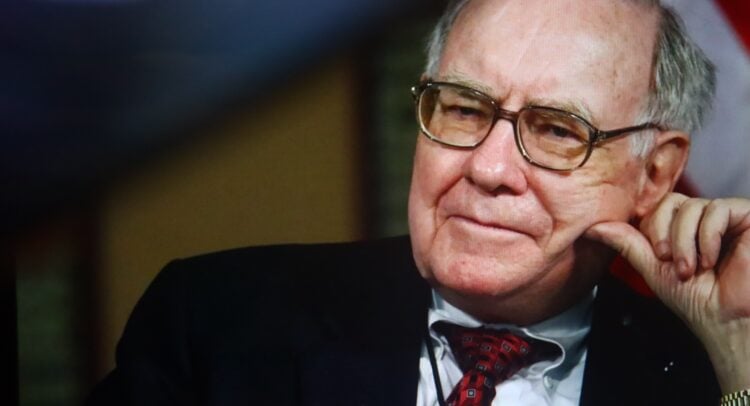

In what would be its biggest deal in three years, Warren Buffett’s Berkshire Hathaway (BRK.B) is closing in on a deal to buy Occidental Petroleum’s (OXY) petrochemical unit OxyChem for $10 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The potential deal, which could be finalized within days, would be Berkshire Hathaway’s largest acquisition since 2022 when it bought insurer Alleghany for $11.6 billion. The OxyChem purchase comes as Berkshire sits on a record cash pile of $344 billion.

The new acquisition also comes months before Buffett, age 95, is due to stepdown as Berkshire’s CEO at the end of this year, although he will remain chairman of the company’s board of directors. Buffett’s successor Greg Abel, who previously ran Berkshire Hathaway’s energy unit, is known for having expertise in the energy sector.

Occidental History

Warren Buffett has a history with Occidental Petroleum and knows the company’s management team. Berkshire Hathaway currently owns $12.5 billion worth of OXY stock, a 26.9% stake. In 2019, Buffett helped Occidental Petroleum purchase rival Anadarko Petroleum with a $10 billion commitment, receiving preferred shares and warrants to buy common stock in return.

Buffett began buying Occidental common stock on the open market in 2022 after reading a transcript of the oil company’s earnings conference call. He has praised Occidental’s management team and says he also likes that the company pays a 2% dividend yield and has been investing in carbon capture technology.

Despite being fond of Occidental Petroleum, Buffett has said repeatedly that he won’t take full control of the oil company, which was founded in 1920.

Is BRK.B Stock a Buy?

Only two analysts currently offer a rating and price target on Berkshire Hathaway’s more affordable class B stock. So instead, we’ll look at the stock’s three-month performance. As one can see in the chart below, shares of BRK.B have risen 2.68% in the last 12 weeks.