Investment firm Wedbush believes that several large tech companies are set to benefit the most from artificial intelligence in 2026, aside from Nvidia (NVDA). In particular, the firm highlighted the following as its top five AI-focused picks:

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Investors Are Underestimating AI-Driven Growth

According to five-star Wedbush analyst Dan Ives, investors are still underestimating the extent of AI-driven growth, especially as companies move from early testing to full-scale AI deployments over the next year. Starting with Microsoft, Wedbush argues that the market is not fully appreciating Azure’s growth potential. While AI use cases expanded in Fiscal Year 2025, the firm believes Fiscal Year 2026 will be the real turning point as CIO budgets increase and AI deployments scale.

Palantir is also viewed as a long-term winner, with Wedbush maintaining that the company remains on track to potentially reach a $1 trillion market capitalization as it continues to win new government and commercial contracts. At the same time, CrowdStrike is expected to benefit indirectly from AI, as complex digital systems create more demand for cybersecurity solutions. Finally, Tesla and Apple round out Wedbush’s AI list, but for different reasons.

Wedbush sees Tesla’s progress in autonomous driving and robotics as major growth catalysts. In fact, the firm expects Tesla to reach a $2 trillion market value in the near term and possibly $3 trillion by the end of 2026, in a bullish scenario. Meanwhile, Apple’s advantage lies in its massive installed base, with more than 2.4 billion iOS devices and 1.5 billion iPhones worldwide. Wedbush believes that successful AI monetization could add $75 to $100 per share over time.

Which AI Stock Is the Better Buy?

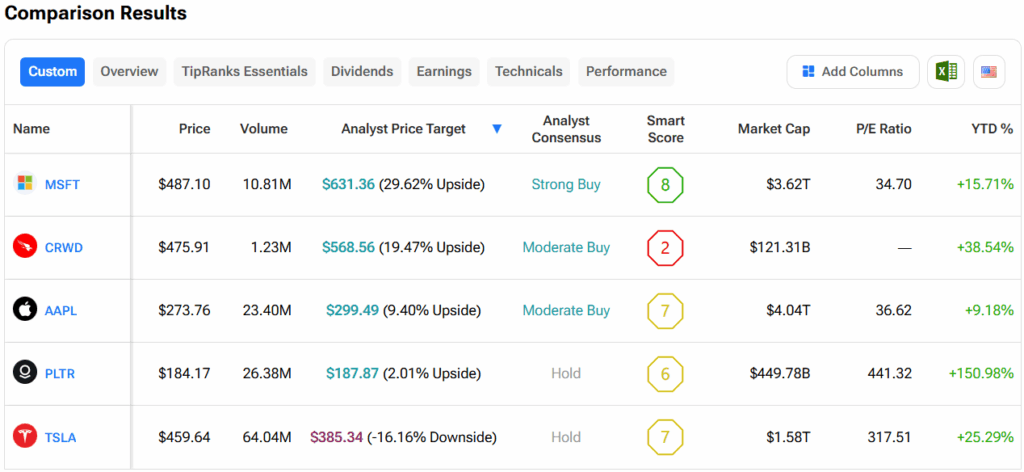

Turning to Wall Street, out of the five Wedbush picks, analysts think that Microsoft stock has the most room to run. In fact, Microsoft’s average price target of $631.36 per share implies more than 29% upside potential.