Investors are always hunting for an edge, and one of the smartest ways to gain it is by tracking the moves of Wall Street’s most legendary figures. And when it comes to investing icons, few – if any – command more respect than Warren Buffett.

Known as the Oracle of Omaha, Buffett has built an unmatched legacy through his disciplined, value-driven approach. As the chairman and CEO of Berkshire Hathaway, he has turned the firm into a global powerhouse by spotting undervalued companies, making strategic long-term bets, and prioritizing strong business fundamentals. So, whenever Buffett makes a move in the stock market, the investing world takes notice.

Buffett’s latest 4Q24 portfolio activity reveals a significant bet on two low-yield dividend stocks. While these stocks may not scream excitement, their long-term potential is hard to ignore.

In fact, according to TipRanks’ database, analysts see plenty to like in Buffett’s picks. Let’s dive in and explore what makes these investments so compelling despite their modest yields.

Constellation Brands (STZ)

Let’s start with one of Buffett’s top picks – a heavyweight in the beverage industry, Constellation Brands. This industry giant has carved out a dominant position in the world of alcoholic drinks, boasting an extensive lineup of beers, wines, and spirits. The company is best known as the US importer of Mexico’s famous Corona and Modelo beers, which are consistently among the top-selling beers in the US.

The high inflation of recent years has put something of a damper on consumer discretionary spending, and that has had a negative impact on Constellation’s business. In its most recent reported quarter, fiscal 3Q25, Constellation noted a 0.4% year-over-year drop in sales. In addition, Constellation is a major importer from Mexico – and President Trump has been using import tariffs as a diplomatic weapon with that country, in relation to the US southern border. While the tariff issue is in abeyance for now, it remains to be seen how it will shake out in the long term.

Despite those headwinds, the company has maintained its regular quarterly dividend, which it declared on January 9 for $1.01 per common share. That marks the fourth payment at that rate, which annualizes to $4.04 per share and gives a forward yield of 2.3%. We should note that Constellation has been paying out regular quarterly dividends, and gradually raising the payments, since 2015.

Turning back to the latest earnings, as mentioned, Constellation reported quarterly revenue of $2.46 billion – just shy of expectations, missing the forecast by $70 million. Meanwhile, non-GAAP earnings per share came in at $3.25, falling 6 cents short of analyst projections.

But here’s where it gets really interesting: Buffett is buying in. The ‘Oracle of Omaha’ opened a brand-new position in Constellation Brands during Q4 2024, purchasing 5,624,324 shares – a stake now valued at ~$990 million. His latest move suggests confidence in Constellation’s ability to push through near-term challenges and deliver long-term gains.

STZ has also caught the attention of RBC analyst Nik Modi, who explains why he believes it should weather the tariff uncertainty – and why the stock is a solid long-term choice for investors.

“For STZ the tariff conversation is not new, shares have reacted to tariff headlines since early last year. Based on our analysis, at the current valuation we believe STZ shares are already pricing in impacts from tariffs (coupled with cyclical topline concerns) and have overreacted to the downside. We understand STZ shares could be range bound for a period, but we continue to view the longer term risk reward favorably. We rate STZ Outperform and are buyers on weakness,” Modi opined.

That Outperform (i.e., Buy) rating is paired with a $293 price target, pointing toward a 66% upside on the one-year horizon. (To watch Modi’s track record, click here)

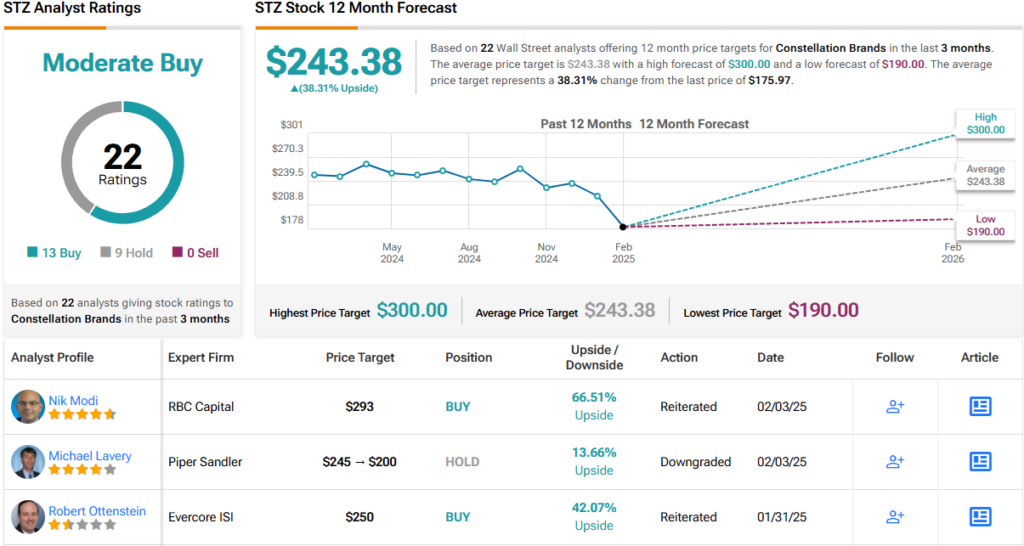

The broader Street sentiment leans positive as well. With 22 recent analyst reviews – 13 Buys and 9 Holds – STZ holds a Moderate Buy consensus rating. Trading at $175.97, the stock’s $243.38 average price target suggests a 38% upside over the next 12 months. (See STZ stock forecast)

