Warren Buffett appears to have soured on bank stocks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The legendary investor’s holding company, Berkshire Hathaway (BRK.B), eliminated its entire position in Citigroup (C) during the year’s first quarter and continued to reduced its large holding in Bank of America (BAC). In all, Berkshire was a net seller of stocks in the first quarter. The firm bought $3.2 billion of stocks and sold $4.7 billion worth.

According to Berkshire Hathaway’s latest 13-F regulatory filing with the U.S. Securities and Exchange Commission, Buffett’s holding company sold 14.6 million shares of Citigroup and cut its holding in Bank of America by 48.6 million shares. Berkshire now owns 631 million shares of BAC stock worth $28 billion based on the current share price.

Buffett also trimmed Berkshire’s holding in Capital One Financial (COF) by 300,000 shares. The company now owns 7.15 million shares of COF stock.

Apple Stake

Buffett has been selling down his stake in Bank of America since last year. At one point, the lender was Berkshire Hathaway’s second largest position after Apple (AAPL). The Oracle of Omaha, as Buffett is known, might be paring his bank holdings as speculation grows that the U.S. is headed for an economic recession. Banks and their stocks tend to perform poorly when the economy struggles.

Berkshire’s position in Apple, its biggest holding in an equity portfolio worth nearly $300 billion, was unchanged in the quarter at 300 million shares. Berkshire’s AAPL stake is now worth $63 billion. Berkshire eliminated its entire investment in Nu Holdings (NU), which operates a Brazilian digital bank, selling all 40 million shares that it had owned.

Adding to STZ

While Berkshire Hathaway offloaded bank stocks, the company roughly doubled its stake in Constellation Brands (STZ) to 12 million shares. Berkshire also requested confidentiality with the SEC for one or more equity holdings that it omitted from its latest 13-F report. This likely reflects a desire by Buffett to continue accumulating one or more holdings without alerting investors and driving up the share price.

Buffett has requested confidentiality when building an equity stake in the past. This occurred as recently as last year, when it was revealed that Berkshire had built a secret stake in Swiss insurer Chubb (CB). It’s not clear when Berkshire’s new secret stock(s) might be revealed. BRK.B stock has risen 12% this year.

Is BRK.B Stock a Buy?

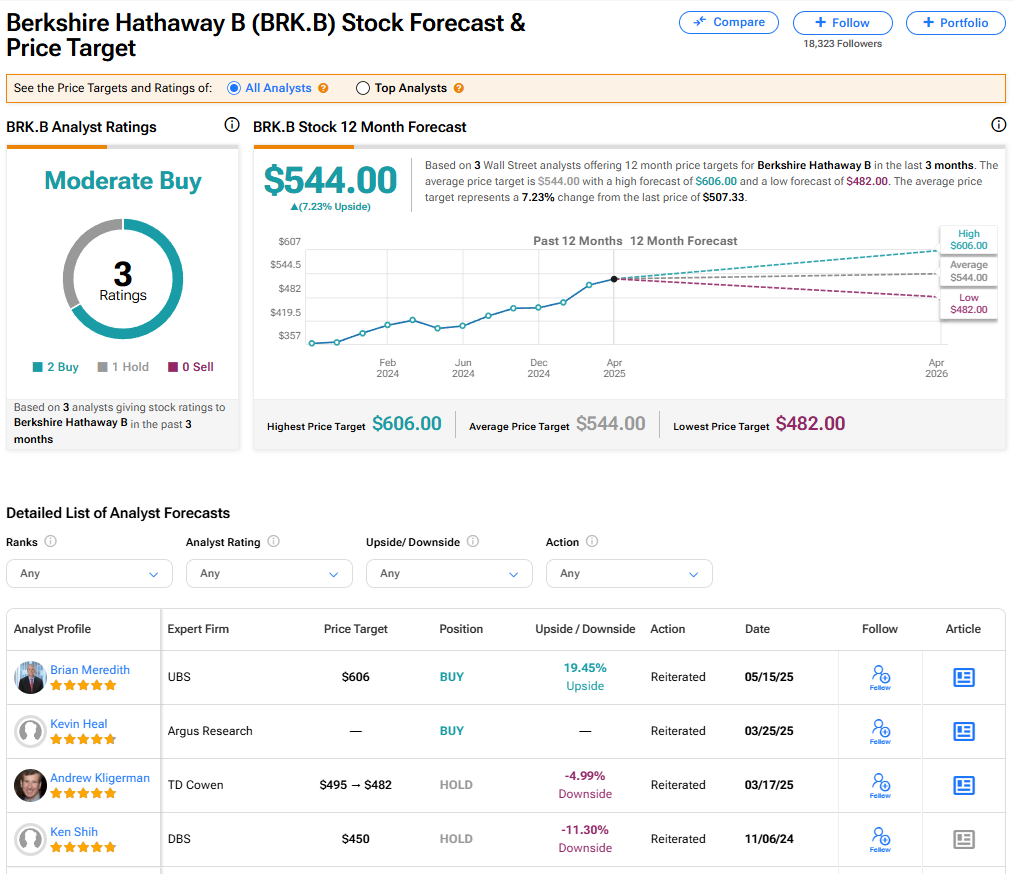

Berkshire Hathaway’s more affordable Class B stock has a consensus Moderate Buy rating among three Wall Street analysts. That rating is based on two Buy and one Hold recommendations assigned in the last three months. The average BRK.B price target of $544 implies 7.23% upside from current levels.