Trying to pin down entertainment giant Warner Bros. Discovery’s (WBD) strategy can be downright difficult these days. One of its latest initiatives is leaving a lot of outside observers scratching their heads, as Warner has staged a purge of some of its classic content. In fact, the classic cartoons seem to have taken the hardest hit. This left investors on the back foot, scrambling for answers and selling shares. Warner shares are down nearly 2% in the closing minutes of Friday’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The reports suggest that the damage is widespread. While Warner seemed to have something against its own property as far back as last year when it shut down the Cartoon Network website, some thought it was part of a larger strategy when Warner redirected users from Cartoon Network’s library of online content to Max instead. But now Max has been hit, and some of Warner’s biggest and most venerable names are gone altogether.

Reports note that Max’s library of classic content is now limited to two versions of Scooby-Doo properties: The Scooby-Doo Show and Scooby-Doo, Where Are You!. Hundreds of episodes of content from The Flintstones to Tom and Jerry to even the best of Looney Tunes shorts were apparently wiped out in a blink. What will happen to all this content, meanwhile, remains to be seen.

But Where’s the “Global”?

Meanwhile, another report took a look at the naming conventions poised to be used when Warner Bros. Discovery completes its split into Warner Bros. and Discovery Global. The issue at hand seems to be why Warner Bros. did not add the “global” onto its own name.

That is an interesting oversight, especially in light of the fact that Warner just fired 10% of its motion picture group as part of a larger overall initiative to pursue a global focus. Remember that? Warner wanted to pivot from a “United States/international management model” to a “global structure” model. So if that is the case, and Discovery got a global touch by becoming Discovery Global, then why is Warner Bros. just Warner Bros. and not Warner Bros. Global?

Is WBD Stock a Good Buy?

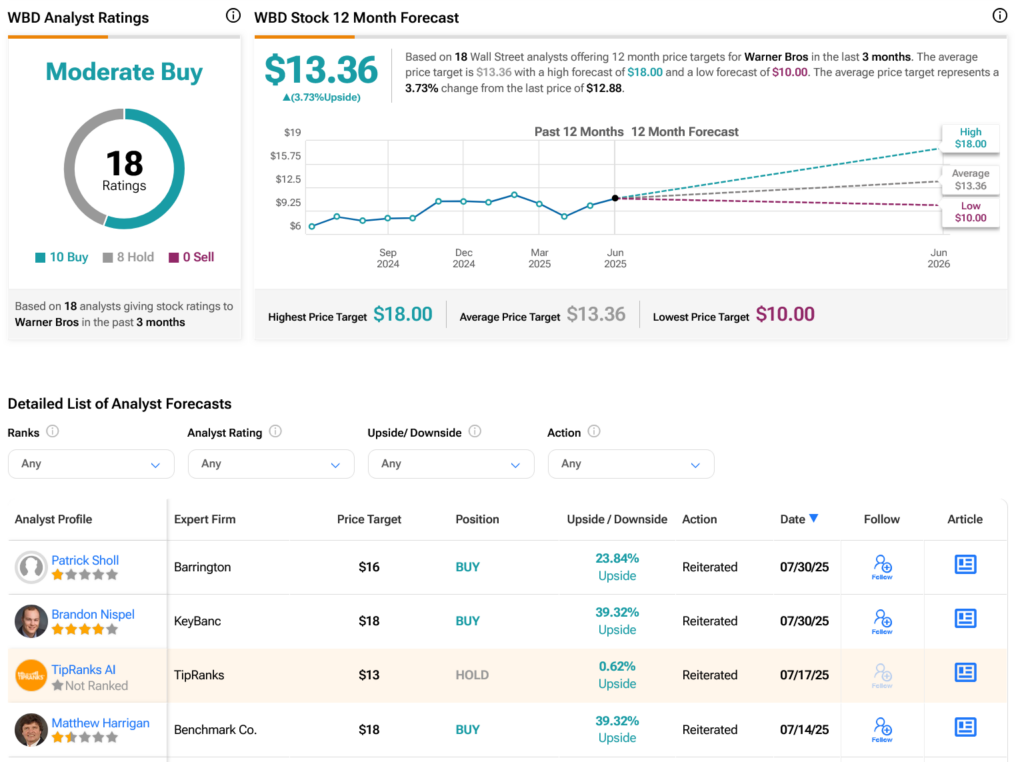

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WBD stock based on 10 Buys and eight Holds assigned in the past three months, as indicated by the graphic below. After a 59.25% rally in its share price over the past year, the average WBD price target of $13.36 per share implies 3.73% upside potential.