Enterprise cloud applications provider Workday (NASDAQ:WDAY) delivered better-than-expected Q1 results, driven by a growing customer base. However, the company trimmed its full-year subscription revenue outlook, and this hurt investor sentiments. As a result, WDAY stock dropped over 11% in Thursday’s after-hours trading.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

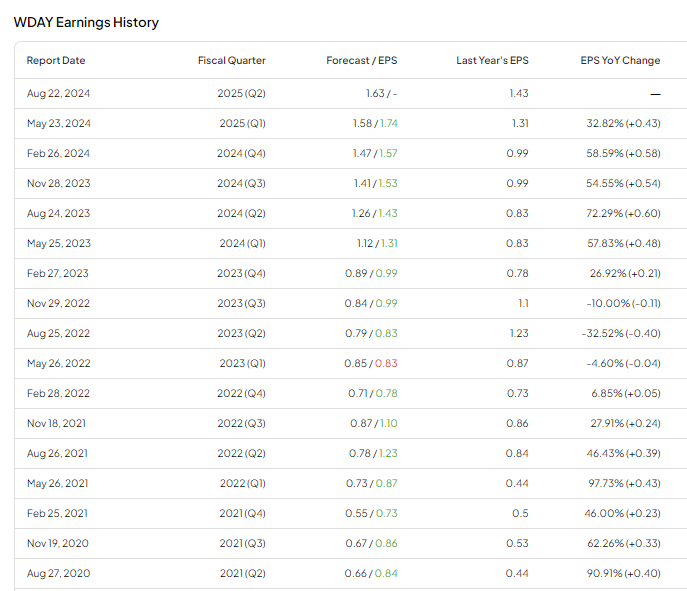

Interestingly, WDAY has an impressive earnings beat history, as it has missed expectations only once since August 2020.

WDAY’s Q1 Earnings Snapshot

The company reported adjusted earnings of $1.74 per share, which exceeded analysts’ estimates of $1.58 per share. Furthermore, the reported figure increased by 32.8% from the prior-year quarter. Meanwhile, WDAY delivered revenues of $1.99 billion in Q1, up 18.1% year-over-year, driven by higher subscription revenues. Also, the company’s top line exceeded Street’s forecast of $1.97 billion.

During the first quarter, Workday’s financial management and full platform customers increased by 20% in comparison to the same quarter last year.

Revised Outlook

For Fiscal 2025, WDAY expects subscription revenue to be between $7.7 billion and $7.73 billion, compared with the previous expectations of $7.725 billion to $7.775 billion. The company cited increased sales scrutiny and lower-than-expected customer headcount growth as key reasons for lowering estimates.

On the other hand, Workday raised its adjusted operating margin expectations to 25% from 24.5%, driven by increased efficiencies.

For the second quarter, WDAY expects subscription revenue of $1.9 billion, reflecting about 17% year-over-year growth. This compares unfavorably with the analysts’ expectations of $1.903 billion.

What Is the Forecast for WDAY Stock?

Workday’s focus on global expansion positions the company well for continued growth. Overall, Workday has a Moderate Buy consensus rating based on 19 Buy and 8 Hold recommendations. The analysts’ average price target on WDAY stock of $318.75 suggests an upside of 22.2%. Shares of the company have gained 10.3% in the past six months.