Investing in sustainable water infrastructure could be an overlooked stock market opportunity in a sector poised to boost profits through the end of the decade.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Water is indispensable for both households and industries. As the global population increases annually, the demand for H20 is rising. Additionally, some climate change scientists anticipate a negative impact on water availability in the coming years. This current economic condition presents a compelling argument for investing in water.

Untapped Investment Opportunity

Addressing the urgent need for investment in water infrastructure presents a promising untapped opportunity. Water infrastructure encompasses pipes, valves, pumps, and treatment facilities vital for delivering clean and safe water to various sectors. The pressing issue of aging water systems in the US and globally has heightened concerns over water safety and availability. According to the American Society of Civil Engineers, the U.S. alone needs to invest $123 billion in drinking water infrastructure and $102 billion in wastewater infrastructure by 2029 to maintain a state of good repair.

Global Water Industry Growth

Current economic conditions provide a strong argument for investing in water. The global water industry is expected to grow at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2028, reaching a market size of $1.1 trillion by 2028. Factors driving this growth include population growth, urbanization, and increased demand for water in various industries such as agriculture, energy, and manufacturing.

Government Support For Water Infrastructure

Governments and international organizations are making water a priority at an increasing rate. The Infrastructure Investment and Jobs Act in the United States, for example, allocates $55 billion for water infrastructure improvements, including $15 billion for lead pipe replacement and $10 billion for addressing emerging contaminants like PFAS. In Europe, the European Commission’s Recovery and Resilience Facility includes €13.5 billion for water-related investments.

Investors looking to capitalize on the upward trend of a resource, which is not likely to ever see reduced demand could consider several water stocks that analysts expect to have strong potential for long-term returns.

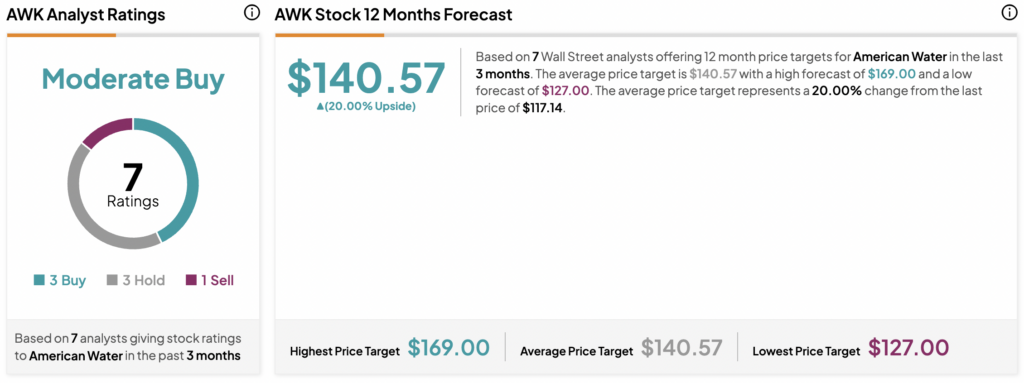

The largest publicly traded water utility in the United States is American Water Works (NYSE: AWK). It provides water and wastewater services to about 15 million people in 46 states. The company has a history of consistent dividend growth and is well positioned to benefit from increased infrastructure spending. The average AWK price target is $140.57, with three Buy ratings, three Holds and one Sell rating.

Which Water Stocks Are a Buy?

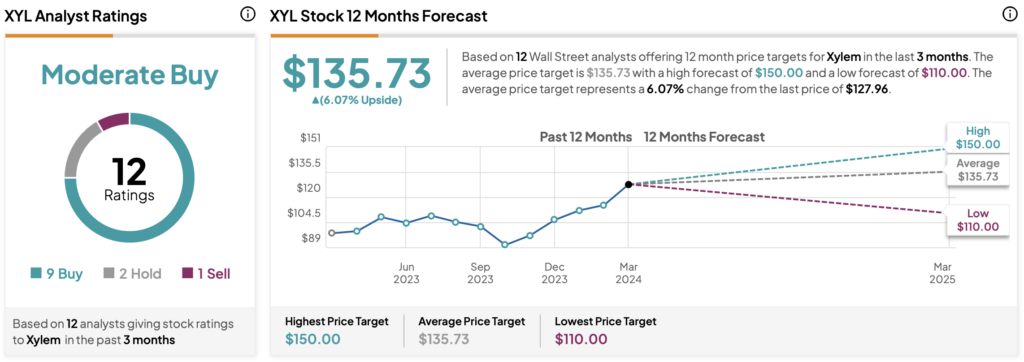

Out of the 12 analysts that cover Xylem Inc. (NYSE: XYL), only one rank it as a sell. This global water technology company provides equipment and services for water and wastewater applications. The company’s innovative solutions and focus on sustainability make it an attractive investment in the water sector. Analysts have given XYL a Moderate Buy consensus rating.

Pentair PLC (NYSE: PNR) is a diversified industrial company with a focus on water treatment and filtration. The company’s strong product portfolio and strategic acquisitions are believed to have positioned it for growth. Analysts remain overall bullish about PNR with a Moderate Buy consensus rating based on 11 Buys, four Holds and one Sell.

Combining water hygiene with energy technologies and services is what makes Ecolab Inc. (NYSE: ECL) attractive among those that prefer sustainable investing. The company focuses on water conservation and efficiency, and this makes it an interesting opportunity for those looking to capitalize on the growing demand for water-related solutions. The average ECL price target is $232.07 with six Buy ratings, 11 Holds and no Sell ratings.

In order to make more informed decisions, the TipRanks Stock Comparison Tool can aid your investment research.

Take Away

A splash of water infrastructure stocks in a portfolio can offer diversification into a sector benefitting from heightened government expenditure, through the decade’s end. This diversification could furnish protection during economic downturns and secure steady growth in varied economic conditions. With the global population on a constant rise and water resources under strain, the demand for enhanced water infrastructure and innovative solutions is set to intensify. Investing in water stocks enables investors to access a sector with substantial growth opportunities, and play a part in fostering a more sustainable future.