s strong scale and improving execution under CEO Charlie Scharf. Poonawala believes the gap could narrow if the bank delivers steady revenue growth while keeping profits strong, supported by past investments.

On the contrary, Baird analyst David George downgraded Wells Fargo to Underperform from Neutral and set a $90 price target. He said that while he likes Wells Fargo’s business model and sees solid gains from the removal of the asset cap, expectations for the stock are now very high.

George noted that core trends in wealth and trading remain strong and management’s return targets are clear, but with shares trading at a rich valuation, much of the upside appears already priced in.

What Is the Price Target for WFC?

Turning to Wall Street, Wells Fargo stock has a Moderate Buy consensus rating based on 10 Buys, five Holds, and one Sell assigned in the last three months. At $99.47, the average WFC price target implies a 4.75% upside potential.