Top Wedbush analyst Daniel Ives boosted his price target for Apple (AAPL) stock to $310 from $270 and reiterated a Buy rating. The 5-star analyst raised his price target based on solid early demand signs for the iPhone 17 cycle. Ives stated he was “positively surprised” by the iPhone 17’s demand trajectory, with units that now seem to be tracking 10% to 15% ahead of iPhone 16 so far.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Daniel Ives Is Optimistic About Apple’s iPhone 17

Ives believes that supply checks in Asia will lead to production ramps of about 20% for base iPhone 17 and Pro models. In fact, he sees the new iPhone Air as the potential “surprise” of this Apple upgrade cycle based on Wedbush’s multiple store checks over the weekend. Based on shipping times, checks indicated particularly strong demand for iPhone 17 Pro models, which is a favorable sign for Apple.

Heading into the iPhone 17 cycle, Ives was expecting the upgrade cycle to be a “good,” but not a “great one.” However, the demand backdrop looks upbeat, thanks to a pent-up consumer upgrade cycle, with an estimated 315 million of 1.5 billion iPhone users not upgrading their iPhones over the last four years, coupled with some design changes/enhancements.

Ives believes that the Street’s Fiscal 2026 estimate of $230 million for iPhone units seems conservative and could now be in the 240 million to 250 million range. He contends that the Street is clearly underestimating the iPhone cycle and it’s a “Ryder Cup Bethpage moment for Cook and Cupertino after a few years of disappointing growth years.”

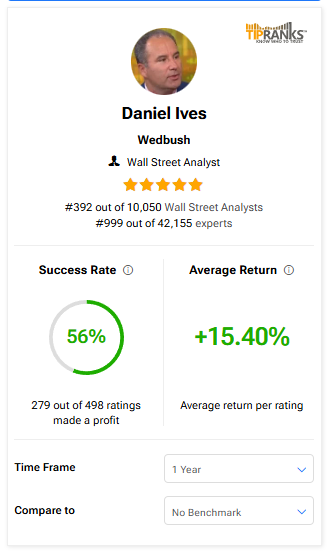

Ives ranks No. 392 among more than 10,000 analysts on TipRanks. With a success rate of 56%, the analyst has delivered an average return per rating of 15.4% over a one-year period.

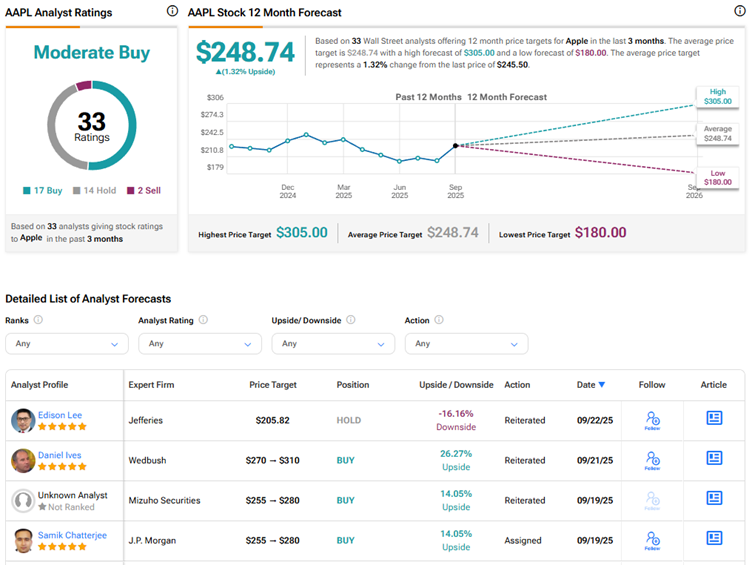

Is Apple Stock a Buy, Sell, or Hold?

Currently, Wall Street is cautiously optimistic on Apple stock due to macro uncertainties, tariff woes, and U.S.-China trade war. The Moderate Buy consensus rating on Apple stock is based on 17 Buys, 14 Holds, and two Sell recommendations. The average AAPL stock price target of $248.74 indicates a modest 1.3% upside potential from current levels. AAPL stock is down about 3% year-to-date.