Elon Musk is no stranger to headlines, but lately, the buzz around him has been less about his leadership at Tesla (NASDAQ:TSLA) and more about everything else.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The vocal Trump supporter has been heavily involved in the DOGE efforts to drastically cut certain government programs, eliciting no shortage of controversy along the way. And yet, despite his many extra-curricular activities, Musk’s remains fully associated with the Tesla brand.

In fact, one can argue that it is Musk’s ability to capture the imagination of investors that has kept Tesla’s valuation sky-high despite weakening EV sales and deliveries over the past year. Musk’s ability to promote visions of robotaxis and robots – along with optimistic projections of improving vehicle deliveries in 2025 – have pushed Tesla shares up almost 90% over the past year.

However, investor Jeffrey Fischer believes that Musk’s image – particularly his political affiliation with Trump – will be a weight that drags down Tesla’s prospects going forward.

“Tesla’s CEO has firmly planted his flag on one side of the political spectrum,” notes the investor, adding that those “who disagree with the Trump Administration seem likely to have a lower view of Musk, and Tesla by association.”

Fischer points out that there is ample evidence that this political partnership is already beginning to hamper Tesla sales in Canada and Europe. The investor cites some anecdotal examples of how Trump’s open disdain for Canadian sovereignty has led to a spike in nationalist fervor, along with cancelled Tesla purchases.

“Beyond simple consumer unwillingness to buy Tesla vehicles in Canada, there’s been talk amongst Canada’s political parties about implementing tariffs on Tesla vehicles of as much as 100% of the purchase price,” the investor adds.

According to Fischer, this could very likely extend to Europe, where Musk’s vocal support for far-right parties could alienate those who strongly disagree with these views. Europe, which represented some 18% of Tesla sales in 2024, has already seen sales plummet in markets such as Germany, France, and Belgium.

Not to mention, roughly half of American voters are Democrats, meaning that “American consumers who are fiercely opposed to the administration may also feel opposed to Musk and Tesla.”

With all this in mind, Fischer isn’t mincing words – he’s slapping a Strong Sell rating on TSLA shares. (To watch Fischer’s track record, click here)

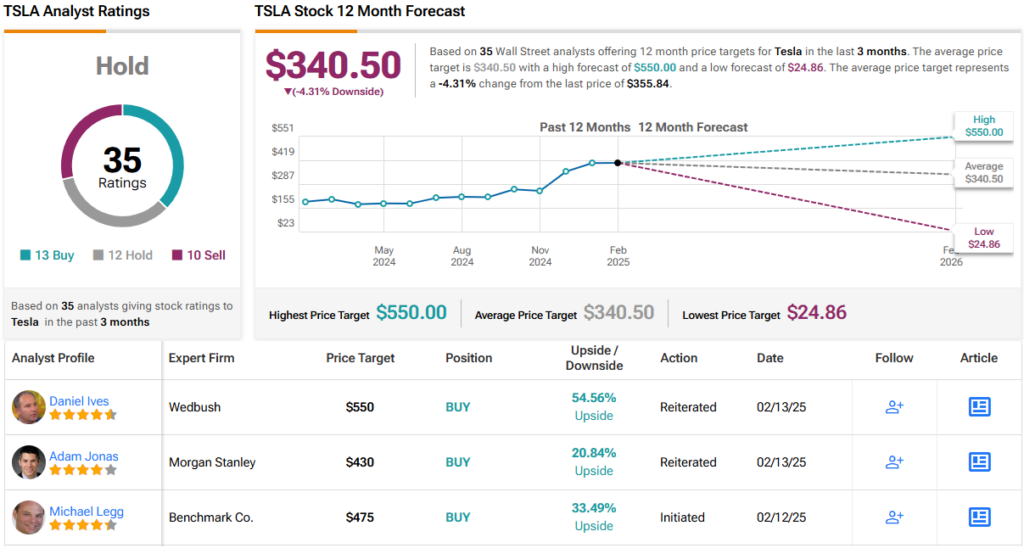

Wall Street, however, seems divided when it comes to Tesla. With 13 Buy, 12 Hold, and 10 Sell ratings, TSLA holds a consensus Hold (i.e. Neutral) rating. Its 12-month average price target of $340.50 implies that shares will decline slightly over the coming year. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.