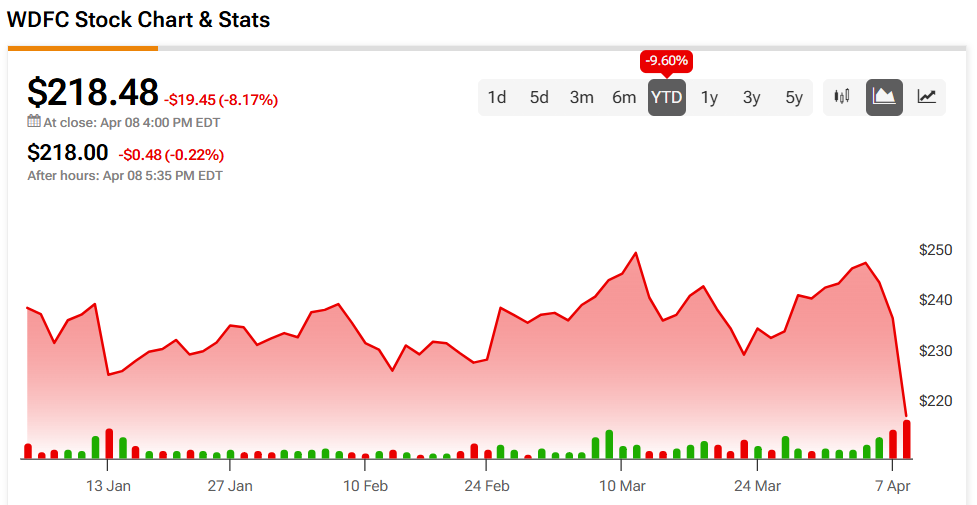

WD-40 Company (WDFC) saw its stock price drop today despite reporting significantly improved profitability in its second-quarter of fiscal 2025 results. While the company posted a 5% year-over-year sales increase to $146.1 million, that figure fell short of analysts’ expectations of $154.41 million. At the same time, net income surged by 92% to $29.9 million, and adjusted earnings per share grew by 16% compared to the same quarter last year, yet missed analyst expectations, creating a puzzling situation for investors.

TipRanks Cyber Monday Sale

- Claim 60% off TipRanks Premium for data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

Top and Bottom-line Misses

WD-40 Company specializes in maintenance and cleaning products, with its WD-40 Multi-Use and Specialist brand offered in a range of aerosol sprays, greases, lubricants, and other specialty maintenance items. Additional product lines include 3-IN-ONE lubricants, GT85 bike-specific maintenance products, and various cleaning products under different brand names, including 2000 Flushes, Spot Shot, Carpet Fresh, 1001, Lava, and Solvol.

For the second quarter of FY2025, the company reported a 5% increase in total net sales, reaching $146.1 million. This was primarily driven by Maintenance product sales, which grew by 6%. The gross margin improved to 54.6%, up from 52.4% in the previous year. Selling, general, and administrative expenses rose by 9% to $49.0 million, while advertising and sales promotions increased by 10% to $7.4 million. Operating income saw an 11% rise to $23.3 million. Net income surged by 92% to $29.9 million, mainly due to an $11.9 million favorable tax adjustment; excluding this, the rise would be 15%. The diluted earnings per share increased by 92% to $2.19, with a non-GAAP adjusted earnings per share increase of 16% to $1.32. However, this missed analyst expectations by $0.10.

The company announced a regular quarterly dividend of $0.94 per share payable on April 30, 2025, along with an ongoing share repurchase plan allowing the company to acquire up to $50 million of its outstanding shares through August 31, 2025.

Management revised fiscal 2025 guidance, projecting net sales growth between 6-11%, equating to $600-$630 million. The gross margin is now forecasted at 55-56%, with advertising and promotions at 6% of net sales. Operating income is anticipated to be $95-$100 million, implying 6-12% growth from the 2024 pro forma. The diluted EPS is expected to rise to $5.25-$5.55, representing 11-17% growth from 2024’s pro forma.

Is WDFC Stock a Buy, Sell, or Hold?

The stock is thinly followed by Wall Street, and as yet, there has been no analyst response to the recent earnings published.

WD-40 Company is rated a Moderate Buy based on the most recent analyst recommendations. The average price target for WDFC stock is $322.00, which represents a potential upside of 47.38% from current levels.