Foodservice equipment provider Welbilt, Inc. (NYSE: WBT) has signed an agreement for the sale of its Manitowoc Ice business to London-based water treatment company Pentair PLC (NYSE: PNR) for nearly $1.6 billion in cash.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Manitowoc Ice designs, produces and sells ice machines and related equipment. Last year, its sales totaled around $308 million.

Commenting on the transaction, Welbilt’s President and CEO, Bill Johnson, said, “We are confident that the successful closing of this transaction will pave the way for Welbilt to complete its sale to Ali Group, while Manitowoc Ice will benefit from Pentair’s focus on water solutions and its diversified customer base and product lines.”

Welbilt expects the sale to complete in the first half of this year.

About Welbilt

Based out of Florida, Welbilt designs, manufactures and supplies food and beverage equipment for the global commercial foodservice market. Its product brands include Cleveland, Convotherm, Crem, Delfield, Frymaster, Garland, Kolpak, Lincoln, Manitowoc Ice, Merco, Merrychef and Multiplex.

The company provides services through cloud-based digital platform KitchenConnect; kitchen systems brand FitKitchen, and aftermarket parts and service brand KitchenCare.

Welbilt has 19 manufacturing facilities spread across the Americas, Europe and Asia as well as a network of more than 5,000 dealers, distributors, buying groups and manufacturers’ representatives in over 100 nations.

Analysts’ Take

Last week, Robert W. Baird analyst Mircea Dobre maintained a Hold rating on the stock with a price target of $24 (0.8% upside potential).

Overall, the stock has a Hold consensus rating based on a single Hold. The average WBT price target of $24 implies 0.8% upside potential. Shares have gained 55.4% over the past year.

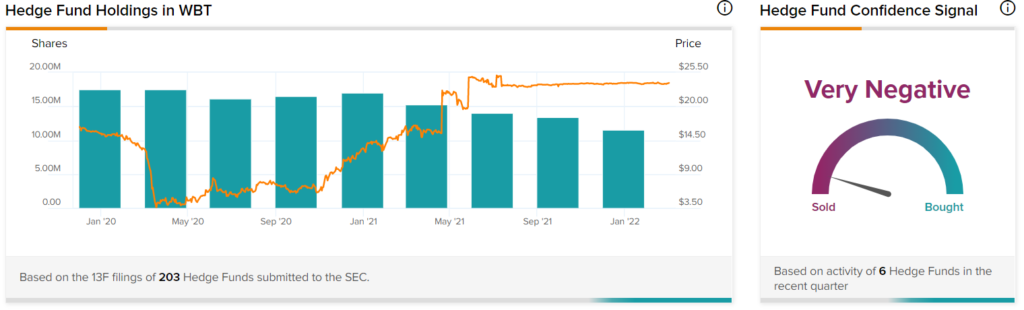

Hedge Fund Trading Activity

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Welbilt is currently Very Negative, as the cumulative change in holdings across all six hedge funds that were active in the last quarter was a decrease of two million shares.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

SoFi Concludes Acquisition of Technisys

Marvell Posts Upbeat Q4 Results, Provides Impressive Projections

Verizon Partners with Celona to Launch Turn-key Private Networking Solution