Waste Management (NYSE:WM) shares gained nearly 3% in the early session today after the trash collection and recycling solutions provider delivered a healthy performance for the fourth quarter. Revenue increased by 5.7% year-over-year to $5.22 billion, outpacing expectations by roughly $21.8 million. In tandem, EPS of $1.74 exceeded estimates by a wide margin of $0.21.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

This performance was driven by core pricing gains of 7.3% and a 1.1% volume increase in Collection & Disposal. Additionally, a focus on efficiency helped WM increase its adjusted EBITDA by 14.7% to $1.56 billion. Notably, operating EBITDA margin in the company’s Collection & Disposal business expanded by 260 basis points to 37%.

Looking ahead to Fiscal Year 2024, WM expects a 6% to 7% growth in its top line. Adjusted operating EBITDA for the year is anticipated to land in the range of $6.275 billion to $6.425 billion. Moreover, the company plans to spend about $850 million to $900 million on high-return growth projects during the year.

Further, WM will increase its annual dividend by $0.20 per share to $3. This translates into an annual dividend distribution of nearly $1.2 billion. The company also plans to repurchase shares worth $1 billion in 2024.

What Is the Future of WM Stock?

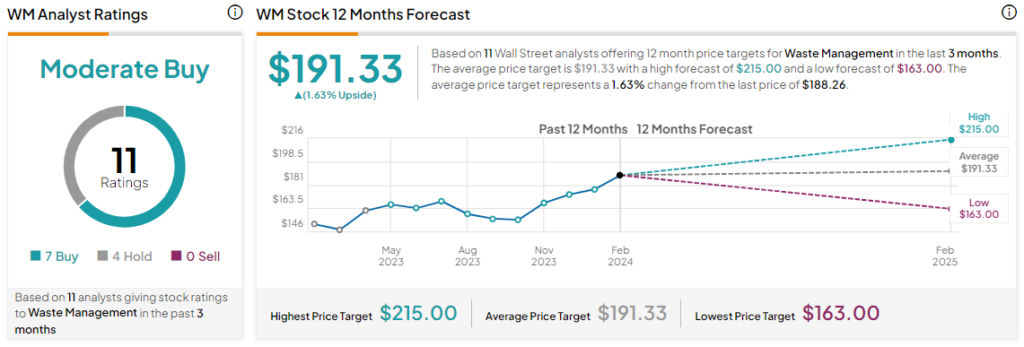

Overall, the Street has a Moderate Buy consensus rating on Waste Management, and the average WM price target of $191.33 implies the stock may be hovering at fair valuation levels at present. That’s after a nearly 18% climb in the company’s share price over the past six months.

Read full Disclosure