Warren Buffett’s love of Coca-Cola (KO) is no secret. The Berkshire Hathaway (BRK.B) CEO, who will retire from that role next year to become the company’s Executive Chairman, drinks five cans of Coca-Cola a day. That’s split between classic Coca-Cola while working, and winding down from a long day of investing with Cherry Coke at night.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It’s not just the flavor of Coca-Cola that Buffett loves. KO stock is among Berkshire Hathaway’s largest holdings, with 400 million shares worth $24.90 billion. The beverage company also represents 9.32% of the investment firm’s portfolio, only surpassed by Bank of America (BAC) at 11.19%, American Express (AXP) at 16.84%, and Apple (AAPL) at 28.12%.

Buffett’s investment in Coca-Cola has paid off, as Berkshire Hathaway has netted a 77.9% return from its average buy price of $40.28 per share. KO stock has also rallied 15.99% year-to-date, despite economic uncertainty weighing on the market. This illustrates the resilience of the stock and makes it an attractive investment right now.

Analysts Agree With Buffett

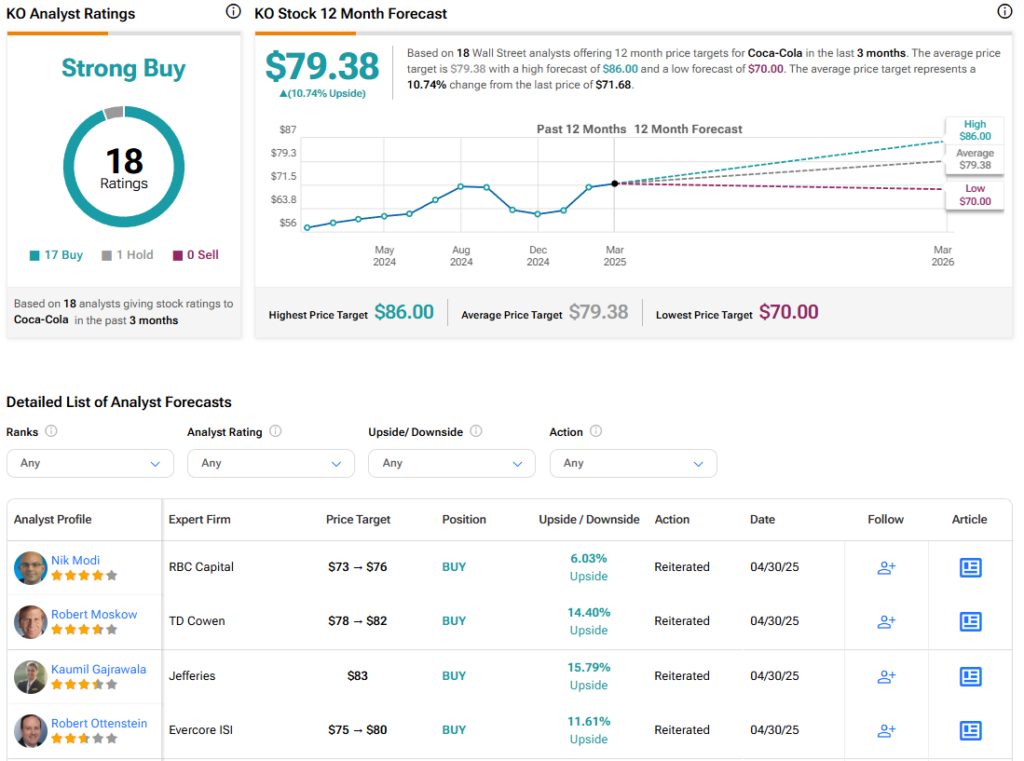

Five-star Morgan Stanley analyst Dara Mohsenian agrees with Buffett. The analyst reiterated an Overweight rating and $78 price target for KO stock, representing a potential 8.88% upside for the shares. Mohsenian noted that “Q1 upside and unchanged FY guidance serve as further confirmation points of KO’s strong positioning vs peers.”

The Morgan Stanley analyst wasn’t alone with his praise of Coca-Cola. Several others reiterated Buy ratings and price targets with strong upside potential after the soda maker beat Q1 estimates last week.

Is KO Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for Coca-Cola is Strong Buy, based on 17 Buy and one Hold ratings over the last three months. With that comes an average price target of $79.38, representing a potential 10.74% upside for KO stock.