After a slow start to the year, Tesla stock has quietly regained momentum, with shares up 13.8% year-to-date and 7% over the past month. Top Baird analyst Ben Kallo believes that this rebound reflects that the market is starting to look beyond near-term noise. He reiterated an Outperform rating on Tesla and kept his $548 price target, which implies about 19% upside from current levels.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Kallo believes Tesla enters 2026 with several key updates on the horizon. While vehicle demand remains uneven in the near term, he continues to view Tesla as a core holding with long-term growth potential. As he put it, “We want to own TSLA” heading into the New Year.

What’s Driving Kallo’s Confidence

To start, Kallo expects clearer progress on Tesla’s robotaxi plans in 2026. He sees progress coming through expansion into new cities, early signs of revenue, and steps toward approval in regions such as China and Europe. Together, these updates would help move autonomy from idea to real business.

Beyond robotaxis, the analyst highlighted Optimus, Tesla’s humanoid robot, as another long-term opportunity. He expects updates on production plans and clearer timelines toward launch next year, which could help investors better judge the size of that market.

Finally, Kallo pointed to other areas of steady progress. He expects a ramp-up in Tesla Semi production and continued growth in the company’s Energy business, which remains an important part of Tesla’s longer-term outlook.

Is Tesla Stock a Buy, Hold, or Sell?

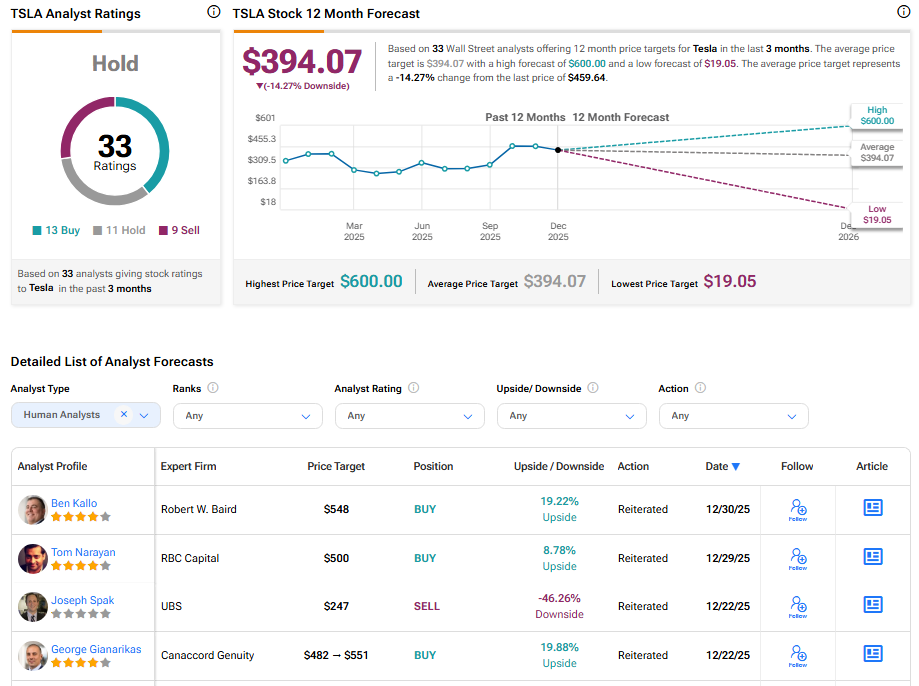

On TipRanks, TSLA stock has received a Hold consensus rating, with 13 Buys, 11 Holds, and nine Sells assigned in the last three months. The average Tesla stock price target is $394.07, suggesting a potential downside of 14.27% from the current level.