Domino’s Pizza (DPZ)

Next on Buffett’s radar is a household name in the fast-food game, Domino’s Pizza. What started as a small shop in Ypsilanti, Michigan, in 1960 has grown into a global pizza powerhouse, now headquartered in Ann Arbor. Whether you’re in North America, Europe, Asia, or the Caribbean, chances are you’ve seen –or ordered from – one of its countless locations. With its iconic red-and-blue box and unmistakable domino logo, the brand has become a staple of quick, reliable delivery worldwide. Backed by a ~$16 billion market cap, it generated nearly $4.5 billion in revenue in 2023, the most recent full-year data available.

This Monday, Domino’s will serve up its first-quarter earnings, but we can get a sense of what’s cooking by revisiting its 3Q24 performance. The company reported $1.08 billion in total revenue, marking a 5% year-over-year increase, though it fell short of estimates by $20 million. On the profit side, the pizza giant delivered an EPS of $4.19, up a penny from the previous year and beating expectations by 55 cents per share. Global retail sales climbed 5.1% year-over-year, and the brand expanded its footprint with a net addition of 72 stores.

Looking ahead to 4Q24, analysts are forecasting $1.48 billion in revenue and EPS of approximately $4.92 per share. Historically, Domino’s shines the brightest in Q4, so investors will be watching closely to see if the company can keep the momentum rolling.

The company last declared its dividend on October 8 for $1.51 per common share and paid it out on December 27. The dividend annualizes to $6.04 per share and gives a modest forward yield of 1.3%.

Buffett clearly likes what he sees. In Q4 2024, he massively increased his stake in Domino’s, scooping up over 1.1 million additional shares, an 86.5% jump from his initial position. Through Berkshire Hathaway, Buffett now holds 2,382,000 shares, valued at ~$1.1 billion at current prices.

As for what’s next, Baird analyst David Tarantino sees a promising future for Domino’s but warns that its upcoming report could present some near-term challenges.

“The setup surrounding the upcoming report seems somewhat tricky when considering the potential for relatively uninspiring Q4 core operating results and the risk that management may choose to defer offering specific updates on the (likely) sales-driving initiatives that been contributing to rising investor optimism about the 2025 outlook. That said, when looking beyond this event, we do believe DPZ can fuel better top-line momentum as 2025 unfolds, and given this outlook, we still think risk/reward on the shares leans favorably for investors with a 6-12 month horizon,” Tarantino opined.

Backing up his bullish stance, Tarantino rates DPZ shares as Outperform (i.e., Buy), setting a $545 price target, which suggests an 18% upside from current levels. (To watch Tarantino’s track record, click here)

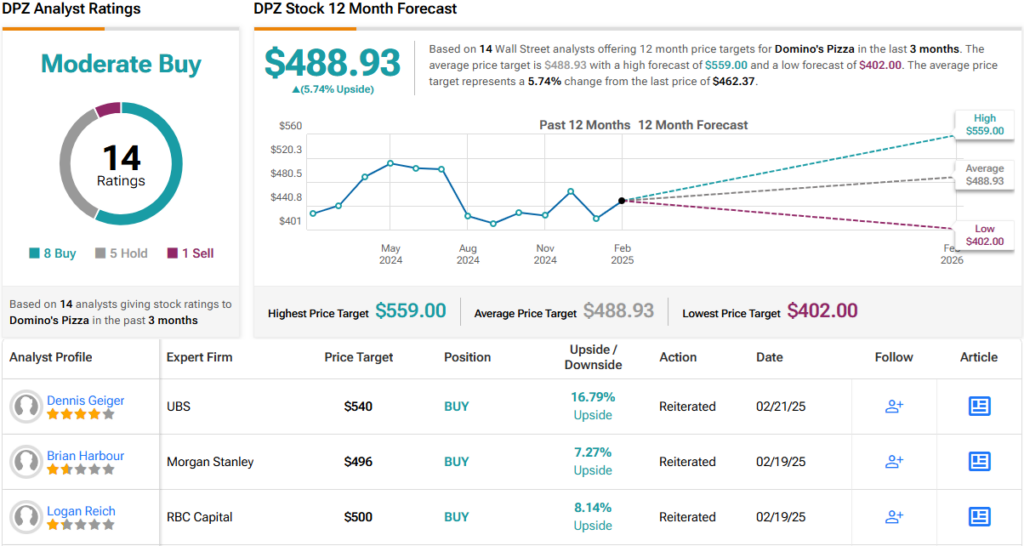

The broader analyst consensus on DPZ skews Moderate Buy, based on 14 recent reviews: 8 Buys, 5 Holds, and 1 Sell. With the stock currently trading at $462.37, the Street’s average price target of $488.93 implies a ~6% upside in the year ahead. (See DPZ stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.